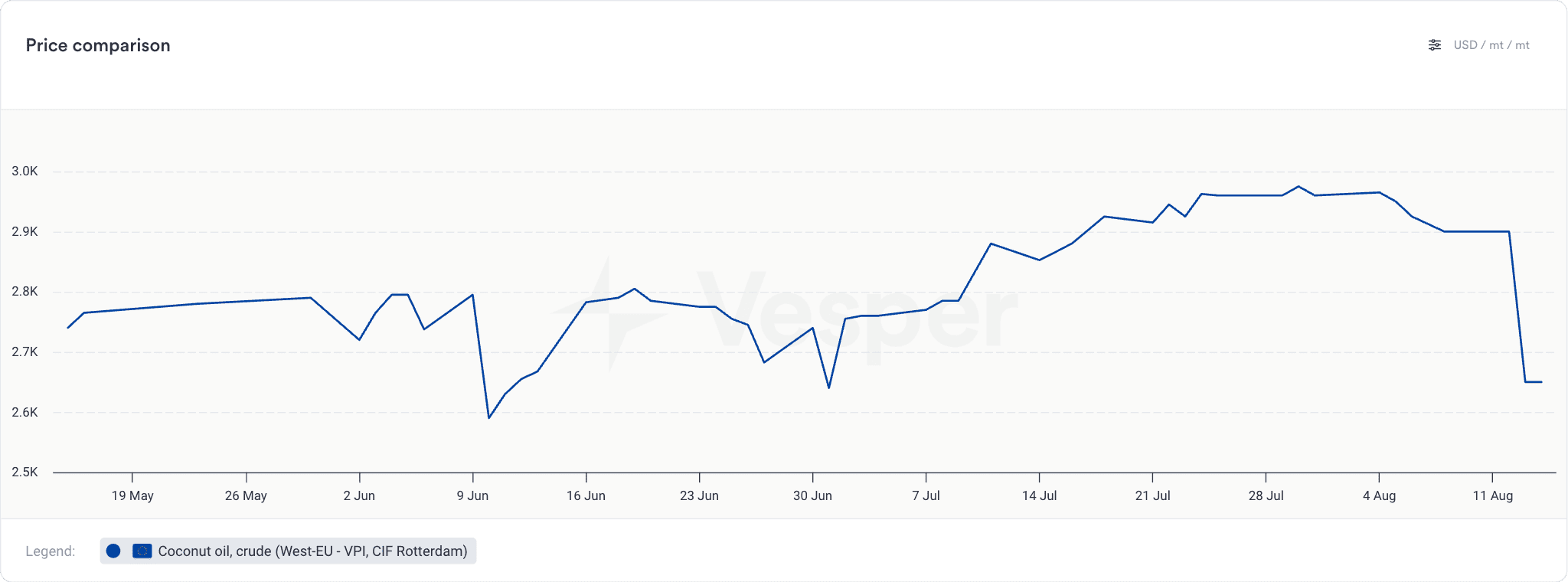

Following this week’s significant price correction in coconut oil markets, the downward trend has accelerated with origin prices in the Philippines dropping to $1,750–1,800/mt EXW, down from $2,800/mt just one week ago. After holding steady while origin prices tumbled, CIF Rotterdam for crude coconut oil finally followed suit, dropping approximately $250/mt to $2,650/mt.

Origin pressure finally impacts CIF Rotterdam

The CIF Rotterdam price for crude coconut oil, which had been holding steady despite the volatility at origin, finally succumbed to pressure yesterday. Prices dropped approximately $250/mt to $2,650/mt, marking the end of a period where European importers had managed to maintain pricing stability.

“CIF has been slow to follow as shippers tried their best to hold the market up (especially nearby), but the pressure from origin has finally forced them to reduce CIF selling,” reported one paper broker. “Buyers see blood and are holding off with their buying ideas, but they will need to come in and buy at some point.”

Two theories emerge for the price decline

Market participants remain divided on the root cause of the current price correction. Several players believe that large copra suppliers have decided to release stock they had been holding due to slower sales in recent months, which were linked to the previously high prices.

However, others suggest that actual copra production may not have improved significantly, indicating the decline could be more about inventory management than fundamental supply changes.

Adding to the downward pressure, fresh reports indicate that copra prices continue to drop as farmers look to move material to protect it from heavy rains threatening their crops.

Market transparency challenges persist

The coconut oil market’s traditional lack of transparency makes it difficult to pinpoint exact drivers behind the current movements. What is clear is that prices reached extremely high levels this year due to anticipated slower production and increased domestic coconut oil usage from higher biofuel mandates in the Philippines.

Export sales from the Philippines have declined in recent months partly due to weaker demand. Market participants suggest this could have increased inventories at origin, pushing suppliers to ease prices.

Price outlook remains uncertain

Some market participants suggest that origin prices (EXW Manila) could rebound above $2,000/mt, but will likely remain below the previously seen $2,800–2,900/mt levels.

As one player summarized the situation: “The writing is on the wall—prices of coconut oil and copra are too high.”

While several sources suggest the sell-off could be over and that sellers have now withdrawn, fresh prices continue to show further declines for both copra and coconut oil at origin, indicating the market has not yet found its floor.

For weekly updates on the coconut oil market keep follow our market analysis page: https://app.vespertool.com/market-analysis?commodity=vegetable-oil