Our September outlook report mentioned that El Niño weather conditions would continue into 2024, potentially intensifying and concluding in spring. The anticipation of a stronger El Niño in these coming months created uncertainty among vegetable oil traders, prompting them to secure adequate vegetable oil reserves.

However, experts now agree that El Niño may not significantly impact vegetable oil production adversely.

This article examines the potential effects of El Niño and other (forecasted) weather conditions on the expected yields of various vegetable oil crops like soybean, palm oil, rapeseed, sunflower, and olive oil in 2024 worldwide.

El Nino, La Nino, and ENSO-neutral phase

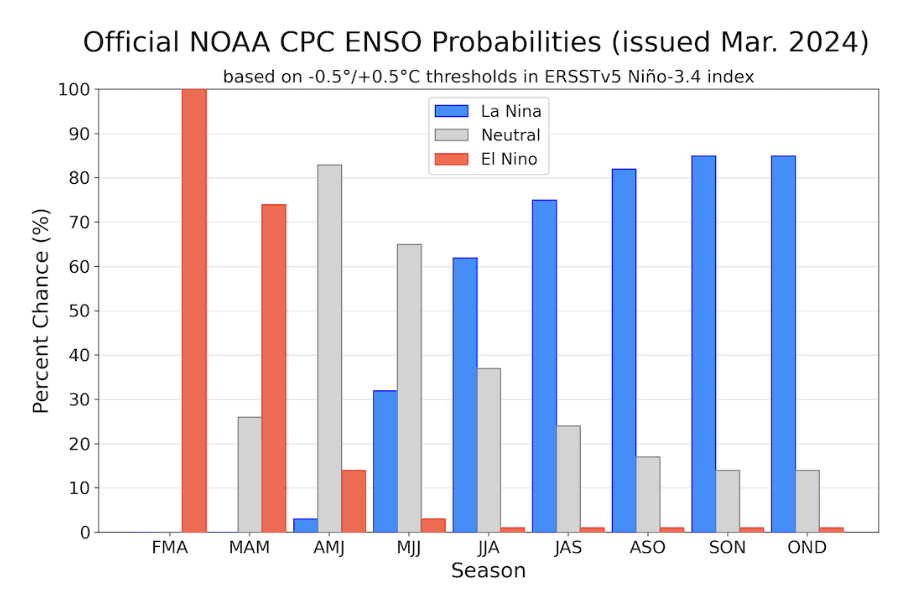

Before we delve further, here’s a brief overview of the NOAA’s predictions for this year’s weather patterns: The NOAA forecasts a shift from El Niño to ENSO-neutral conditions between April and June 2024, with a 83% likelihood. Additionally, there’s a 62% chance of moving into La Niña conditions from June to August 2024, see Figure 1.

Figure 1: Official ENSO probabilities for the Niño 3.4 sea surface temperature index (5°N-5°S, 120°W-170°W)

