The global market for nuts has grown significantly over the past few decades, driven by rising demand for healthy snacks, plant-based nutrition, and sustainable food sources. Nuts such as cashews, walnuts, macadamia, pecans, and pistachios have all played crucial roles in international trade, food industries, and consumer preferences. Understanding historical data surrounding nut production, pricing, and market trends is essential for those involved in the nut industry, from buyers, sellers, and traders.

In this article, we will explore the long-term trends in global nut production, historical price movements based on supply and demand dynamics, and key events that have shaped the trade flows of nuts.

Long-Term Trends in Global Nut Production and Yields

Global nut production has seen significant growth over the past few decades, driven by increasing consumer demand, technological advancements, and improved farming practices. Several key regions, including North America, West Africa, and Asia, have contributed to this surge. Let’s look at the specific trends for various nuts:

1. Almonds in California

California is the world’s largest producer of almonds, contributing over 80% of the global almond supply. Between 2000 and 2020, almond production in California increased by 118%, rising from approximately 671,000 metric tons in 2000 to 1.47 million metric tons in 2020.

Despite challenges such as recurring droughts, the almond industry has managed to expand production, thanks to innovations in water management and irrigation technology. The introduction of drought-resistant varieties has also helped sustain production levels despite water shortages.

Impact on Prices: The surge in production has helped meet growing global demand, but the environmental challenges of water usage continue to affect pricing and production costs.

2. Cashews in West Africa

West Africa, particularly countries like Ivory Coast, Ghana, and Nigeria, has emerged as a key global supplier of cashews. Ivory Coast, the largest exporter of raw cashews, has seen its production more than double over the past decade, rising from 350,000 metric tons in 2010 to around 800,000 metric tons by 2020.

This growth is largely due to government initiatives and foreign investments aimed at boosting agricultural exports and capitalizing on rising demand for cashews in global markets, particularly in Asia and Europe.

Impact on Prices: The increase in production has helped stabilize global cashew prices, although factors like transportation costs and labor shortages continue to impact overall pricing.

3. Pistachios in the United States

The U.S., particularly California, is the world leader in pistachio production, accounting for 75% of the global supply. Between 2000 and 2020, U.S. pistachio production nearly tripled, increasing from 146,000 metric tons to 447,000 metric tons.

Innovations in harvesting techniques, pest control, and irrigation systems have enabled U.S. producers to significantly expand output.

Impact on Prices: Increased global demand, especially from China and Europe, coupled with the high-quality standards of U.S. pistachios, has kept prices stable and competitive despite the growing production volumes.

4. Hazelnuts in Turkey

Turkey remains the dominant player in hazelnut production, responsible for 60-70% of global output. Turkey’s hazelnut production has experienced fluctuations due to weather-related challenges, but overall volumes increased from approximately 600,000 metric tons in 2000 to 800,000 metric tons in 2020.

Government subsidies and support for farmers have helped stabilize the industry, ensuring that Turkish hazelnuts remain competitive on the world market.

Impact on Prices: Weather disruptions, particularly frost, have caused periodic spikes in prices, but Turkish government support has helped mitigate some of these effects by providing financial assistance to affected farmers.

