Understanding Vesper’s Commodity Price Index

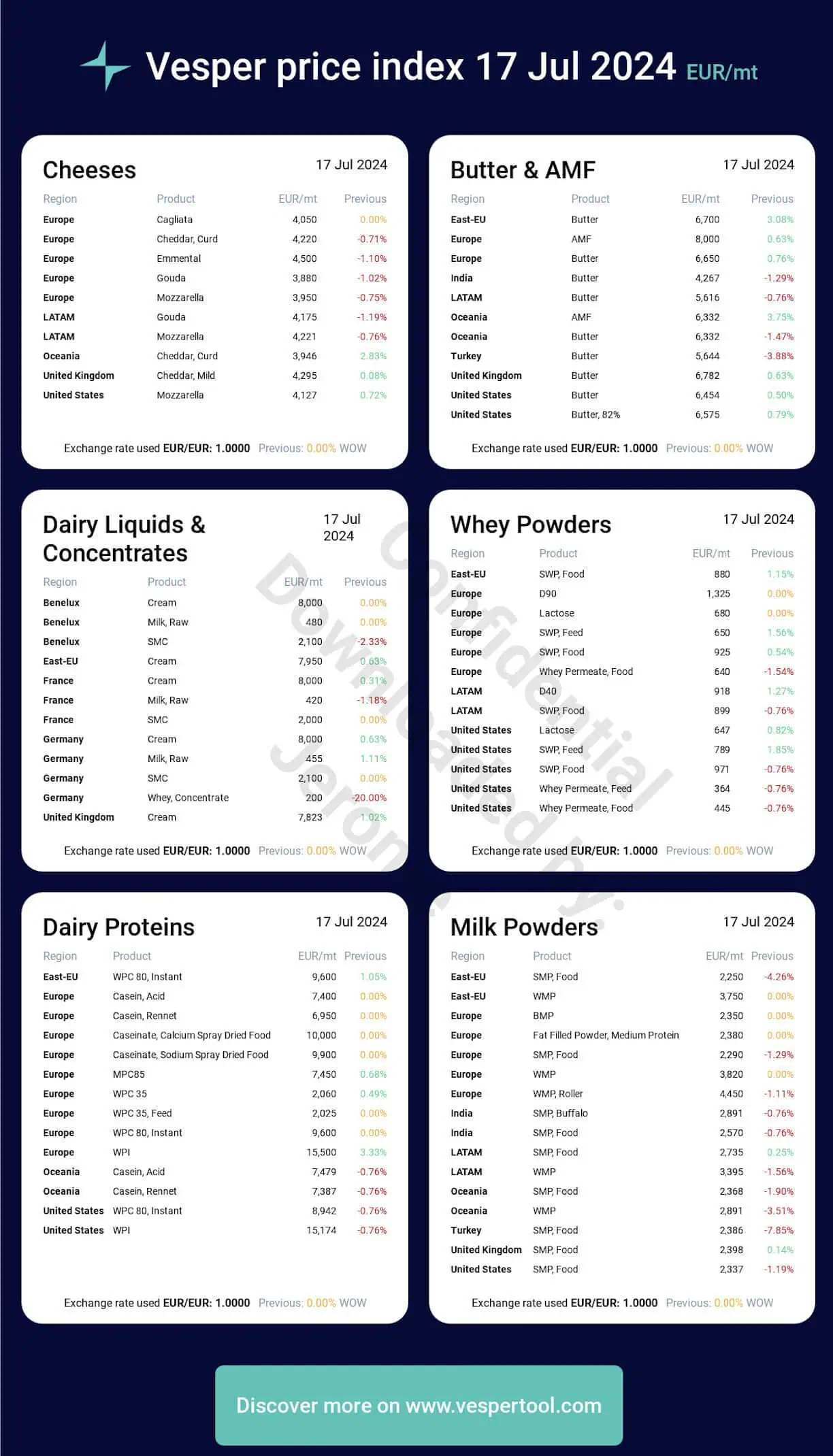

The Commodity Price Index is a critical metric in the world of commodities, reflecting market prices for commodities. It provides invaluable insights for businesses, procurement teams, finance and risk managers and stakeholders dealing with commodities. On the Vesper platform, the Commodity Price Index is represented through the Vesper Price Index (VPI), a proprietary benchmark, created by Vesper.

The Vesper Price Index is a proprietary and independent pricing benchmark created and published by Vesper. We aim to bring transparency to the market by gathering price inputs from a range of trusted industry players, including buyers, sellers, traders and brokers, and publishing prices that are representative of the market. The Vesper Price Index offers unique insights, including presenting previously unseen market prices and enhancing existing benchmarks. The Vesper Price Index is a powerful tool that strengthens negotiation power, providing trusted and reliable market prices. This combination of transparency, accuracy, and unique market insights makes the Vesper Price Index invaluable to market participants, increasing their negotiation power.

