The biodiesel market is witnessing a strong surge in demand and prices, driven by higher feedstock costs and worries over Ukraine’s seed and oil supply after the suspension of the Black Sea Grain Deal. Concerns about potential delays and logistics bottlenecks in Ukraine are shared by market participants both within and outside the country. Positive news about the Grain Corridor has sparked interest in biodiesel, leading to expectations of price support in the short term.

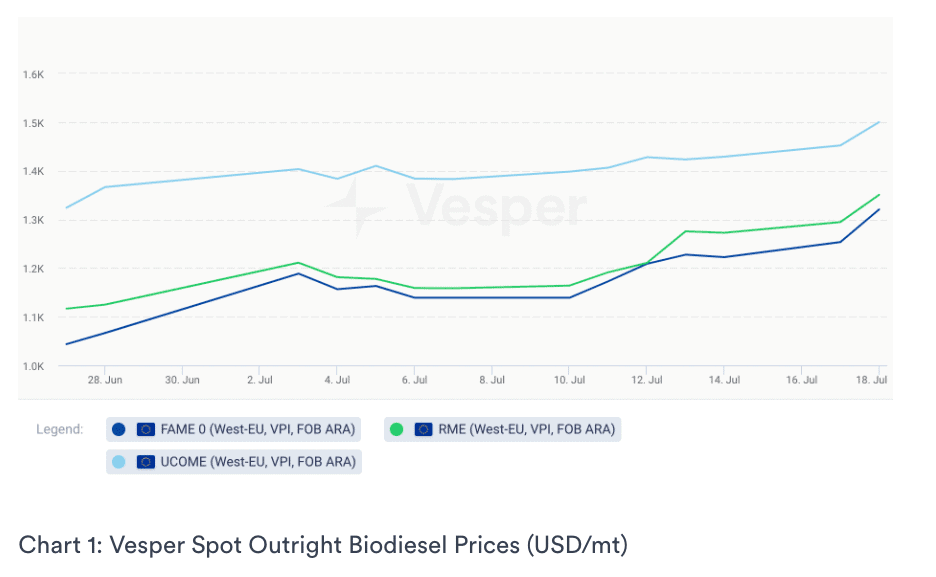

In a significant development for the industry, Vesper commodity intelligence platform has announced the inclusion of biodiesel prices in its coverage. This addition comes at a crucial time, offering valuable insights and data to market players seeking to navigate the biodiesel market’s complexities.

Edible oils are experiencing mixed price movements. Edible oils, except for bean oil, have strengthened, while soybean oil prices have fallen due to lower-than-expected cuts in U.S. soybean production. On the other hand, palm and rapeseed oil prices have risen, driven by strong import demand and concerns over crop outlooks in the E.U. and Canada. Sunflower oil prices have firmed due to reduced supply from Ukraine and Russia’s exit from the Black Sea Grain Deal. The vegetable oil complex is expected to maintain a slightly bullish trend in the short term due to weather concerns in oilseeds-producing countries, uncertainty around Ukrainian logistics, and shifts in Indonesian governmental policies.

In the energy sector, ICE LSGO prices have surged nearly $2 this week. Factors contributing to this increase include China’s economic growth support plans, expectations of the U.S. Federal Reserve pausing interest rate hikes, and projections of a decline in U.S. oil output. Economic news, such as lower retail sales in June, has strengthened beliefs about the Fed’s interest rate strategy. Energy traders predict a tight oil market due to Russian shipment drops and China’s increased support to households. Monitoring the global energy landscape and geopolitical developments remains crucial for market participants and investors.

Small note: Experience zero-cost calculations like biodiesel blend rate, thanks to our complimentary commodity calculators.

With Vesper’s newly integrated biodiesel price data, market participants can now access comprehensive information, enabling them to make well-informed decisions amidst the ongoing supply concerns and policy shifts in the biodiesel and energy sectors. Sign up now for a free trial of our commodity intelligence platform and gain access to the latest biodiesel prices or book a demo to speak to one of our market specialists. Don’t miss this opportunity to make well-informed decisions amidst supply concerns and policy shifts.