In the fast-paced world of commodity market trading, staying ahead of the curve is essential. The ability to access accurate pricing information can make all the difference in making smart trading decisions. That’s where our Vesper’s Price Index (VPI) steps in: an independent pricing benchmark that has revolutionized trade negotiations of thousands of agricultural market players. Unlike many other platforms in the market, Vesper does not engage in buying, selling, or leveraging the VPI for its own gain. This unbiased approach guarantees a reliable pricing benchmark that represents the market.

The concept and development of the VPI can be traced back to Alexander Sterk, the Founder and CEO of Vesper. With a background as a former dairy trader, Sterk experienced first-hand the challenges of navigating a market that lacked a dependable and regularly updated pricing benchmark for agricultural commodities. This experience fueled his determination to create the VPI. Today, the VPI is based on input from respected buyers, sellers, and traders, all sharing the common goal of making global commodity markets more reliable and transparent.

While online platforms like Mintec, Reuters, and Bloomberg offer commodities pricing benchmarks, they often come with high costs and can be overwhelming for those not well-versed in data research. Moreover, these databases may not always provide pricing data for niche commodity sub-market products, such as whey protein isolate (WPI), whey protein concentrate 80 (WPC80), oleochemicals, biofuels, and more. This is where Vesper truly shines.

Vesper not only offers access to hard-to-find data but also presents it in a user-friendly format. This platform streamlines your data research, making it effortless to track and analyze pricing information. Additionally, Vesper provides exclusive calculations based on the latest Vesper Price Index prices, allowing you to conduct your analysis within the platform itself. This convenience saves you time and enables you to make informed trading decisions without the hassle of navigating complex databases.

So, what makes the VPI unique?

The Vesper Price Index:

1. Ensures a comprehensive market representation

Vesper collates price data by engaging with market players, including buyers, sellers, traders, and brokers. By leveraging the active participation of our Vesper Community, we ensure that we have a well-distributed range of inputs for each price to achieve a representative market view. This enhances the accuracy and representativeness of our price indices. This process underscores our commitment to transparency and market integrity, making the VPI an invaluable tool for market participants.

2. Utilises robust price assessment

Our analysts conduct active validation, ensuring we receive additional insights for inputs when necessary, and that the range of inputs reflects the market. Alongside this active validation, we use a mathematical approach to establish prices, focusing on reducing the impact of outliers and ensuring market accuracy. This involves techniques like mode calculation or average determination, post-outlier removal. Any attempts at speculation or price manipulation will have no effect on the price published.

