The BMD Crude Palm Oil (CPO) (October 24) has primarily moved sideways from previous reports, fluctuating between $1000/mt and $1010/mt. The Malaysian Palm Oil Board (MPOB) has reported a nearly 7% increase in Malaysia’s palm oil stocks for September. This rise has exceeded market of a maximum increase of 4%, and can be attributed to a decline in local consumption and exports. Despite this increase in stock, palm oil prices remain robust, bolstered by a weakening Malaysian Ringgit (MYR), strong export figures from September, and lower production levels reported by the Southern Peninsular Palm Oil Millers Association (SPPOMA).

The robust palm oil prices has strengthened POME prices, driving their increase. Some palm oil suppliers are blending POME with crude palm oil, allowing them to take advantage of the higher BMD CPO prices. According to the Vesper Price Index for Indonesia, POME prices have risen to $795/mt (FOB Indonesia) as of October 15, up from $785/mt during the same period last week. Similarly, the Vesper West EU Price Index for POME has increased to $1010/mt (CIF ARA), climbing from $1000/mt in the previous week.

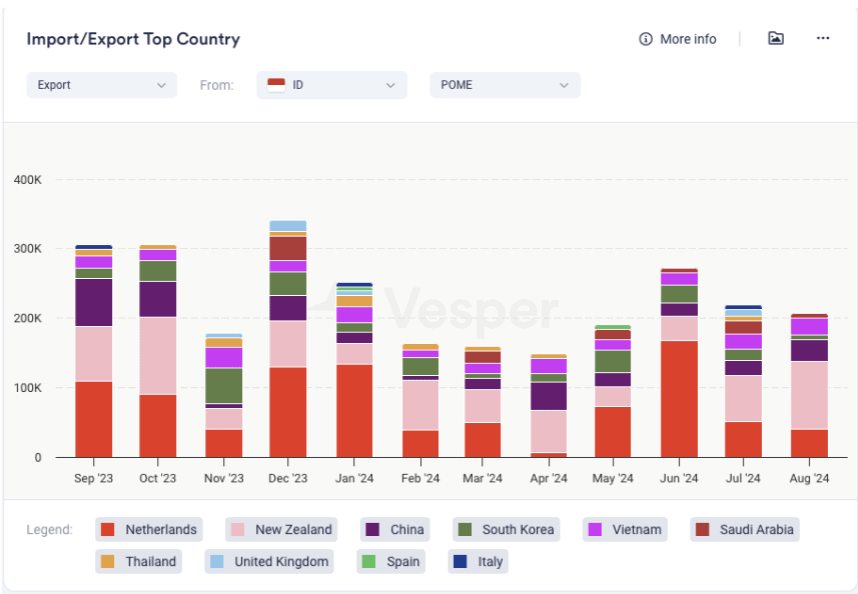

In August, Indonesia exported approximately 200,000 mt of POME, with only 40,000 mt

headed to Europe, see Figure below.

Figure 1: Indonesia POME Exports (mt)

Ireland, Belgium, the Netherlands, and Germany have urged the EU Commission to investigate the high volume of POMEand POME-based biofuel imports, questioning their legitimacy given global production capacity. The unexpectedly large volumes have raised concerns that some of these biofuels may contain virgin palm oil. Ireland has suggested considering a cap or restriction on the amount of POME-based biofuels that can count toward the EU Directive targets amid suspicions of mislabeling palm oil as POME.

The Indonesian Ministry of Trade will introduce an export permit for POME startingOctober 25. Exporters must now fulfill domestic market obligations (DMO) by selling a portion of POME domestically to obtain export permits. Even companies dealing exclusively with POME must participate in the domestic vegetable oil market, potentially pushing some players out. This new measure is expected to limit POME supply and support prices, as it imposes stricter conditions on exporting entities.

For more insights into the biodiesel and vegetable oil market, visit Vesper for free.