– Q&A with expert Veg Oil and Biodiesel Analyst Gehrman Kosenkov

In recent months, the global community has grappled with the repercussions of Middle Eastern geopolitics, specifically Red Sea attacks, on various industries. One sector feeling the ripples is the vegetable oil complex. Together with Gehrman Kosenkov, Veg Oils and Biodiesel Analyst at Vesper, we will explain the (potential) impacts on the vegetable oil complex.

The story begins around November when Iranian-backed Houthi militants seized headlines by hijacking and bombing ships in the Red Sea following Israel’s invasion of Gaza.

The Red Sea attacks have undeniably introduced instability into this maritime space, impacting one of the critical logistics routes, and affecting global trade dynamics as it connects Europe, the Red Sea, the Middle East, and Asia.

1. How does the conflict in the Middle East affect the logistics costs, delivery times, and trade flows?

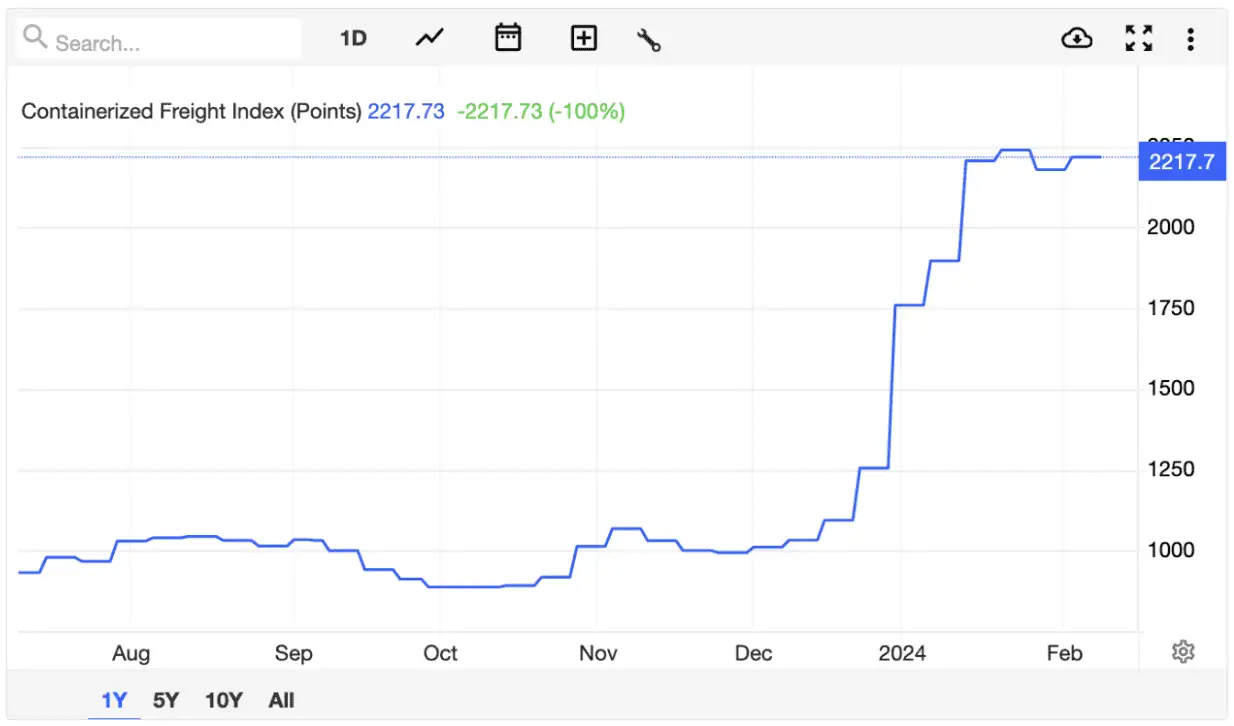

The Red Sea attacks disrupted maritime stability, sending shockwaves through logistics, delivery times, and trade flows. Transport indices, such as the containerized freight index, soared, amplifying costs for all vessel types, see Figure 1, especially from the beginning of 2024. The Suez Canal, a vital route, saw increased insurance premiums, crew bonuses, and rerouted vessels, resulting in prolonged delivery times and heightened expenses.

