Nestlé, a global leader in the food and beverage industry, manages an extensive range of commodities, with dairy being the largest and most critical. Sourcing dairy products from more than 200,000 farmers across 27 countries, Nestlé ensures a high-quality supply while promoting sustainable farming practices. Dairy not only represents the highest volume of raw materials but also plays a crucial role in Nestlé’s sustainability efforts.

Given the volatile nature of the dairy market, Nestlé monitors market conditions closely every day. Jan-Bert Banga, Regional Strategic Buyer for Dairy at Nestlé, brings over 15 years of experience in the dairy industry, including roles at FrieslandCampina and Interfood. “As the largest buyer of dairy, it’s always important to establish how or when to buy, so our strategic approach is very important to us,” says Banga.

Each commodity has its own dynamics, market development, and prices. Banga, responsible for the Skimmed Milk Powder (SMP) and Milk Fat team based in Switzerland, oversees a large team of 20 buyers, each dedicated to a specific dairy product. “Our team is highly specialised, with each buyer focusing on products ranging from milk powders to whey and fresh milk,” he explains.

Banga has witnessed the transformative impact of Vesper’s AI-driven market intelligence tools on their procurement strategy. “Vesper has changed the way we operate,” he says.

The Challenge of Managing Market Data

Before adopting Vesper, Banga had to manage numerous websites and market indicators daily. “If you looked at my internet browser, I had tabs open for nearly 20 different websites to gather market data,” he recalls. This process was both time-consuming and inefficient.

The introduction of Vesper changed this completely. “Vesper is a great solution – everything is combined in one space, and you can personalise it depending on what is important to you,” says Banga. “It is a great time-saver, saving me at least 30-45 minutes per day searching for data, which I can then spend doing what I should be doing – trying to get the best prices from our suppliers!”

Key features that Banga finds particularly useful are Vesper’s price forecasts and calculations. These tools provide critical insights into future price movements and help Nestlé create more accurate budget plans.

Forecasting Success

Vesper’s price forecasts are another critical component for Nestlé. “We look at Vesper’s forecasts on a daily basis. Knowing what prices are expected to do in three, six, or nine months is the most important feature for us as buyers,” says Banga. These forecasts, based on computer models, provide an unbiased opinion that helps Nestlé refine its buying strategies and policies.

Integrating Vesper’s tools into Nestlé’s procurement process has streamlined decision-making and improved efficiency. “Vesper helps us build a strong case for our purchasing decisions, whether it’s deciding to stop buying for a certain period or to lock in volumes when prices are favourable,” Banga notes.

For instance, Vesper’s price forecast for SMP indicated an upcoming price increase, prompting Nestlé to secure volumes in advance (see Figure 1). This foresight, coupled with an understanding of the bullish drivers from Vesper’s price drivers section, enables Nestlé to stay ahead in the competitive dairy market.

Figure 1: Vesper Price Forecast for SMP Europe

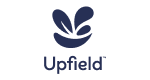

Calculating the most profitable production stream

“Nestlé needs to understand what our suppliers prefer to produce from milk, as sometimes SMP and butter are not the most profitable options for manufacturers,” Banga explains. Vesper’s calculations section allows users to experiment with different components and commodity prices based on milk prices. For example, Vesper’s latest data shows mozzarella is highly valued compared to SMP and butter (see Figure 2), making it more appealing for manufacturers to switch their production to mozzarella. “This helps us anticipate future price developments and adjust our budget planning accordingly.”