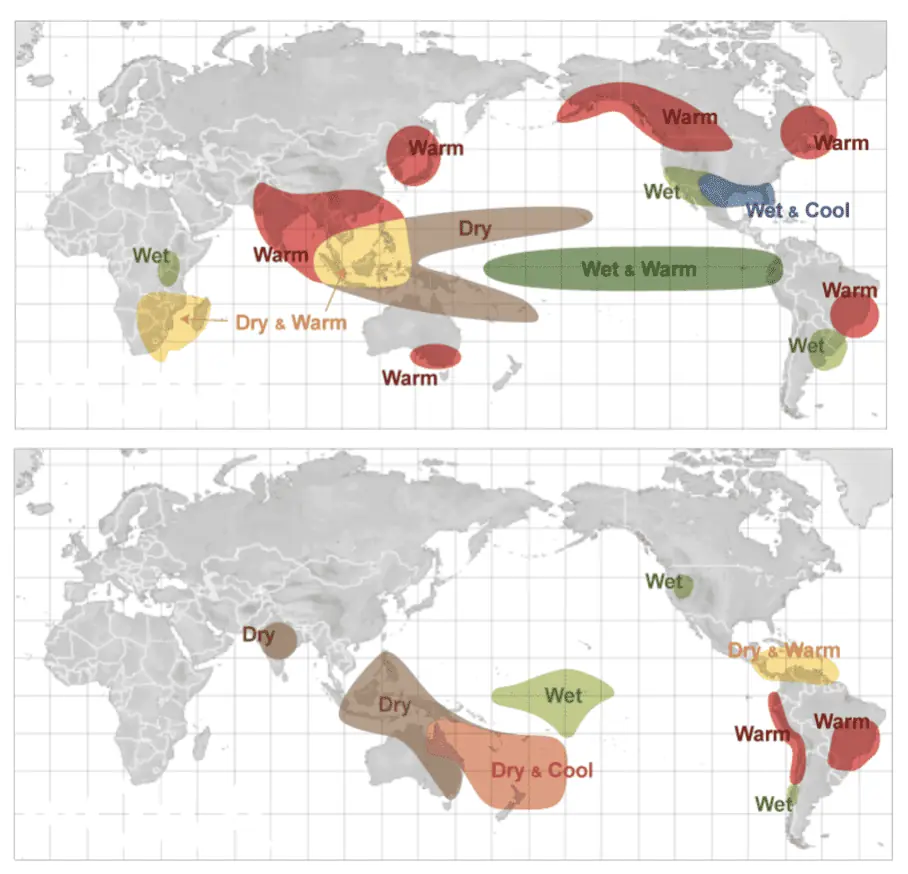

For those who might not be familiar with these weather patterns: El Niño leads to higher-than-normal sea surface temperatures in the tropical Pacific, affecting global climate and altering weather patterns, such as increased rainfall in the Southern USA and Gulf of Mexico, and drier conditions in Southeast Asia, Australia, and Central Africa, see Figure 2.