Figure 1: Containerized Freight Index

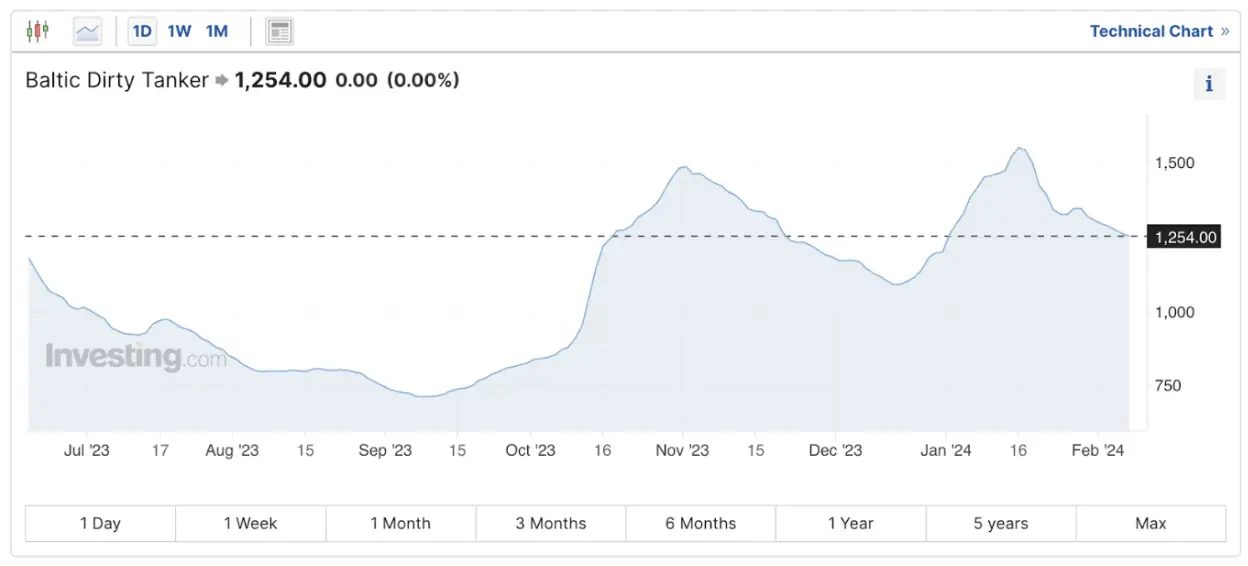

In a less dramatic scenario, we observe a similar trend in tank rates for vessels transporting oil or vegetable oils, see Baltic Dirty Tanker in Figure 2. At the start of January, there was a significant increase, followed by a recent cooling-off period. Despite the recent dip, the rates remain higher than they were in December.

Figure 2: Baltic Dirty Tanker (BAID)

The orange line on the map (Figure 3) represents the Suez Canal, and it’s evident that shipping from North Europe to Asia has doubled. Vessels opting for the Suez Canal route are facing increased expenses in the form of high insurance premiums and crew bonuses. On the other hand, vessels choosing the purple route around the Cape of Good Hope are experiencing elevated fuel and bunkering costs due to the longer journey.

Figure 3: Red Sea conflict increases shipping times

2. How much longer are delivery times due to Middle East conflict, and which commodities specifically have been impacted?

The Middle East conflict added approximately 10 days to delivery times, creating a domino effect on available shipping capacity. Agricultural and energy commodities, particularly grains and mineral oils, have been affected by longer delivery times and higher shipping costs.