3. Spot VPI: Gets updated every week

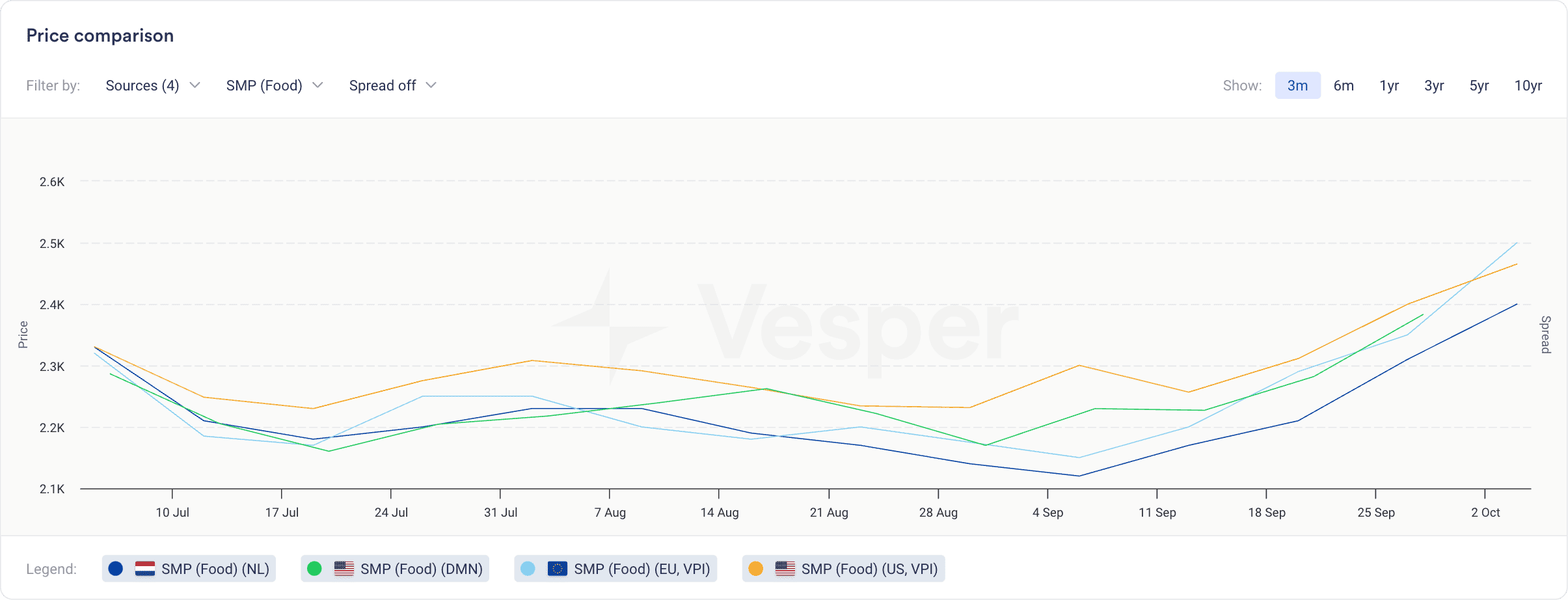

Contracts commonly rely on open-source settlement prices. However, these prices often lag one or two weeks behind the VPI, which is updated every Wednesday and more reflective of the current market conditions. To ensure you make informed decisions, it’s essential to compare the open-source prices with the latest VPI prices, which we try to make as effortless as possible with our price comparison widget.

With the price comparison widget, you can easily compare public source and futures prices with VPI across multiple countries and products. For instance, you can compare the US VPI price with the Dairy Market News (DMN) price for SMP Food. As shown in Figure 1, the SMP food price from DMN is lagging two weeks behind the US VPI price. Another comparison is made between the Dutch (ZuivelNL) and the EU VPI price for SMP Food. According to our price comparison widget, the EU VPI price is observed to be lower than the Dutch ZuivelNL price, which can provide Dutch dairy industry stakeholders with advantageous leverage during contract negotiations.

Figure 1: Price comparison widget for SMP Food

4. Forward VPI: Gets updated multiple times daily

Some commodities, such as oils and fats, experience rapid market fluctuations. Their market volatility necessitates the use of the most up-to-date data for making pricing decisions. That’s why we update our Forward VPI up to six times daily, ensuring it reflects the absolute latest market conditions. This frequent updating process helps you stay ahead of market trends, providing you with the most current and accurate information for your trading and negotiation strategies.

5. Covers a wide range of products worldwide

Drawing on the strength of our global community, Vesper collects prices worldwide, providing you with a comprehensive resource. Whether you’re purchasing butter from France, dealing with AMF from New Zealand, or trading Whey Permeate in the US, the VPI is your trusted tool for benchmarking prices against industry-wide figures.

The VPI’s unique capability to compare global commodity prices empowers you to gain a holistic view of the global market and make informed decisions when sourcing or selling products. Kiruba Tinakararajan from Uno Nutrition shared her experience: “We used to import raw materials primarily from the US. At one point, the US prices surged whilst the EU ones showed to be more affordable, which encouraged us to switch suppliers for a while. We would not have been able to do this before using Vesper”. By leveraging the VPI, you can navigate global markets with confidence and seize opportunities that were previously out of reach.

6. Is adopted by 1000+ buyers, sellers, and traders

Access to independent pricing benchmarks significantly enhances your negotiation power with industry players, especially when they recognise and acknowledge the reference point you use for price benchmarking.

While initially, you might assume that using the same benchmark leaves no room for price negotiations, it facilitates a better understanding of different viewpoints. Kristian Kabel, Head of Sales at Lactoprot Germany, expressed, “Some of my customers also use data from Vesper. As Head of Sales, I first thought it’d be a problem, but it’s actually quite handy. I can easily explain prices to customers; they know what I’m talking about, and we’re sure to be on the same page.”

Sharing the same market information also saves time. Ewald Bontje, Owner of Grozette, pointed out, “It’s nice to see how Vesper connects different industries with the same data. Looking at the same independent market information as my customers helps me save heaps of time substantiating certain prices and setting up contracts.” A common pricing benchmark fosters mutual understanding and expedites negotiations, benefiting all parties.

7. Is downloadable for convenience

Our Vesper Price Index offers an additional time-saving feature as it can be easily downloaded for internal use. Tim Pilon, Global Head of Derivatives at Numidia, attests to its convenience by saying, “I refer my colleagues to Vesper, so they can see and download the data themselves, which saves our team a few hours per week.

Download the latest Vesper Price Index for Dairy, Sugar, or Oils and Fats commodities.