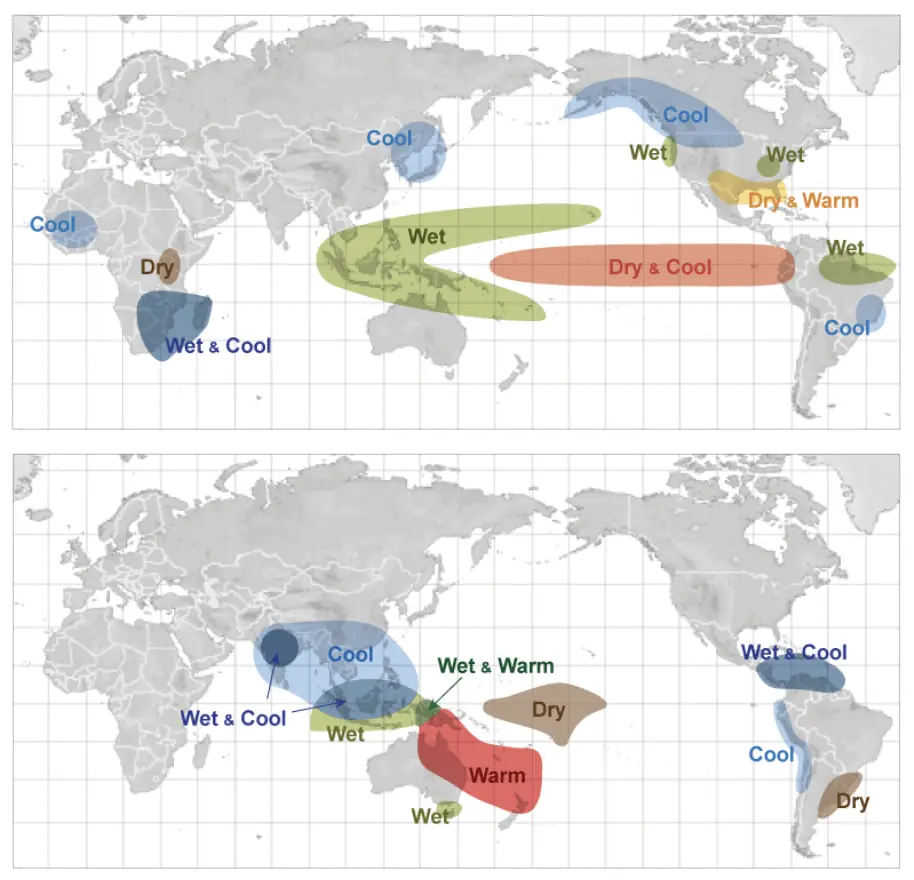

La Niña on the other hand is marked by cooler-than-normal sea surface temperatures in the tropical Pacific, influencing global weather patterns. In the U.S., it can cause eastward shifts of warm surface water, altering temperature, rainfall, and wind patterns, see Figure 3.

Figure 2: El Niño effects from December through February (top image), and El Niño effects from June through August (bottom image)

Figure 3: La Niña effects from December through February (top image), and El Niño effects from June through August (bottom image)

Finally, the ENSO-neutral phase indicates a period without El Niño or La Niña, where sea surface temperatures, winds, and rainfall in the tropical Pacific align closely with long-term averages. During this phase, it’s important for farmers to keep abreast of local weather updates to adapt their farming strategies, especially regarding planting and irrigation, due to possible variations in rainfall.

*Note that forecasts this far in advance come with a high degree of uncertainty.

Impact of El Nino on forecasted soybean yields

Let’s start with examining the potential effects of El Niño and other (forecasted) weather conditions on soybean yields in 2024 per region.

🇺🇸

The 2024 US agricultural scene had hoped for improvement following three consecutive La Niña winters, which led to drought in crucial soybean harvesting areas in the Midwest.

While El Niño influenced precipitation in 2023, benefiting the Great Plains with some areas experiencing over 110% of normal rainfall and potentially reaching 150% in the Oklahoma Panhandle, the Midwest’s recovery fell short. Some areas still face significant deficits of 50% to 70% below normal.

With fieldwork for the 2024 Midwest corn and soybean season commencing in a month, the primary focus is on soil moisture recharge. Projections for soybean production in the 2023/24 MY indicate it to be the 12th tightest on record, declining to 113.3 MMT, representing a 2.48% decrease compared to the preceding MY, see Figure 4. Additionally, concerns arise about a potential La Niña, posing further challenges to the soybean sector in the upcoming season.

Figure 4: Global soybean production trends in 2023/2024, compared to 2022/2024.

🇧🇷

The El Nino weather pattern, notorious for heat and dryness in South America, triggered a significant drought in the Amazon around October last year. This led to notably reduced water levels in Amazonian rivers, some recording their lowest rainfall since 1980.

Brazilian soybean farmers became concerned about potential replanting needs and lower yields due to scarce rains and high temperatures, persisting into November and December, resulting in reduced production forecasts in December and January.

Conditions improved in Brazil from January onwards, easing concerns. According to the Agriculture and Horticulture Development Board (AHDB), “For oilseeds values to change trajectory, there will need to be either a fundamental change in medium-term demand or renewed issues with crops somewhere around the world”.

After January’s weather stabilization, production forecasts were adjusted. The USDA predicts the 2023/24 Brazil soybean crop at 156 MMT, a 3.70% decrease from the previous year, see Figure 4. Other estimates include Conab at 149.4 MMT, Safras & Mercado at 151.3 MMT, StoneX at 150.35 MMT, and AgResource at 145.4 MMT.

🇦🇷

Argentina also faced a drought in the 2022/23 season because of La Niña; however, fall 2023 brought timely rains, aiding a significant rebound. While Brazil’s soybean production forecast for 2023/24 is lower, Argentina is set for a remarkable surge, projected at nearly 100% to 50 MMT, according to the USDA and Buenos Aires Grains Exchange at 52.5 MMT.

Predictions suggest the USDA may slightly increase estimates for Argentina to around 50.8 MMT. Despite USDA projecting increased soybean consumption, other agencies anticipate lower consumption due to decreased demand in China’s hog industry. This suggests a neutral impact on prices, given sufficient production from Argentina.