3. Mineral prices are actively reacting to the conflict in the Middle East. What do you know about that?

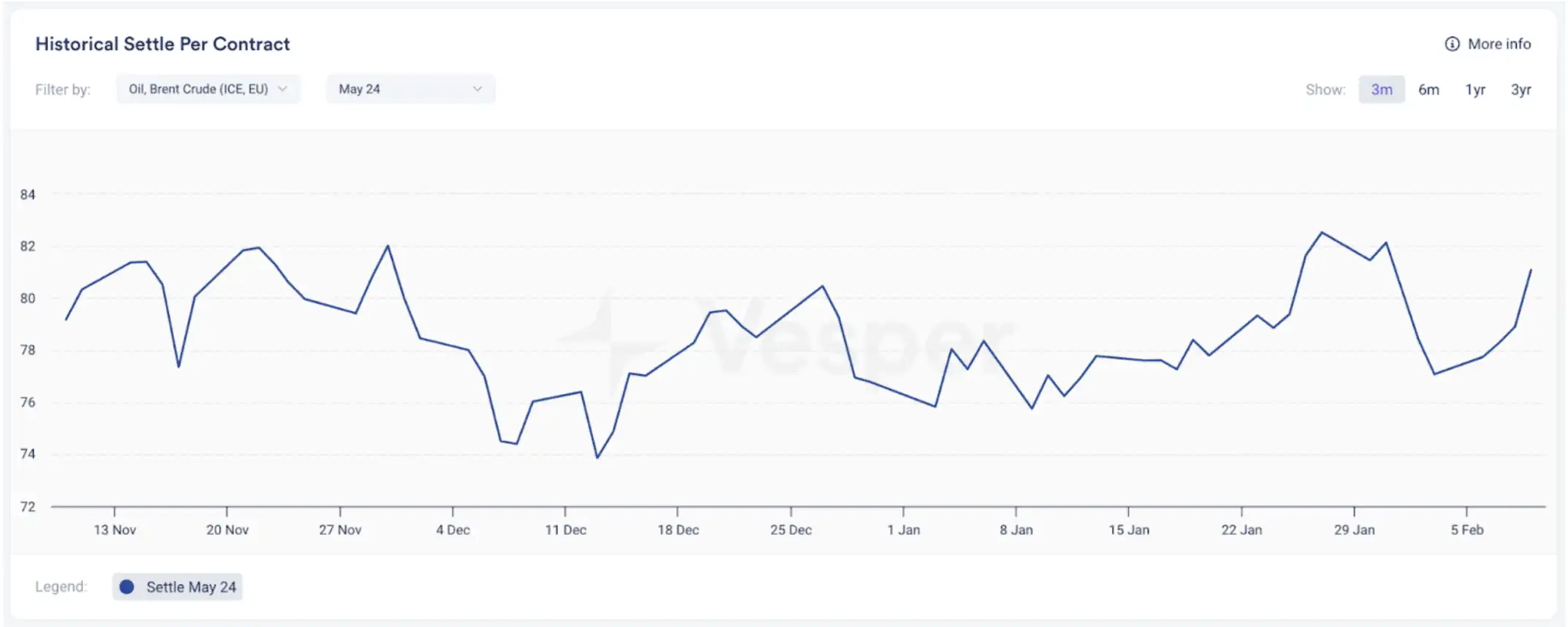

If we examine Brent crude oil, a crucial benchmark for global energy prices, from the start of January until now, there is a noticeable upward trend in the price (see Figure 4). This increase is directly linked to vessels changing their routes, a factor influencing the current market conditions.

Figure 4: Historical Settle Per Contract Graph for Brent Crude Oils in USD/barrel

