In the edible oil markets, sunflower and rapeseed oil remain two of the most functionally interchangeable ingredients in industrial bakery production. For procurement teams, the ability to switch between them is not just a technical convenience, it’s a strategic lever for managing margins.

Over the past year, prices for both oils have fluctuated significantly due to shifts in weather, geopolitical events, and crush margins. The spread between refined sunflower oil (UA – VPI) and refined rapeseed oil (DE – Partner Price) has moved sharply, at times favoring rapeseed oil by more than €100/MT, and at other times flipping in favor of sunflower oil. These shifts highlight the importance of continuous spread monitoring.

For bakeries already set up to switch between these two oils, tracking this spread, and knowing how and when to act on it, can unlock measurable cost savings.

This article outlines a practical, step-by-step approach to tracking the sunflower–rapeseed oil spread and using it as a margin-optimization tool in your sourcing strategy.

1. Setting a spread threshold for action

Before procurement teams act on changes in the sunflower–rapeseed oil spread, they need to define a clear threshold, the minimum price difference at which switching becomes cost-effective.

Just because rapeseed oil is €30–€40/MT cheaper doesn’t automatically justify a switch. If oil makes up just 5.5% of your recipe cost, the impact per unit may seem marginal. But the only way to understand the true financial effect is to simulate it in a detailed cost model.

Simulating the real cost impact

Let’s walk through an example using spot prices from 8 August 2025:

- Refined sunflower oil: €1,157/MT

- Refined rapeseed oil: €1,129/MT

- Spread: €28/MT in favor of rapeseed

At face value, this may look like a cost-saving opportunity. But when plugged into a cost model, such as for a muffin recipe where oil contributes 5.5% to the total cost, the per-unit savings can be just fractions of a cent.