The soybean production forecasts have influenced soybean oil prices, causing the price spread between palm and soy, the two most widely consumed oils, to narrow. This narrowing is evident in Figure 5, bringing the palm/soy oil price ratio back to a historically normal range. This adjustment could provide food manufacturing companies, which can often interchangeably use the two oils, with increased procurement options.

Figure 5: Price comparison between Soybean Oil (CBOT) and Crude Palm Oil (BMD) in USD/mt

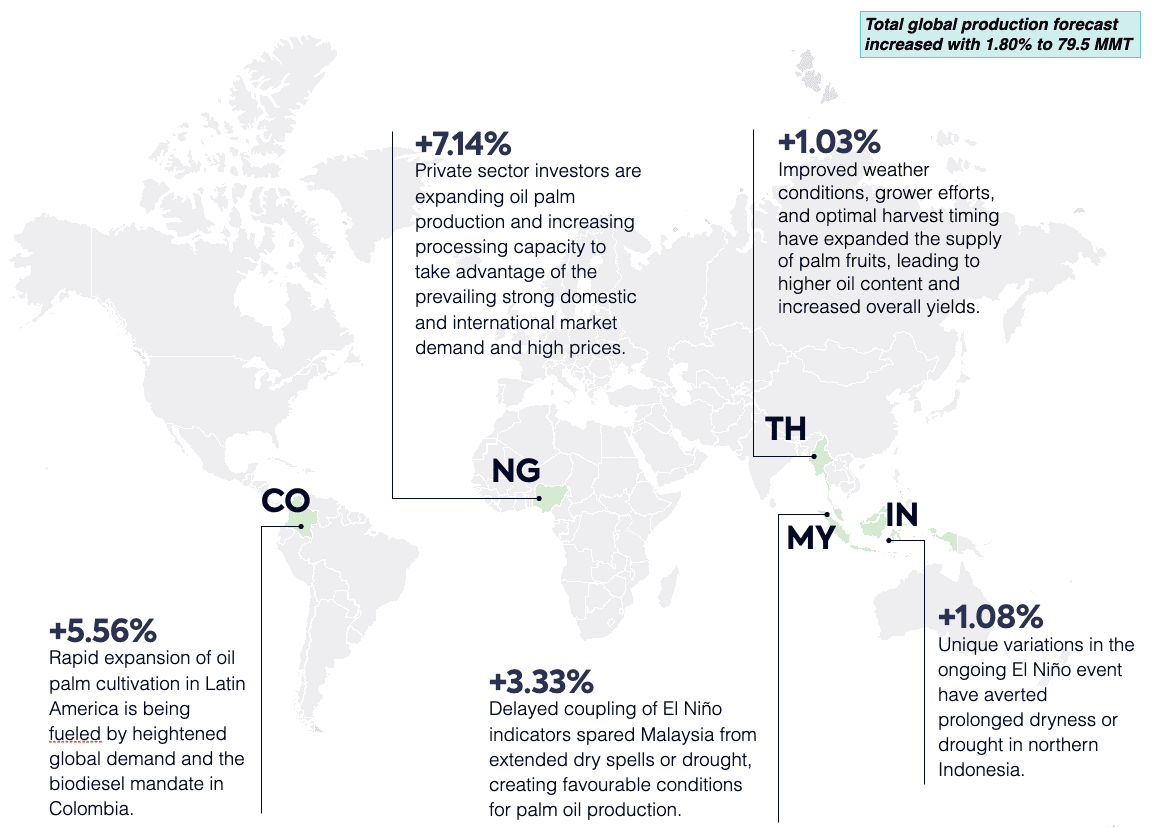

Impact of El Nino on forecasted palm oil yields

🇮🇩 🇲🇾

El Niño, known for causing droughts in key palm oil-producing regions like Malaysia and Indonesia, is currently exhibiting variations from past occurrences, with good rainfall in Malaysia due to late coupling of indicators. Despite initial concerns, precipitation levels have been well above norms since November, and the USDA predicts record production levels for Indonesia (47 MMT, a 1.08% increase) and Malaysia (19 MMT, a 3.33% increase) in the 2023/24 MY.