Figure 2: Milk Valorization based on 10.000 litres of milk

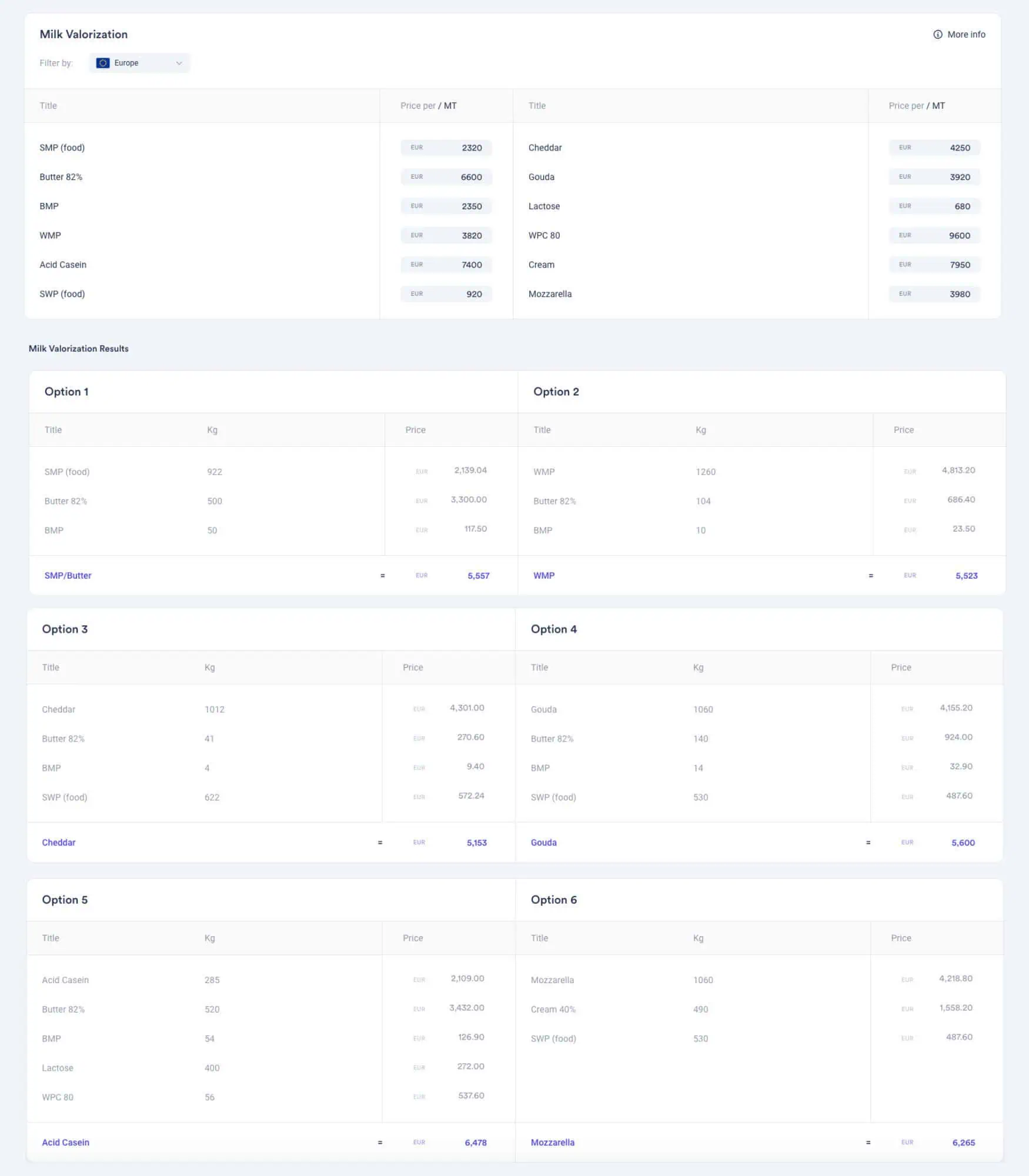

This trend is not new; cheeses have been valued higher than SMP and butter for several years now, as shown in Vesper’s Historical Milk Valorization widget (see Figure 3).

Figure 3: Historical Milk Valorization widget

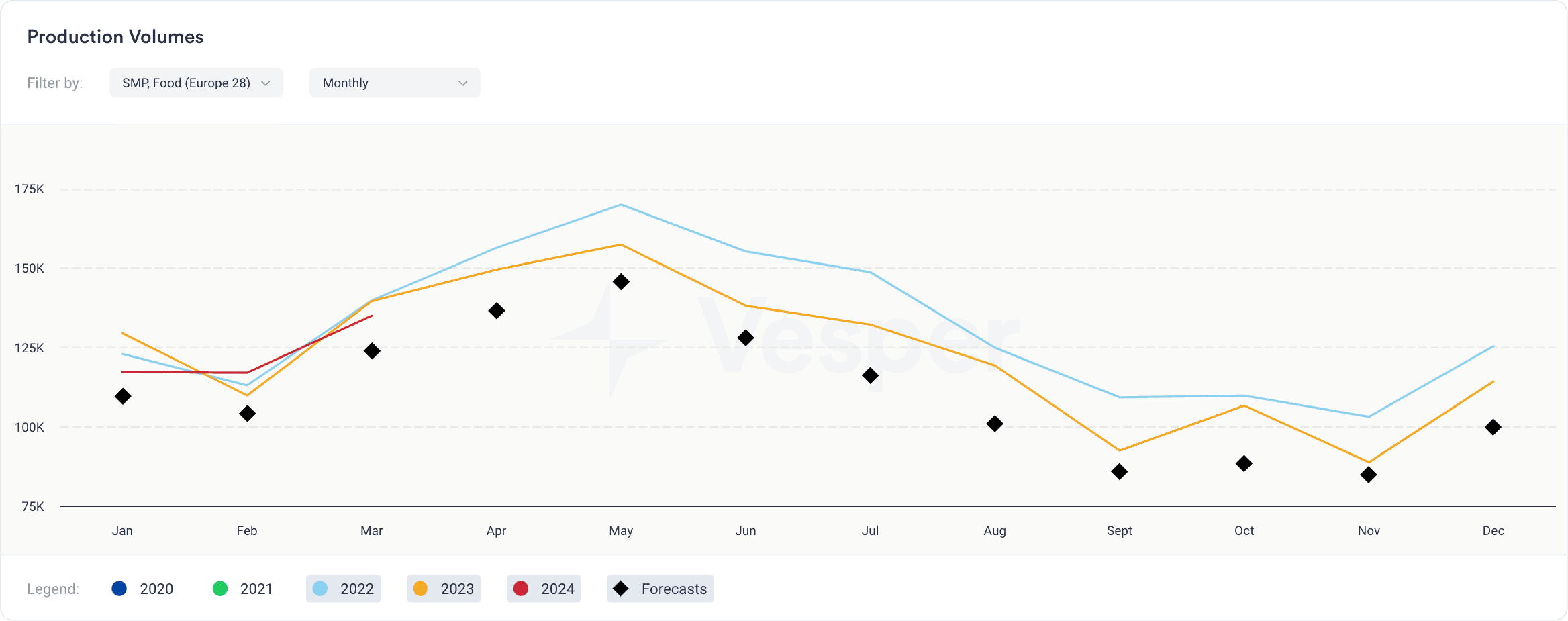

This shift has significantly affected the production of SMP and butter over the past years and is expected to continue, with forecasts indicating an even steeper decline this year (see Figure 4). This trend will likely impact next year’s SMP prices, which Nestlé should consider when planning next year’s budget.

Figure 4: SMP Production levels for 2022, 2023 and 2024 in MMT

All-in all, by consolidating market data into one user-friendly platform, Vesper has allowed Nestlé to focus on what matters most – securing the best prices and ensuring a sustainable, high-quality supply of dairy products.