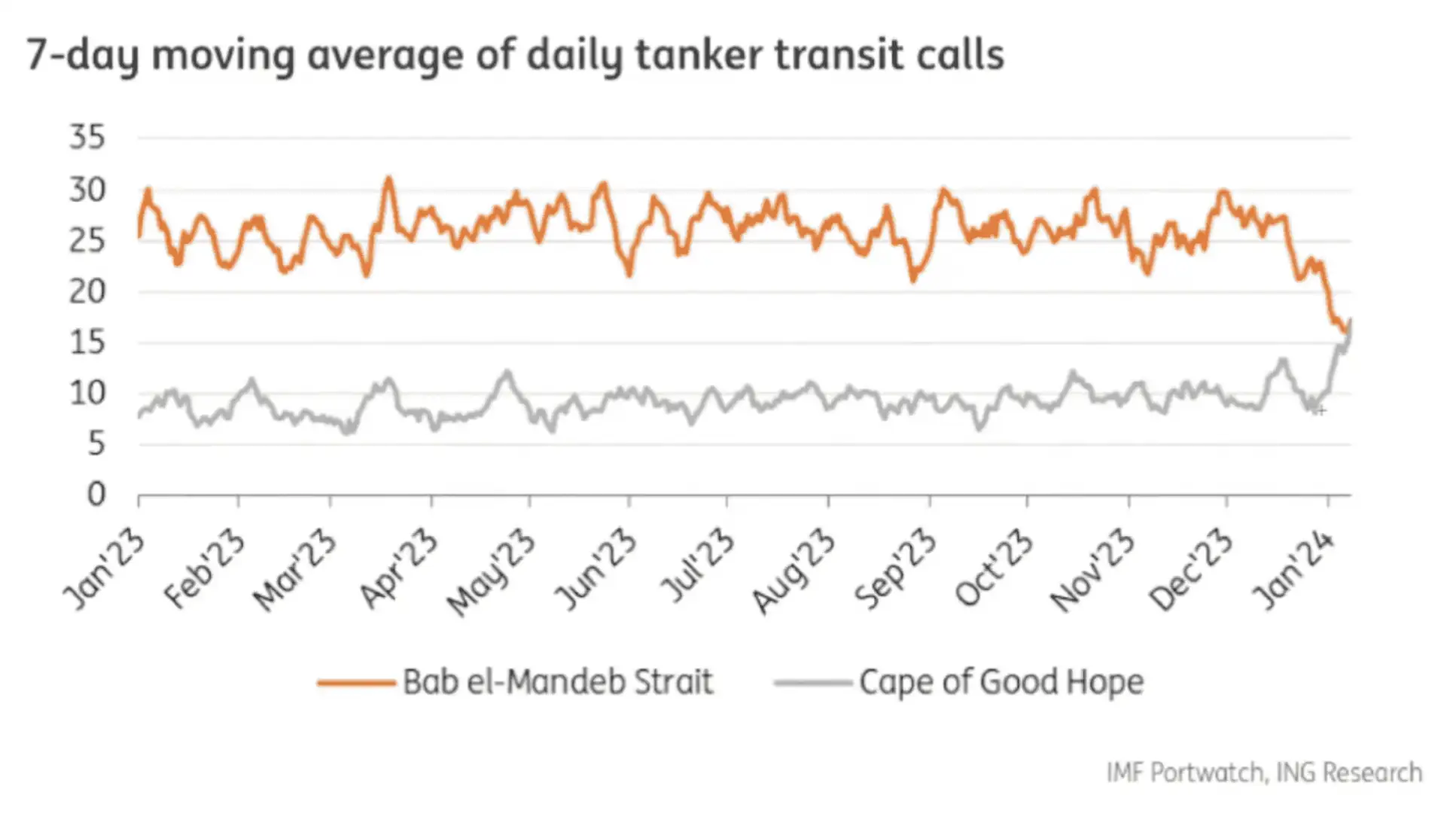

People may wonder why there wasn’t an immediate increase in oil prices in November when the attacks occurred. Figure 5 clarifies that the surge in prices occurred in January, attributed to more shipping companies choosing to divert their routes during that month.

The reason behind this delayed impact lies in the effective traffic flow through the Suez Canal in December. Despite the attacks in November, the canal operations remained stable. It was only when the US and UK launched attacks against the Houthis that tensions heightened, prompting more shipping companies to opt for route diversions in January.

Figure 5: 7-day moving average of daily tanker transit calls, by ING Research

4. Could you say that mineral oil has an effect on the vegoil complex?

Mineral oil typically influences vegetable oils, but it’s essential to consider the broader context. In this case, several factors played a role in driving changes in vegetable oil dynamics.