The potential onset of La Niña, with a 55% chance from June to August, could further influence palm oil production. However, caution is warranted due to the risk of excessive rain impeding yields and harvesting. In the short term, a mildly bullish trend is anticipated, driven by a recent MPOB report and increased demand during Ramadan in March.

However, examining the reduced price gap between palm oil and competing oils like soybean, as illustrated in Figure 5, suggests a potential limitation on any significant rise in palm oil prices. Coupled with the shifting global weather patterns, the overall outlook for palm oil prices in 2024 leans towards a bearish trend.

Figure 6: Global palm oil production trends in 2023/2024, compared to 2022/2024

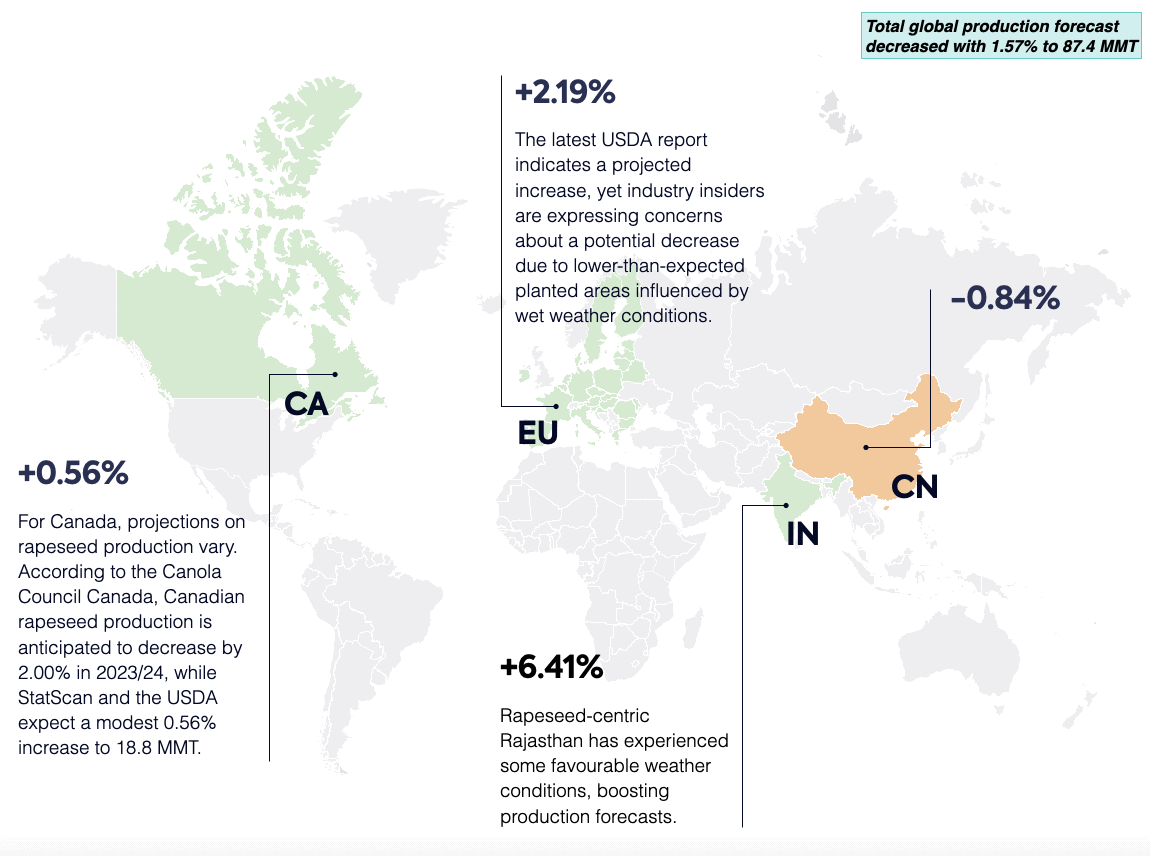

Impact of weather conditions on rapeseed production forecast

🇪🇺

There’s considerable debate surrounding European Rapeseed production, specifically on whether it will increase or decrease. The latest USDA report projects a 2.19% increase in Europe’s rapeseed production for the 2023/24 MY, reaching 20 MMT. The focus of the intense debate among market participants centres on the planted area, with many European players having planted during the August to late October period in 2023.

