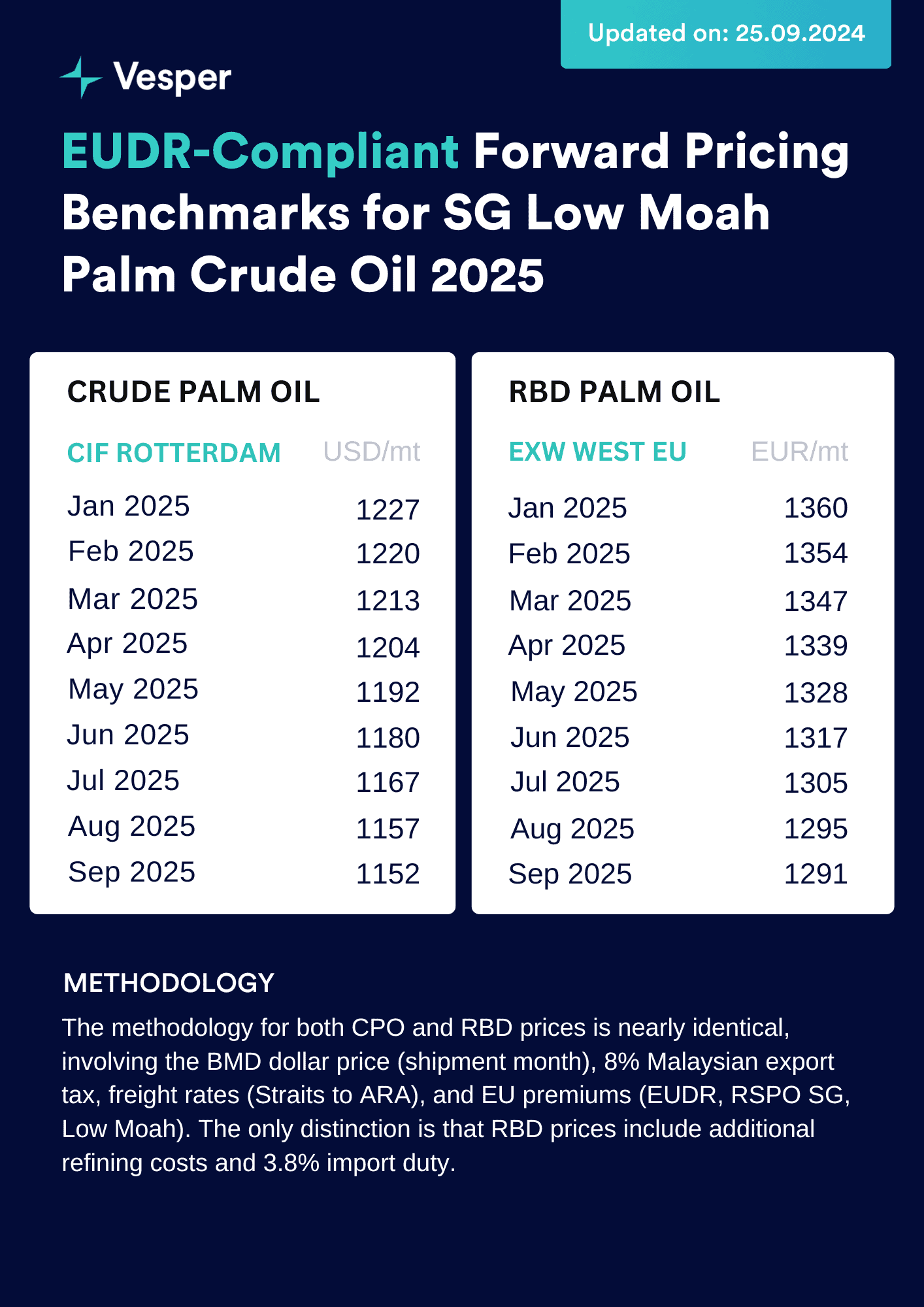

The price of palm oil risen compared to previous week, with several factors contributing to the latest increases. The November 2024 contract for BMD Crude Palm Oil (CPO) climbed to MYR 4074/mt from MYR 3766/mt during the same period last week. Similarly, Vesper’s EUDR-compliant S.G. Low Moah CPO benchmark saw an increase to $1227/mt (CIF Rotterdam, January 2025) from $1137/mt the previous week, see Below.