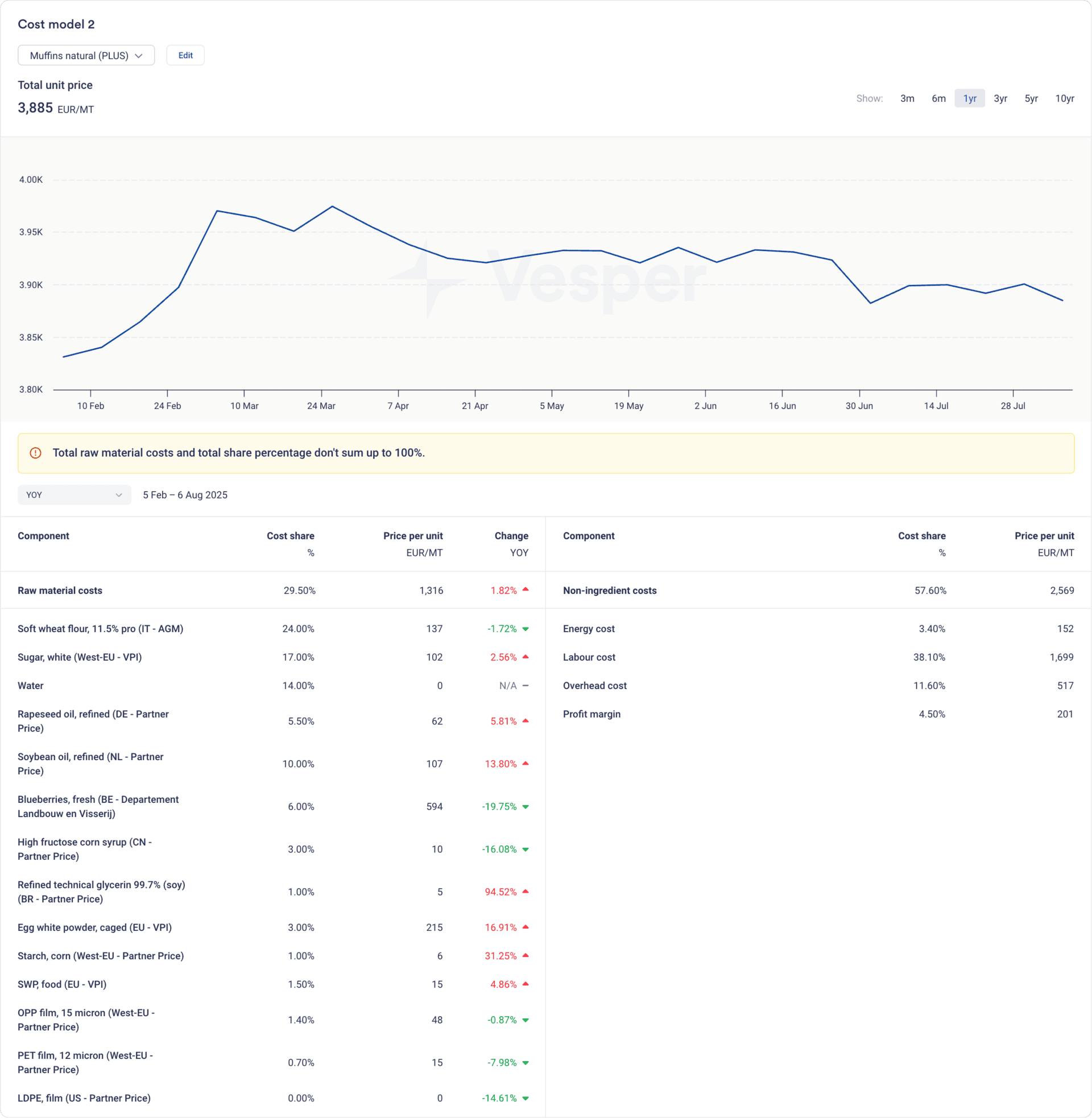

See the Vesper cost model example below for ‘Muffins natural,’ where rapeseed oil accounts for 5.5% of the total cost share, contributing to a unit price of €3,885/MT.

While that may seem negligible, scale tells a different story.

If you produce 10,000 MT of finished goods annually, a modest €10/MT savings leads to €100,000 in yearly savings. If the spread widens to €30 or €50, that scales to €300,000–€500,000 in cost reductions.

Don’t forget the real switching costs

Switching isn’t just about ingredient prices. It may involve:

- QA and recipe revalidation

- Regulatory and labeling updates

- Packaging and scheduling changes

- Loss of supplier discounts or volume-based rebates

That’s why your cost model needs to go beyond raw material pricing. Vesper’s cost model lets you manually adjust any variable, including supplier pricing tiers, switching costs, and even formula tweaks (like adding a flavoring to compensate for sensory differences).

This gives you a realistic, end-to-end view of what switching will mean for your margin, not just in theory, but on your actual bottom line.

2. Monitor trusted refined oil benchmarks

Once you’ve defined your spread threshold, the next crucial step is to monitor reliable, real-time price benchmarks. Making sourcing decisions based on outdated or inconsistent data can be risky, especially when those decisions affect recipes, packaging, or supplier agreements.

At Vesper, we offer a complete set of benchmarks tailored to procurement teams in the food industry:

✅ Vesper Price Index (VPI):

The VPI is an independent benchmark based on real traded spot prices, crowd-sourced from verified industry participants, and updated frequently to reflect current market conditions.

✅ Partner Prices:

Directly sourced from trusted commercial partners, providing a real-world view of current market offers and trades.

✅ Public Benchmarks:

Sourced from governmental institutions and commodity exchanges (e.g., MAPA), offering transparency, but often with delays that don’t reflect real-time market shifts.

Why does this matter?

Because many suppliers still reference lagging public prices in their offers. Without access to real-time benchmarks, you risk missing opportunities or making misinformed decisions.

With Vesper, you can compare all these benchmarks on a single platform, helping you benchmark intelligently, challenge outdated references, and negotiate with confidence.