Primarily, attention should be directed to sunflower oil, which travels from the Black Sea, notably Russia, to destinations like India. Additionally, palm oil, transporting from Indonesia and Malaysia to Europe, is another key focus. Both of these trade routes previously utilized the Suez Canal before the conflict.

Let’s take a closer look at the Forward Vesper Price Index Positions for Sunflower oil, a benchmark with strong correlation to other origins, see Figure 6.

Figure 6: Forward Vesper Price Index Positions for West-EU Sunflower Oil in EUR/mt

As you can see in the Vesper Forward Price Index Positions for Sunflower oil there is a notable price decrease.

This might raise the question of how this decrease is possible when logistics costs are on the rise. To validate this, a closer look at the CIF (Cost, Insurance, and Freight) prices, which include logistics costs, instead of the full prices is necessary, see Figure 7.

Figure 7: Vesper Price Index Positions for Turkish Sunflower Oil in EUR/mt

When sunflower oil crude prices for Turkey, a key importer, it becomes apparent that despite the increasing logistics costs, the CIF prices affirm a recent decrease in overall prices.

In a nutshell, insights from discussions I had with Ukrainian traders shed light on the dip in Turkish and Indian prices. It seems the confidence in Asia, particularly India and China, is the driving force. These buyers are holding the upper hand with ample oil stocks, coupled with the advantage of Malaysia and Indonesia being nearby countries that can quickly deliver palm oil to meet their needs.

The message from Asian buyers to Ukrainian and Russian exporters is crystal clear – they’re unfazed by rising shipping costs and heightened risks. The burden to navigate these challenges rests on the exporters. Fail to do so, and they risk losing business. Consequently, Asian buyers see themselves in a position of negotiation strength.

In response to the escalating logistics risks, major Ukrainian exporters like Kernel are strategically redirecting their focus. They’ve ramped up sunflower oil sales to Turkey, a move that’s geographically closer to Europe.

The tactical shift by these significant Ukrainian players, flooding Turkey and Europe with offers, has played a role in driving prices down.

Returning to your question, while mineral oil generally impacts vegetable oils, it’s important to evaluate each case individually. Interestingly, the significant logistics and mineral costs didn’t seem to have an effect on sunflower oil prices.

5. What is the effect of the Middle East conflict on soybean oil prices?

There has been a significant decline in soybean oil prices week on week, which can be attributed to the fact that the soybean complex is currently less preoccupied with the Red Sea and is predominantly focused on the supply side. We anticipate a record global supply of soybeans, and this aspect is being closely monitored by everyone in the industry.

For instance, last week, the forecast for Argentinian soybean production was revised upwards. The weather conditions in Brazil are generally favorable, and the harvesting process is advancing at a rapid pace, leading to quicker filling of storage facilities.

At the same time the demand from China is not robust, largely due to a weakened pig sector, which is exerting considerable pressure on soybeans. In response, Brazilians are offering discounts, leading to a downward trend in prices.

Furthermore, the demand for U.S. soybeans has slowed down, influenced by reduced demand from both food markets and the biodiesel industry. Despite these short-term challenges, looking at the bigger picture, it is anticipated that this year the demand for soybean oil in the U.S. from the biodiesel sector will be oke, providing support for soybean oil.

6. Can you provide us with a short-term outlook of vegetable oil complex regarding the Red Sea conflict?

Discussing the Red Sea attacks, I must clarify that I’m not an expert in politics, but based on what I’ve gathered, I can share the prevailing sentiment. It appears that if the crisis remains unresolved, there’s a possibility of a tightening of available ships in the market, leading to increased freight costs. This could potentially have a more pronounced impact on oil prices. People are also expressing concern about the potential spillover effects of the conflict.

Despite these concerns, there seems to be a lack of significant intervention, suggesting that this situation might persist. If it does spill over, it has the potential to significantly impact energy markets, ultimately influencing vegetable oil prices.

Gehrman Kosenkov gives complementory bi-weekly updates on the vegetable oil and biodiesel industry. Sign up for his webinar series for free here, to get insights on the latest trends driving the vegoil complex.