Key Drivers of the Price Increase

Several dynamics are driving these upward trends. A combination of bullish trends in competing oils, rising Brent Crude oil prices, and uncertainties around supply and demand are pushing the benchmarks higher. Malaysian exports have been strong so far in September, with AMSPEC reporting a 6.84% rise in exports between September 1-20 compared to the same period in August. ITS data shows an even larger increase of 10.08% for the same period.

At the same time, production figures from SPOMA raise concerns. Yield is down 7.80%, and overall production has dropped by 7.01%, despite a slight improvement in oil extraction rates (OER), which increased by 0.15%.

Outlook

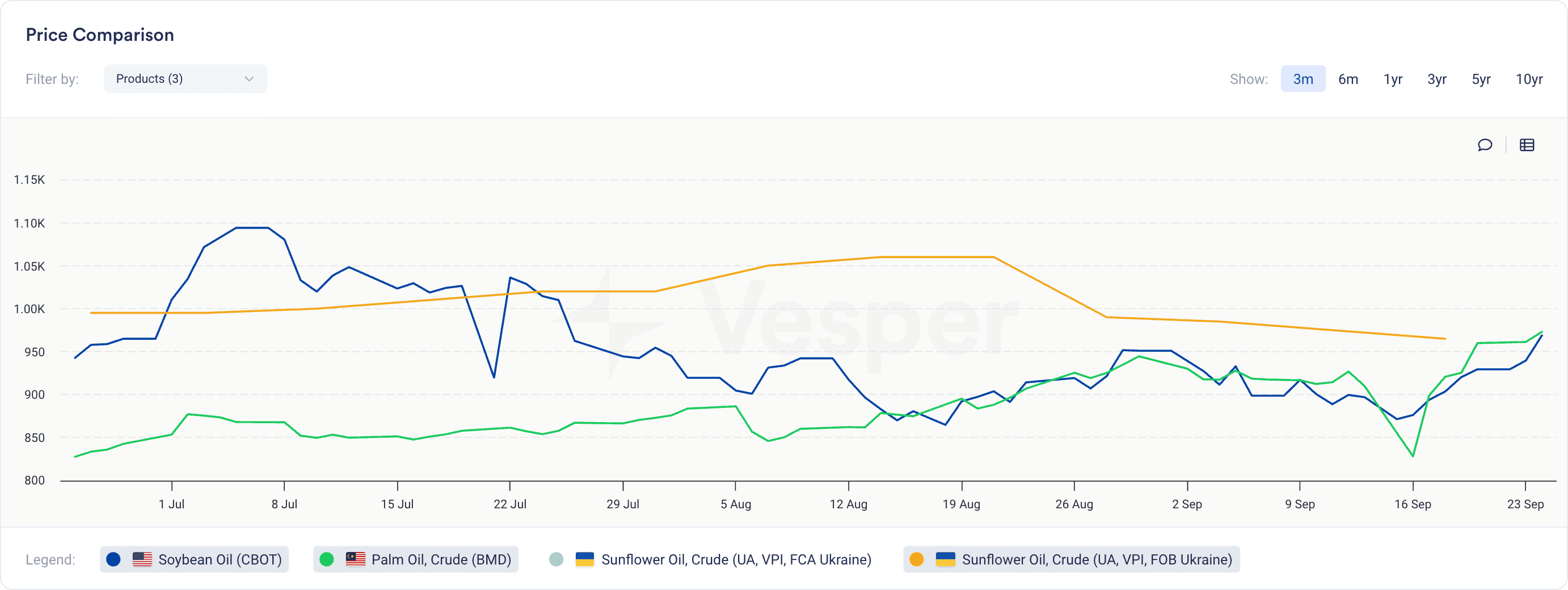

On the flip side, market pressures could soon limit further price increases. Indonesia has reduced its export levies on CPO, setting the rate at 7.5% of the base price. This change makes Indonesian CPO more competitive on the global market, which may put pressure on Malaysian-origin CPO. Additionally, India’s recent increase in import duties on vegetable oils is already affecting the market. Reuters reported that Indian refiners canceled 100,000 metric tons of palm oil purchases for October to December deliveries due to the tariff hikes. This raises the possibility that India may look to alternative oils, such as soy or sunflower, which could impact palm oil demand, especially as the festive season approaches. At present, the price spread between palm oil and other vegetable oils remains tight, see figure below.

Interested in receiving the daily updated EUDR-compliant Benchmark for S.G. Low Moah Crude Palm Oil? Book a demo here.