These are the benchmarks we provide for refined sun oil and rapeseed oil:

| Oil Type | Benchmark Name | Country/Region | Source Type |

|---|---|---|---|

| Sunflower Oil, Refined | BG – Partner Price | 🇧🇬 Bulgaria | Partner Price |

| UA – VPI | 🇺🇦 Ukraine | Vesper Price Index (VPI) | |

| IT – AGM | 🇮🇹 Italy | Public Price (AGM) | |

| CN – Partner Price | 🇨🇳 China | Partner Price | |

| ES – VPI | 🇪🇸 Spain | Vesper Price Index (VPI) | |

| ES – MAPA | 🇪🇸 Spain | Public Price (MAPA) | |

| Sunflower Oil, Refined Organic | West-EU – VPI | 🇪🇺 Western Europe | Vesper Price Index (VPI) |

| Rapeseed Oil, Refined | BR – VPI | 🇧🇷 Brazil | Vesper Price Index (VPI) |

| ES – Partner Price | 🇪🇸 Spain | Partner Price | |

| FR – Partner Price | 🇫🇷 France | Partner Price | |

| NL – Partner Price | 🇳🇱 Netherlands | Partner Price | |

| DE – Partner Price | 🇩🇪 Germany | Partner Price |

3. Use price forecasts to anticipate spread movements

Once you’ve set a spread threshold and established trusted benchmarks, the final piece is timing; knowing not just where prices are today, but where they’re likely headed next.

That’s where AI-driven price forecasts come in.

Vesper’s forecasting models use machine learning trained on historical prices, seasonality, macro trends, and market patterns to predict where key edible oil prices are likely to move in the coming months.

In the chart below, you can see forecasted price trends for:

- Refined sunflower oil (UA – VPI)

- Refined rapeseed oil (DE – Partner Price)

These forecasts are back-tested for accuracy, with sunflower oil (UA – VPI) showing a 93% historical accuracy and rapeseed oil (DE – Partner Price) reaching 97%. The dotted lines represent forward projections, giving you early visibility into when the spread may widen or narrow again.

Why does this matter for procurement?

Timing is crucial when switching oils, you want to act before the opportunity peaks, not after it passes.

But a short-lived price dip isn’t enough. Switching only makes sense when the spread is likely to last long enough to outweigh the operational costs.

With forecast data, you can:

- Spot favorable spreads in advance

- Align contract or recipe updates with market shifts

- Act proactively, not reactively

- Avoid switching too late or back too soon

4. Track leading indicators that move the spread

Tracking prices, especially with AI-driven forecasts, gives you a strong head start. But to make truly strategic sourcing decisions, you also need to understand what drives those prices. Several macro and micro factors can cause the sunflower–rapeseed oil spread to widen or narrow.

Here’s a breakdown of the key indicators, and how Vesper helps you track them:

Weather in Ukraine & the EU

Weather conditions in major growing regions like Ukraine, Romania, and France play a huge role in sunflower seed yields and availability. Droughts, delayed sowing, or harvesting disruptions can quickly drive price volatility.

To help you track this, Vesper integrates satellite-driven crop and weather analytics via partnerships with EarthDaily Agro and HSAT. These tools let you monitor real-time vegetation indexes, drought stress, and yield projections, giving you an early signal before the market reacts.

🔗 Read more about our EarthDaily Agro partnership

🔗 Read more about HSAT integration

Crush margins in Europe

Rapeseed oil prices are strongly influenced by crush margins; the financial return from processing seeds into oil and meal. When margins become unprofitable, processors may reduce activity, tightening supply.

