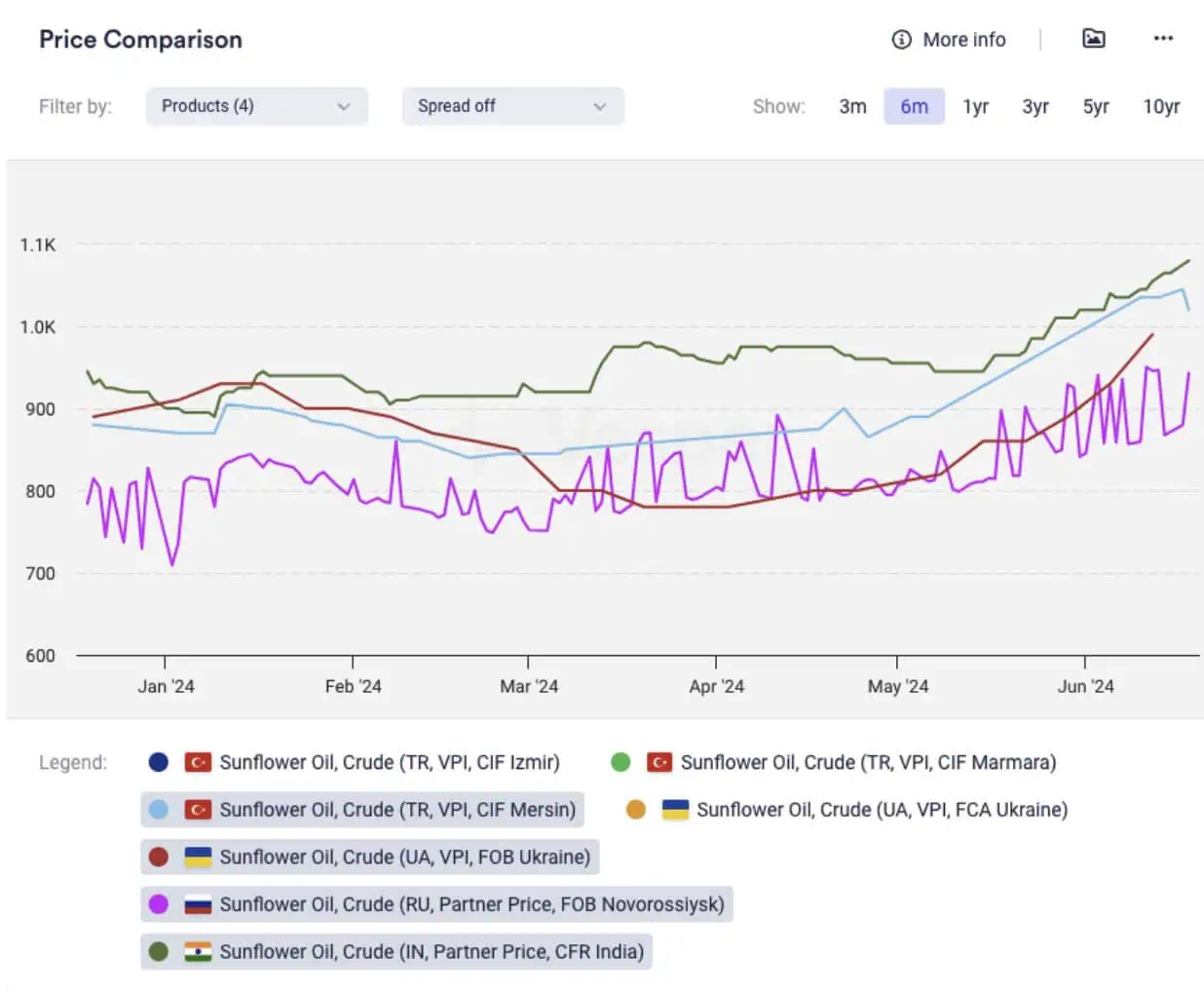

The Vesper West-EU Forward Price Index for Crude Sunflower Oil (2024-06-17) decreased to €972 | $1040 / mt (FOB 6Ports (FOSFA 52), Jul-Aug-Sep) from €984 | $1060 / mt on 2024-06-10. However, prices at key origins and destinations strengthened week-over-week, as shown in Figure 1.

Figure 1: Sunflower Oil prices (USD/mt)

Prices have been supported by higher sunflower seed prices and bullish news related to the global sunflower seed crop. Worldwide sunflower seed production in 2024/25 is expected to remain below the previous year’s record level, according to the latest forecast by the International Grains Council (IGC).

The IGC lowered its forecast for global sunflower seed output in 2024/25 from its April estimate of 58.1M tonnes to 57.21M, compared to 57.4M tonnes the previous year, due to smaller expected harvests in Russia and Ukraine caused by adverse weather and reduced planting areas. Sharply below-normal rainfall, above-normal temperatures, and critically low soil moisture are stressing agricultural crops in many parts of Russia and Ukraine, further tightening farmer selling.

“Ukrainian crush margins are tight. Prices are stabilizing as some players have stocks here and there, but higher pricing can be seen in the coming months,” said a representative of a Ukraine-based crushing business.

From June 1-13, Ukraine exported around 84,000 mt of sunflower oil, 54% below the same period in May. Of this, nearly 70,000 mt were destined for E.U. countries.

During the same period, Russia exported 88,000 mt of sunflower oil, 57% below the same period in May. Out of this, 46,000 mt were destined for Turkey and 25,000 mt for India.

Outlook

Vesper’s machine learning model predicts a price increase from now until the end of July, followed by depreciation. However, we anticipate that prices will remain strong in August as well.

Slower farmer selling and a significant reduction in sunflower seed stocks in Ukraine and Russia, along with a weak UAH, are driving prices up.

This year, Russia is expected to reduce its gross sunflower seed harvest by 8.4% to 15.8 mmt, down from 17.25 mmt last year, according to ProZerno. The reduction is due to smaller sown areas (decreasing from 9.9 million hectares to 9.7 million hectares) and lower yields caused by unfavorable weather conditions.

Ukraine is also expected to harvest a smaller crop of 12.4 mmt compared to 12.9 mmt in the previous season due to reductions in planting areas and lower yields. This is anticipated to result in the tightest sunflower seed balance for 2024/25 in years.