Global sugar prices experienced a decline after witnessing an upward trend for three consecutive sessions, largely attributed to the surge in Brazilian output. UNICA, in its recent cane-crushing report for September, highlighted a significant increase in cane crush, registering at 44.8 MMT, a remarkable 77% growth year-on-year. This surge can be credited to the favourable weather conditions prevalent in the region. Additionally, sugar production reached an impressive 3.36 MMT, marking a 98% increase year-on-year. Notably, this is the highest production recorded in the past years for the same timeframe.

Conversely, the ongoing Israeli-Palestinian conflict has had a pronounced effect on Brent Oil prices, causing them to soar by nearly 4% since the previous Friday, reaching 87.65 USD/barrel. This escalation in oil prices subsequently nudged sugar prices upwards. Expert opinions suggest that, despite the conflict, oil supplies are unlikely to face significant disruptions. In the broader perspective, the reliance on Center-South Brazil for sugar is projected to intensify, with expectations of it accounting for approximately 60% in Q1’24, a noticeable increase from the previous average of 45%. This indicates a potential bull market on the horizon.

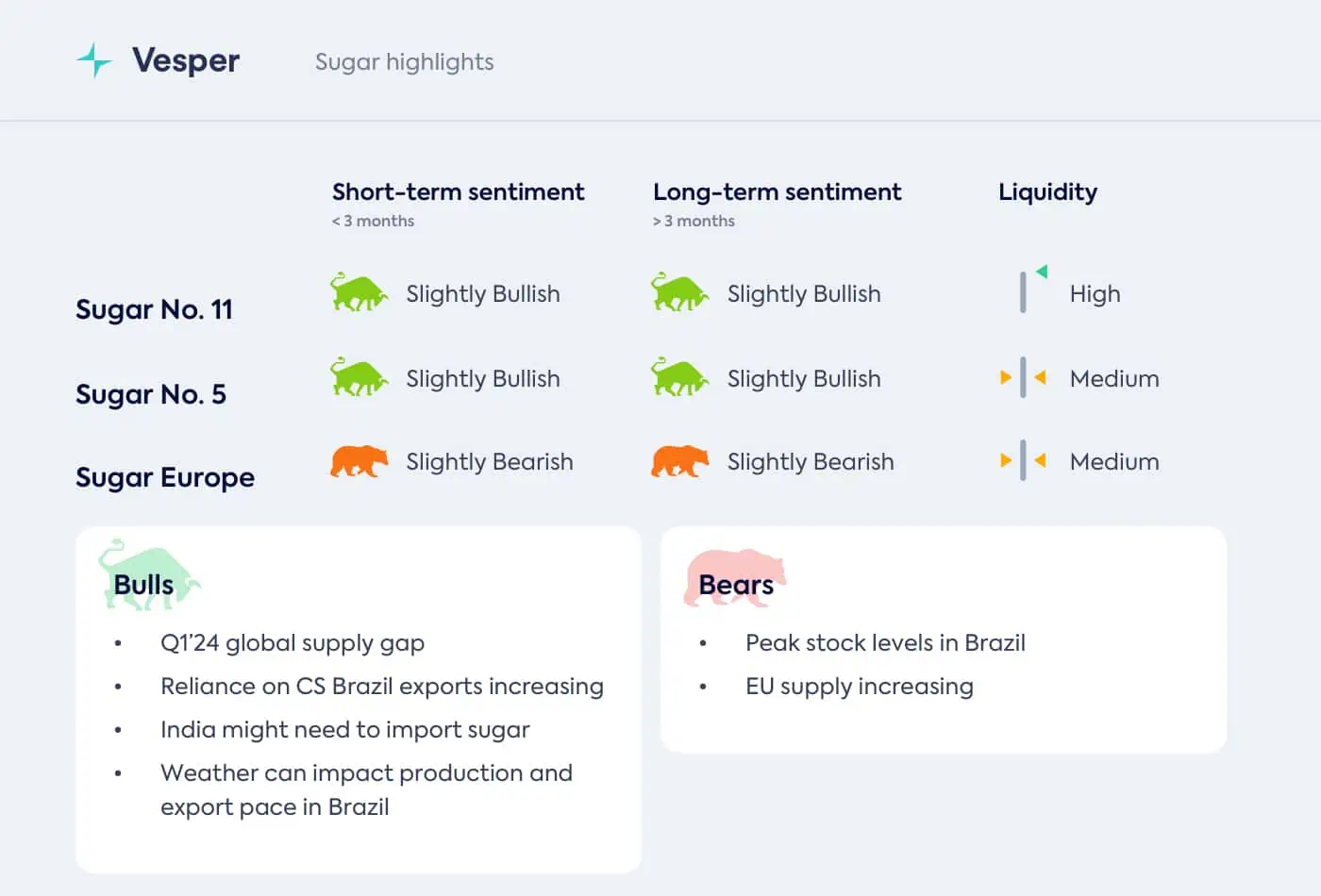

Download our latest global sugar highlights for free and get more insights on the latest sugar prices and trends.