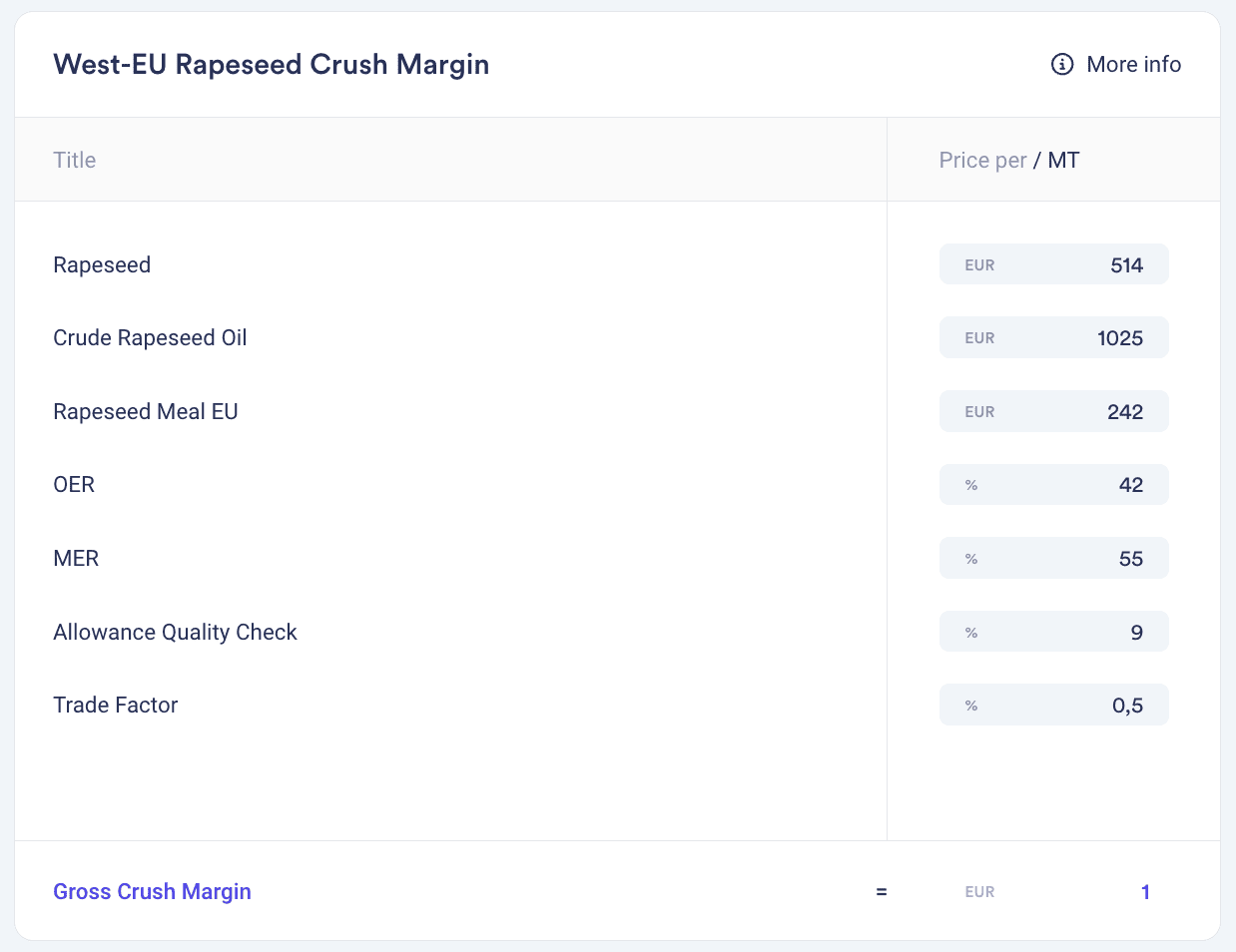

Vesper offers a real-time West-EU Rapeseed Crush Margin calculator, which factors in:

- Seed input cost

- Oil and meal value

- Extraction rates (42% oil, 55% meal in this example)

- Allowance quality checks (e.g., 9% markup)

- Trade factor adjustments (e.g., 0.5%)

In the example below (August 8, 2025), the crush margin is just €1/MT, a level so low it could deter continued production; a potential red flag for upcoming supply constraints.

Biodiesel policy shifts

Rapeseed oil is a core feedstock for EU biodiesel. Shifts in mandates, tariffs, or feedstock demand often ripple directly into edible oil prices.

2025 trend highlights:

- EU anti-dumping tariffs on Chinese biodiesel and renewable diesel constrained supply and pushed up rapeseed oil prices.

- Indonesia’s export ban on UCO and POME redirected biodiesel demand toward rapeseed.