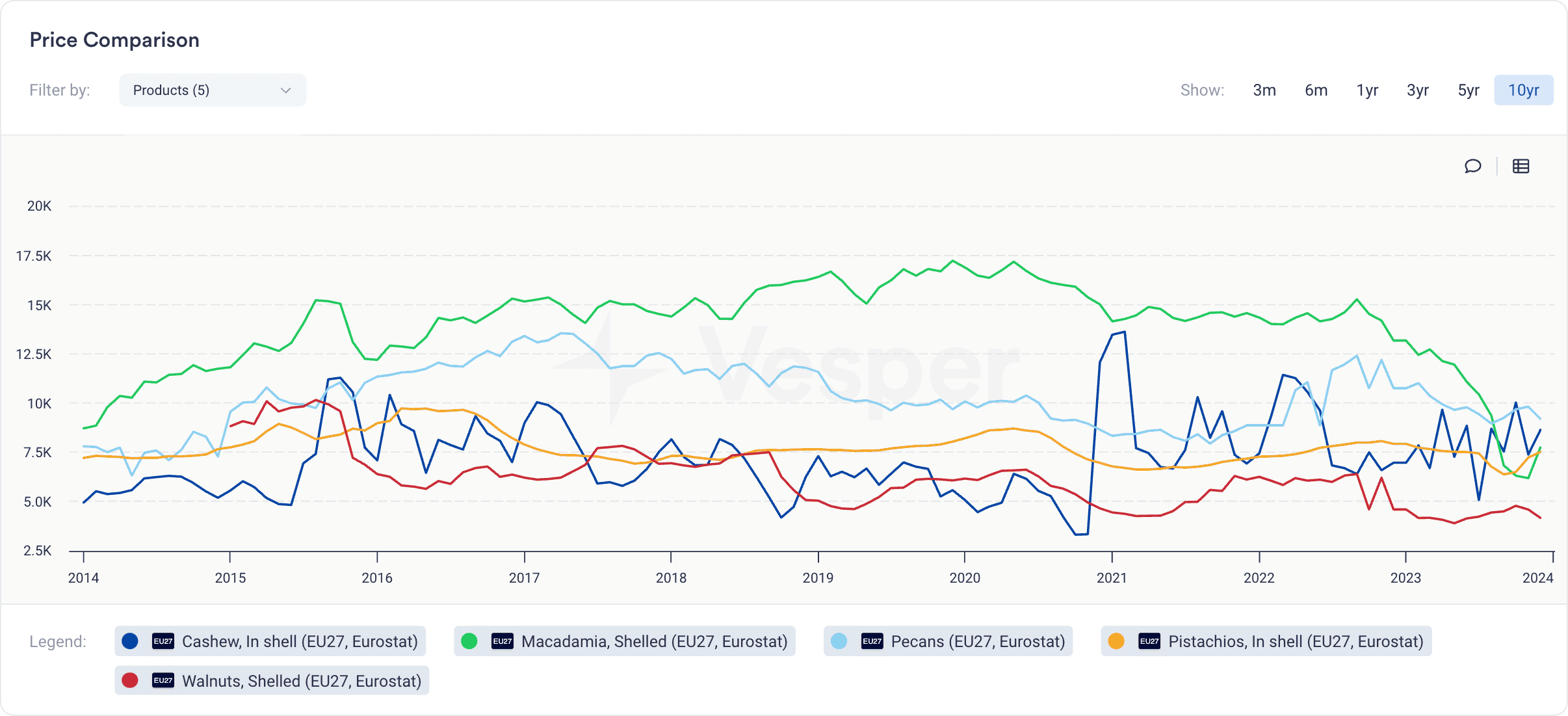

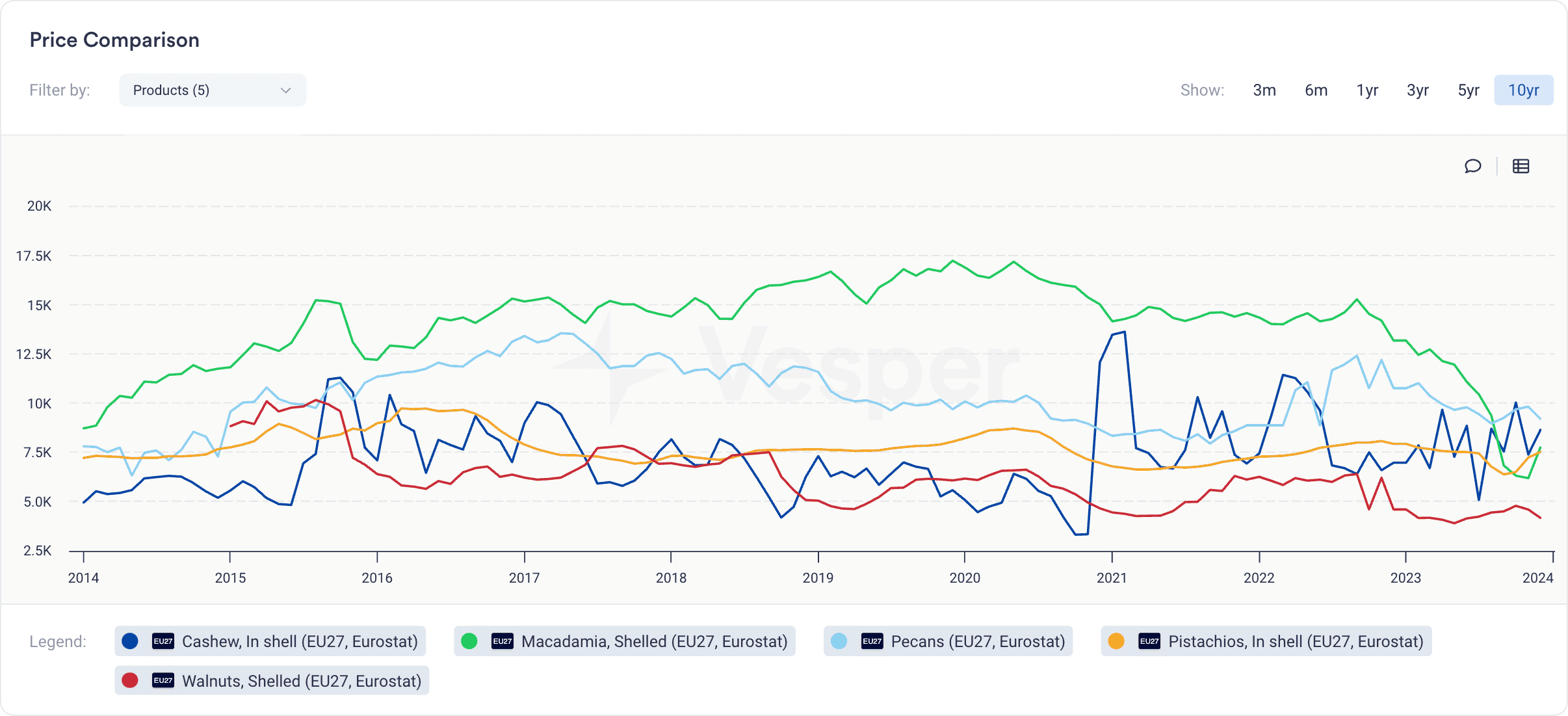

Key Events Impacting Historical Nut Prices

Nut prices have historically been influenced by a combination of environmental factors, trade policies, and global demand shifts. Several key events have significantly impacted nut prices:

Droughts in California

As the world’s largest producer of almonds and pistachios, California’s frequent droughts have caused notable price spikes. During the severe drought of 2014-2015, almond prices surged due to reduced water availability and lower yields. Prices for almonds rose by nearly 50%, reaching an all-time high of $4.50 per pound. This caused concern among buyers worldwide, particularly in Europe and Asia, where California almonds are heavily imported.

African Cashew Production Growth

West Africa, particularly Ivory Coast and Nigeria, has seen rapid growth in cashew production over the last decade. While this growth helped stabilize global prices, external shocks like the COVID-19 pandemic caused temporary disruptions in trade flows. In 2020, cashew prices dipped by 20% due to export delays and supply chain bottlenecks.

Trade Policies and Tariffs

Global trade tensions, such as the U.S.-China trade war, have also affected nut prices. In 2018, China imposed tariffs on U.S. nuts, including almonds, pistachios, and walnuts, in retaliation for U.S. tariffs on Chinese goods. This resulted in a surplus of U.S. nuts on the domestic market and falling prices for U.S. growers, while buyers in China turned to alternative suppliers like Australia.

Weather Disruptions in Turkey

