GIE Synergie is a purchasing cooperative serving food manufacturers across France.

Ronan Potiron, GIE’s Purchasing Director, oversees all dairy procurement for the cooperative. His responsibilities include supplier portfolio management, price risk management, tendering processes, and ensuring stable, competitive sourcing for GIE’s member companies.

Ronan’s team already ran a highly disciplined procurement operation, multiple supplier consultations, strict portfolio rules, and careful comparison of every offer.

But email-based tendering limited their reach and slowed execution. When they tested Vesper Marketplace for three months, competitive bidding across a broader network revealed price spreads of up to 2–3% on identical butter specifications.

Within months, GIE moved over 50% of their French dairy volumes to the platform.

A frequent-purchasing strategy that e-mail couldn’t support

Ronan’s procurement philosophy is “bon père de famille” (good family steward): prudent, risk-averse, and focused on stability rather than speculation.

Instead of making large 500-tonne purchases at a single price point, his team buys frequent small volumes to smooth exposure. They maintain 2–3 months of forward coverage, following the market down when it’s bearish, but never trying to hit the absolute bottom.

“Our number one priority isn’t taking risks. It’s to position ourselves well, average our exposure, and smooth volatility. We want to avoid tsunamis and ride the swells instead.”

— Ronan Potiron, Purchasing Director, GIE

The strategy was sound. But without the ability to run tenders quickly and widely, GIE could not fully benefit from it, leaving hidden price gaps undiscovered.

The operational friction behind the missed savings

Ronan’s team consulted multiple suppliers, compared specifications carefully, and enforced clear rules on market share and origins.

But execution was slow. A single 25-tonne butter purchase could trigger 30 emails plus WhatsApp, SMS, and Teams messages. Tracking responses and comparing formats consumed hours.

“We easily spent five times more time per deal,” Ronan recalls.

“Thirty emails back and forth, WhatsApps, texts. And inevitably, you forget you didn’t respond to someone.”

This administrative load caused delays.

“I’d think, ‘I need to buy butter, but I’ll have to deal with all the replies, the hassle.’ So I’d say, ‘I’ll do it Monday.'”

By Monday, the market might have moved.

More critically, without visibility across the broader supplier network, GIE couldn’t be sure their tender results reflected the actual market.

When the marketplace revealed the full network competing on identical specs, prices came in 2–3% lower than their previous results.

Centralized bidding and broader competition revealed better prices

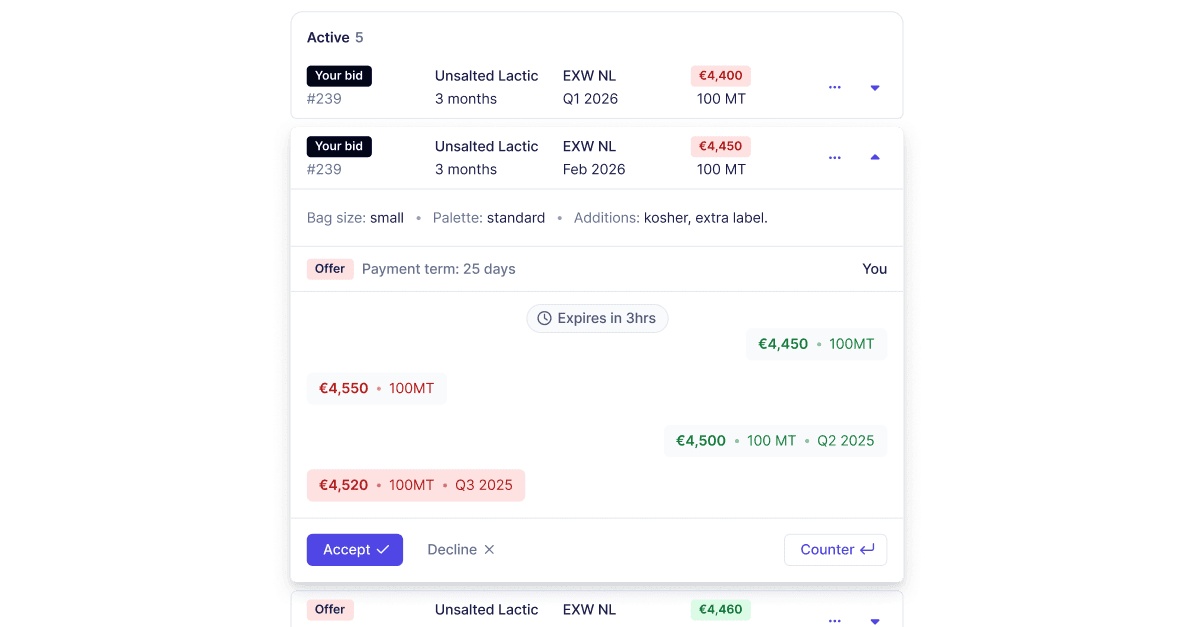

Vesper Marketplace transformed the workflow.

Launching a bid takes seconds.

“Once your specifications are set, it’s two clicks,” Ronan explains.

“You create the bid, choose the delivery period, click, and it’s out.”

All responses arrive in one structured, comparable place. Alerts notify the team whenever bids or offers come in.

“That alert system is critical. Every day, we’re reminded to check. Without it, things fall through the cracks.”

The biggest change was reach.

Email tenders only hit the suppliers GIE contacted. The marketplace broadcast to the entire approved network, revealing more competitive suppliers.

“You opened us to more suppliers we hadn’t targeted,” Ronan says.

“Those few percentage points we gained came from really being in the market and able to compare, and also because you gave us access to a broader network.”

Even external negotiations improved.

“Even if we don’t do everything through the marketplace, it already guides us. We know where the market price is, so we move much faster.”

What GIE discovered in three months: 2–3% savings and faster execution

Early deals on Vesper Marketplace immediately showed meaningful savings.

When multiple suppliers competed on identical butter specifications, prices came in 2–3% lower than outside the platform.

“Even if that exact gap doesn’t repeat every time, one thing is clear: without the platform, we would never have captured those savings.”

Efficiency gains were immediate.

What once required 30+ messages now took two clicks.

The team could act faster, monitor the market from anywhere, and finally execute their frequent small-volume strategy without administrative drag.

“The platform became our daily tool. It’s not just about always winning a few percentage points. It’s about knowing we’ve checked the entire network and we’re buying at market price, not above it.”

— Ronan Potiron

Some volumes remain off-platform when specific suppliers aren’t yet on it. But even then:

“Even if we don’t do everything through the marketplace, it already guides us. We know where the market price is.”

How Vesper’s Marketplace delivered price transparency without exposing their buying strategy

The marketplace shows all bids, offers, and trades anonymously. Buyers see real activity without revealing who is behind it. Only when a deal closes are identities shared with the two parties involved.

The result is full transparency without compromising strategy.

“An anonymous but transparent system is the only realistic way. You get real market transparency without exposing your strategy.”

About GIE

GIE Synergie is a purchasing cooperative serving food manufacturers across France.

About Vesper Marketplace

Vesper Marketplace is a transparent trading platform where buyers and sellers negotiate anonymously until deals close, enabling competitive price discovery while protecting strategic positions.

Related readings:

Why Vesper built a marketplace for dairy trading: 10 Questions with Alexander Sterk

Behind the rollout of Vesper’s new marketplace for dairy trading: 10 Questions with Sebastiaan Laurenceau