- Record-low blending rates in Germany and subsidy reforms affected demand volatility.

- US tariffs on Canadian biofuels created global trade tension, disrupting rapeseed and canola oil markets.

Vesper publishes weekly biodiesel market updates, explaining how regulatory changes and global trade flows impact edible oil fundamentals. You’ll understand how feedstock shifts (UCO, tallow, palm) interact with rapeseed and sunflower oil dynamics. Read the latest market analyses here: https://app.vespertool.com/market-analysis?commodity=vegetable-oil

Export Flows from Ukraine / Black Sea

Sunflower oil prices are tightly linked to logistics, especially export activity from the Black Sea region (Ukraine, Russia, Romania). Even minor disruptions can cause sharp price swings.

Throughout 2025, supply remained unstable. While corridor access largely held, export volumes fluctuated due to infrastructure constraints, weather-related delays, and persistent geopolitical tensions, all fueling uncertainty in the sunflower oil market.

Vesper helps you stay ahead of these shifts with:

- A partnership with Shypple, giving you visibility into container movements and port logistics from key origin points like Ukraine, Read more here.

- Import/export dashboards that track real-time trade flows by country, so you can spot changes in supply patterns early.

5. Align your contracting strategy with the market signals

Once you’ve decided that switching oils makes economic sense, and you’ve identified your timing based on the spread, the next critical step is to secure the best possible deal. This is where execution meets strategy, and where having the right tools at your fingertips can turn planning into profit.

Let’s walk through how to use Vesper’s ecosystem of pricing tools to lock in the optimal contract.

Start with the Forecast

Earlier in this article, we highlighted how Vesper’s AI-driven forecasts help you anticipate price direction. As you can see in the graph mentioned earlier, the data shows that refined rapeseed oil (DE – Partner Price) is expected to remain cheaper than sunflower oil through early 2026.

This forward-looking insight gives you a clear signal: now might be the right moment to secure volume at favorable rates.

Secure volume through forward pricing

If you’re ready to act, Vesper allows you to view forward prices directly from partner benchmarks. For example, you can see that refined rapeseed oil (FOB Hamburg) is currently offered at:

- €1,098/MT for August 2025

- €1,120/MT for ASO 2026 (Oct–Dec delivery)

This lets you lock in a rate with suppliers today, protecting your margin against future volatility.

Benchmark spot prices across countries

Prefer to buy on the spot market? Vesper lets you compare refined oil prices across multiple countries to find the most competitive deals, and strengthen your negotiation leverage.

Take a look at the current rapeseed oil prices:

- 🇳🇱 Netherlands – Partner Price (FOB Rotterdam): among the lowest in the region

- 🇫🇷 France – FCA Rouen: slightly higher

- 🇪🇸 Spain – FCA Spain: considerably more expensive

By comparing these real-time prices, you can either:

- Source directly from lower-cost regions, or

- Use the data to challenge your supplier and negotiate better terms locally.

Use All Tools Together to Maximize Value

By combining:

- Forecast insights to time your decision

- Forward pricing to secure future volume

- Spot comparisons to negotiate better deals

…you give your procurement team maximum leverage to buy smarter, faster, and more profitably. Whether you’re locking in contracts or playing the spot market, Vesper equips you to make data-driven decisions with confidence.

Final Takeaway: Be ready before the spread moves

Tracking the sunflower–rapeseed oil spread can be a powerful lever for margin optimization, but only if you’re prepared to act on it. Spotting favorable spreads, modeling cost impacts, benchmarking in real time, and using AI-driven forecasts are all key parts of the puzzle. But execution matters just as much as insight.

To close the loop, don’t overlook the operational groundwork required to make a switch feasible:

- Document your switching costs, from QA to packaging to regulatory updates

- Track internal lead times for approvals, labeling, and reformulation

- Identify any consumer or brand risks associated with changing ingredients

- Build those delays into your decision model, so you’re not caught off guard

Even if your team is flexible, switching oils isn’t frictionless. But when you’re organized and informed, you can act decisively, turning spread volatility into margin opportunity.