Turkey’s dominance in the hazelnut market means that any weather-related disruptions, such as frost or heavy rainfall, can lead to price volatility. In 2014, a severe frost event in Turkey led to a 60% reduction in the hazelnut crop, causing global prices to surge by nearly 70%, with prices reaching $10,500 per metric ton.

Changing Consumer Preferences for Nuts Over Time

Consumer preferences for nuts have evolved over time, driven by increasing awareness of the health benefits associated with various types of nuts. In recent years, nuts like almonds, walnuts, and pistachios have become more popular as consumers seek out protein-rich, plant-based alternatives to meat and dairy products. This trend has led to an increase in both demand and prices for certain nuts.

In addition, the popularity of “clean eating” and gluten-free diets has bolstered the demand for nuts like cashews and macadamias, which are often used in vegan cooking and dairy alternatives, such as cashew milk and macadamia nut cheese. The rising demand for snack products, granola bars, and energy bars containing nuts has further contributed to the overall increase in nut consumption.

The Importance of Historical Nut Data for Industry Stakeholders

For industry stakeholders, including producers, traders, and retailers, understanding historical nut data is critical for making informed decisions in a complex and volatile market. By analyzing long-term trends in production, pricing, and trade flows, businesses can better anticipate supply shortages, shifts in consumer demand, and the effects of climate events on yields and prices.