Insiders in the industry believe the European planted area might be lower than initially anticipated, estimated at around 5.65 million hectares. According to the European Commission, this estimate represents a significant decline compared to the 6.10 to 6.15 million hectares harvested in 2023.

The reduced planted area aligns with wet weather reported by Crop Monitoring in Europe (MARS), where continuous precipitation in Germany, Austria, Czechia, and Poland has exceeded the long-term average (LTA) threefold. This situation raises concerns about substantial crop abandonment and damage, making it challenging to assess the extent of the impact.

As a result, some experts anticipate a 7% drop in the next EU rapeseed crop to 18.4 MMT due to a sharp decline in planted areas across most producing countries.

🇨🇦

For Canada, projections on rapeseed production vary. According to Canola Council Canada, Canadian rapeseed production is anticipated to decrease by 2.00% in 2023/24 to 18,3 MMT, compared to the previous MY. However, StatCan and the USDA expect a modest 0.56% increase to 18.8 MMT compared to the previous year.

As of the end of January 2024, the entire Prairie Region, including key rapeseed-growing provinces like Saskatchewan, Alberta, and Manitoba, was classified as Abnormally Dry (D0) or in Moderate to Exceptional Drought (D1 to D4). This classification covers the entire agricultural landscape of the region, as shown in Figure 7. Given the challenging weather conditions, this raises the question: Can Canada realistically achieve the 18.8 MMT forecasted by StatCan and the USDA?

Figure 7: Canadian drought monitor

Nevertheless, compared to the severe impact of the scorching heat in 2021 on Canada’s rapeseed crop, rapeseed production in Canada is performing relatively well.

Looking ahead to the 2023/24 MY, the EU’s rapeseed supply is ample, boosted by increased imports from Ukraine. This is expected to have a ripple effect on continental prices, eventually influencing domestic rapeseed pricing.

Notably, according to PS&D, Ukraine is set to achieve a record-breaking rapeseed production in 2023/24, surging by 38% compared to the previous year, reaching a remarkable 4,300,000 tonnes.

Figure 8: Global oilseed, rapeseed production trends in 2023/2024, compared to 2022/2024.