Benefits of Using the Vesper Price Index (VPI)

Comprehensive Insights

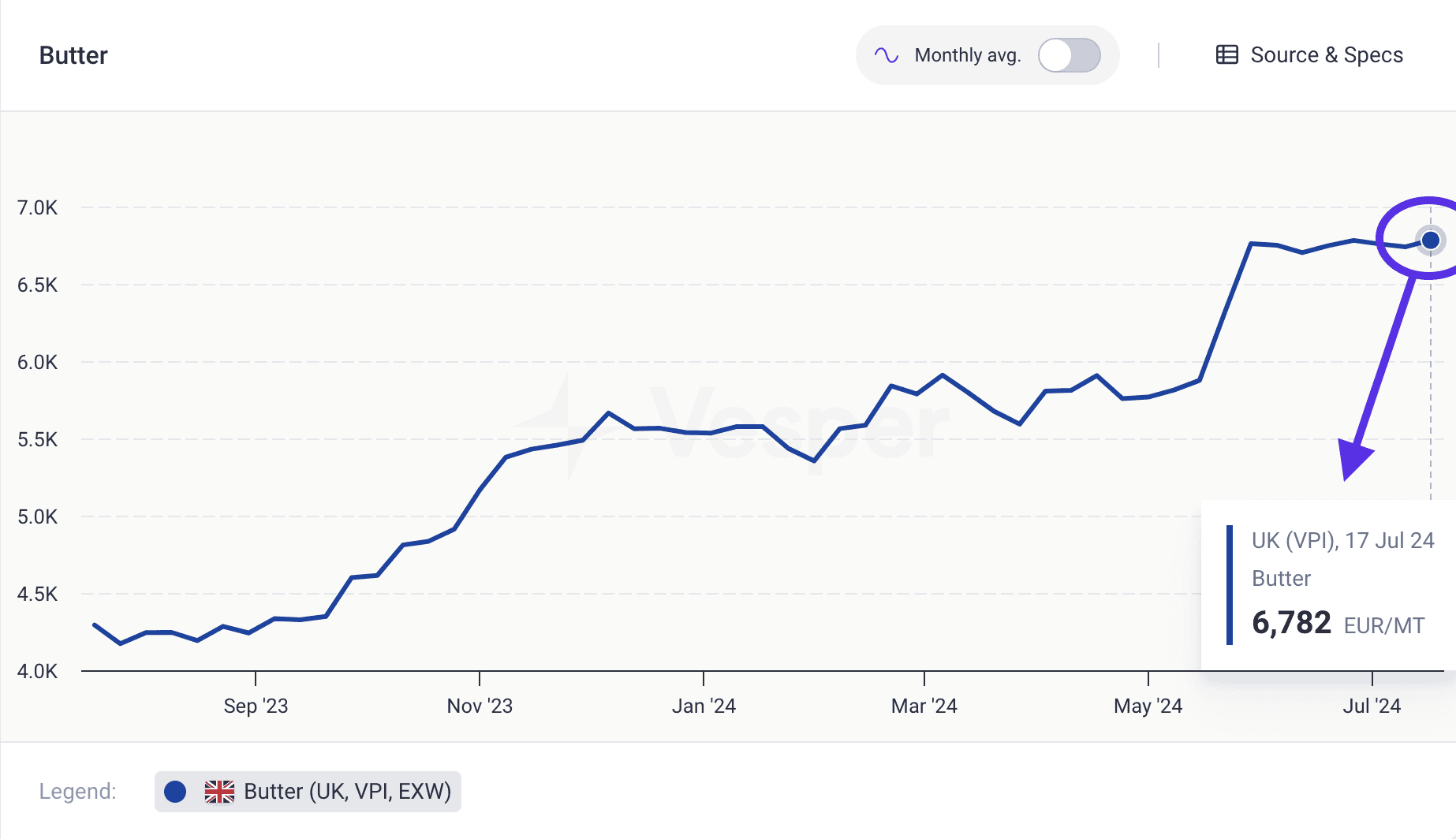

Gain a thorough and accurate reflection of market trends with the Vesper Price Index. Covering commodities across Dairy, Oils & Fats, and Sugar, VPI benchmarks prices from regions and countries worldwide.

Informed Decision-Making

Reliable, up-to-date commodity price benchmarks help you make informed decisions. Accurate price indices allow you to benchmark your own pricing and understand the current market landscape thoroughly.

Increased Negotiation Power

With precise, up-to-date price benchmarks, you can negotiate better terms with suppliers and buyers. Independent data strengthens your position, enabling more favourable deals and contracts.

Market Transparency

The Vesper Price Index enhances market transparency by providing a clear view of market movements. This clarity builds trust with stakeholders and partners, ensuring all parties have access to accurate information.