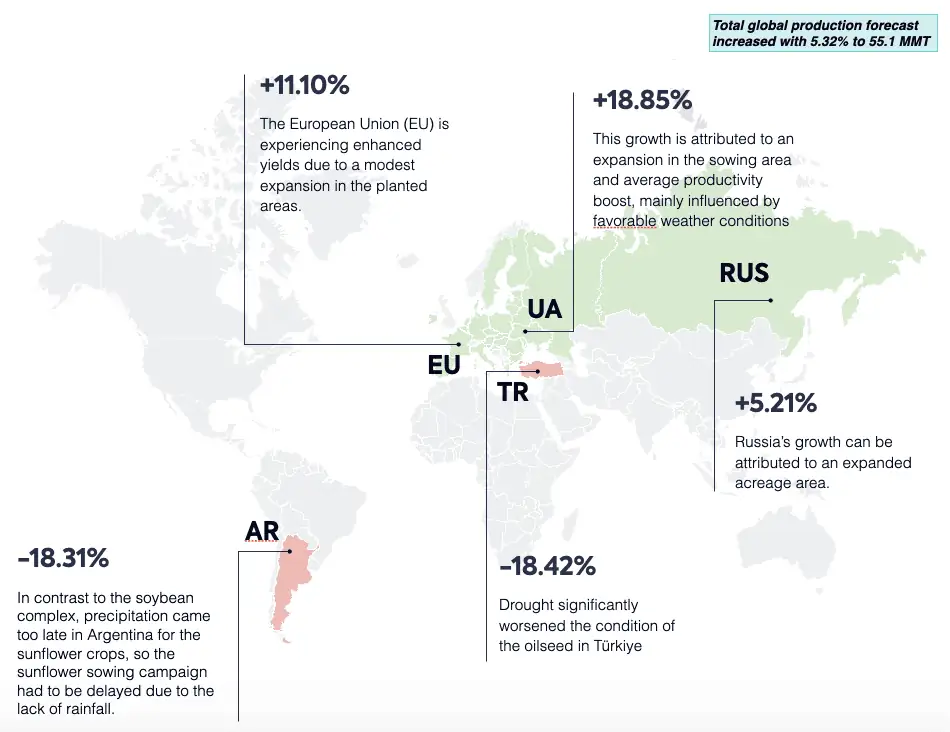

Impact of weather conditions on sunflower production forecast

🇷🇺

During the 2023/2024 crop year, Russia is anticipated to achieve the highest global production volume of sunflower seeds, reaching around 17.1 million metric tons. This reflects a 5.21% increase compared to the preceding MY, as illustrated in Figure 9. The growth is attributed to an expanded acreage area.

🇺🇦

The Ukroliyaprom association forecasts an 18.8% increase in the production of all oil crops in Ukraine for 2023/24. This growth is attributed to a 12.1% expansion in the sowing area and a 5.7% average productivity boost, mainly influenced by favorable weather conditions. Sunflower production is expected to see the most significant increase.

The anticipated global sunflower crush for 2023-24 is approximately 52.5 million metric tons, similar to the previous MY. Notably, increased crush volumes are expected in Ukraine, Russia, and the United States.

Figure 9: Global oilseed, sunflower seed production trends in 2023/2024, compared to 2022/2024.

Coconut oil production forecast

In the 2023/24 season, the global production volume of coconut oil is projected to amount to 3.76 million metric tons, remaining more or less stable without significant fluctuations since 2012/13. Compared to the previous MY, this is only an increase of 1.36%.

Disappointing olive oil production forecast

While El Niño’s impact on global vegetable oil crops seems minimal, the outlook for olive oil tells a different story. Weather conditions are expected to significantly affect olive oil production, unlike other crops.

During the initial phase of winter in 2023-24, a considerable portion of the western Mediterranean experienced wet conditions. Producers are placing their hopes on the much-anticipated spring rains from February through May. They anticipate these rains will help alleviate the stress on olive trees, replenish groundwater levels, and contribute to a more typical upcoming harvest.

Despite the likelihood of increased precipitation forecasts, it is too late for the 2023/24 crop to restore to pre- MY 2022/23 levels. According to the USDA, In MY 2023/24, the EU is facing a second consecutive short olive oil production crop based on precipitation levels to date, temperatures during the olive trees flowering season, and the subsequent extreme summer heat waves that resulted in unripe fruit dropping. The European Union’s (EU) olive oil output in MY 2023/24 could amount to just above 1.8 MMT, an increase of 28.57% compared to the previous MY.

Specifically in Spain, responsible for half the world’s olive crop, the upcoming production is expected to rise by 15%, following last year’s decade-low output. The latest official estimates indicate that olive oil production in Spain in MY 2023/24 may reach up to 765,200 MT, see Figure 10.

Figure 10: Olive Oil Production in the EU by Member State (1,000 MT)

As we navigate the transition from El Niño to ENSO-neutral conditions, coupled with the possibility of La Niña, it’s imperative for stakeholders to stay informed and adapt their strategies accordingly. Despite challenges posed by weather variability, forecasts indicate resilience across various oilseed crops, with notable shifts in production levels expected worldwide.

For a more comprehensive analysis of the vegetable oil landscape in 2024 and beyond, we would like to refer to our global vegetable oil outlook report 2024, providing deeper insights into the dynamic nature of the vegetable oil markets.