Sunflower oil prices have risen despite significant progress in Ukraine’s sunflower seed harvest, as market pressures and global demand continue to drive volatility.

The Vesper West EU Forward Price Index for Crude Sunflower Oil increased to €1,025 ($1,135) per metric ton (FOB 6Ports, FOSFA 52) for the October-November-December delivery window as of October 2nd, up from €959 ($1,070) on September 23. This price increase highlights the influence of broader market factors beyond the harvest cycle.

Prices in Russia and Ukraine have mirrored this trend. FOB Russia crude sunflower oil offers surged by $45/mt last week, reaching $985, while bids rose by $30/mt to $940. In Ukraine, offers climbed to $990, and bids approached $970, driven by strong demand.

Sunflower seed prices in Ukraine also continued their upward trajectory, hitting 21,000-22,000 UAH ($510-530/mt) as of last week.

Market participants attribute the price rally to increased buying from Indian importers, who have turned away from more expensive palm oil due to rising duties. The shift in demand from palm to sunflower oil has supported price growth in both Russia and Ukraine. However, reports suggest that the pace of buying has slowed this week, which could introduce some uncertainty moving forward. Additionally, gains in rival vegetable oils, such as soybean and rapeseed oil, have further bolstered sunflower oil prices.

In other news, vessel lineup data shows Ukrainian sunflower oil exports in September at around 200,000 mt, mainly destined for the EU. This is up from 183,000 mt in September last year. Russia exported 163,000 mt of sunflower oil, destined mainly to Turkey and India. This is below the 184,000 mt exported in September last year. Finally, Strategie Grains lowered its 2024 sunflower production estimate for the EU-27 by 0.4 mmt, bringing it down to 8.9 mmt.

Sunflower Oil Outlook

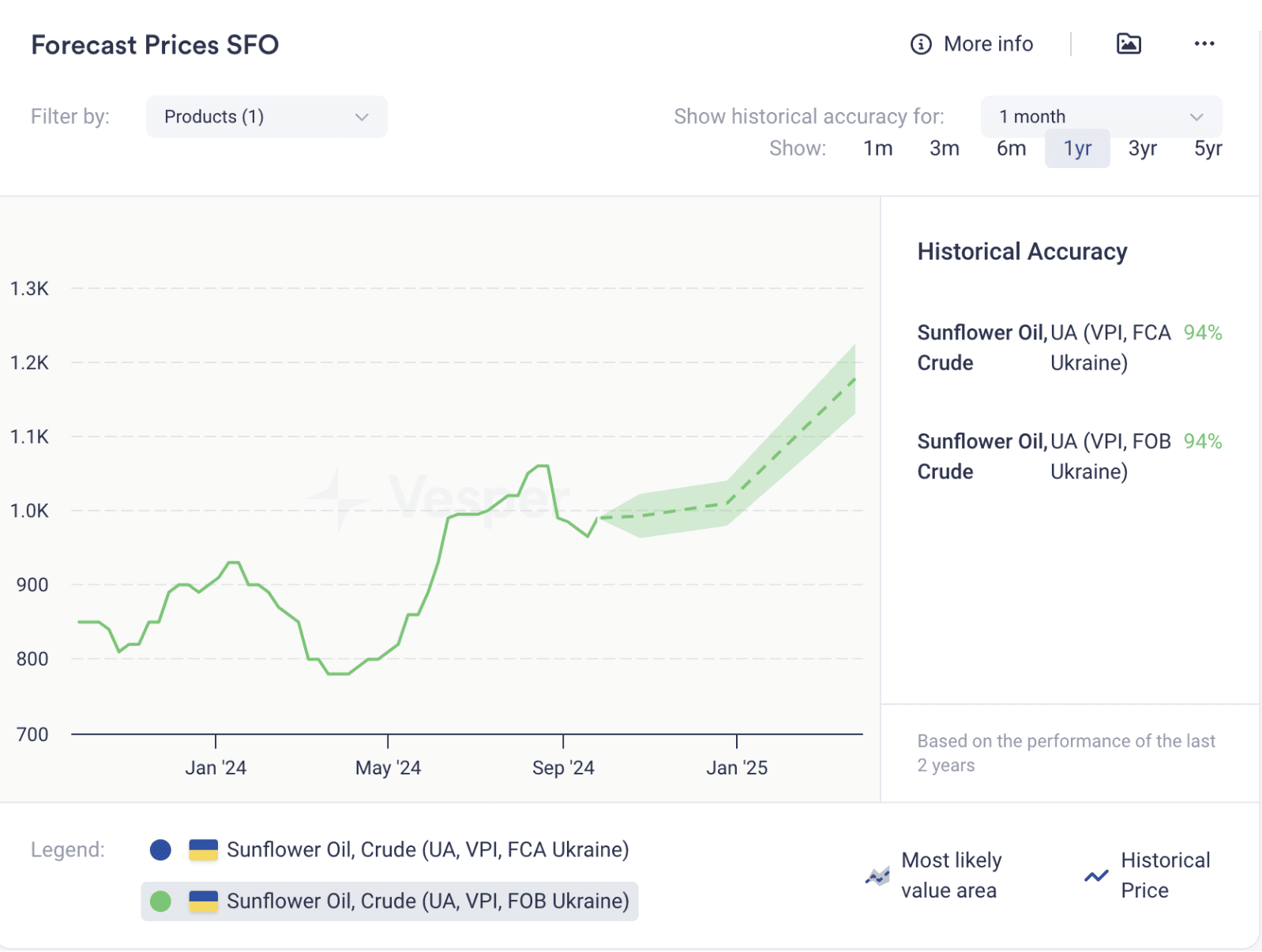

Vesper’s machine learning model predicts a sideways/slightly upward trend in FOB Ukraine Crude Sunflower Oil price until December, with a sharp increase afterwards, see Figure below.

Figure 1: Crude Sunflower Oil Price Forecast for Ukraine FOB in USD/mt

Possible? Yes. The model indicates a lack of harvest pressure in Ukraine. With 70% of Ukrainian seeds and 25% of Russian seeds harvested, crushers are facing tight or nonexistent margins at current seed prices. For Ukrainian crushers to gain margins, seed prices must drop, while sunflower oil prices should at least remain stable. This could reduce harvest pressure on oil or at least limit its impact. Additionally, lower carryover stocks in Russia and Ukraine, nearly depleted by the end of August, further support this outlook.

The longer-term bullishness is possible due to a higher sunseed balance this year. Fastmarkets sees Ukrainian crop at 13-13.5 mmt, APK inform at 14-14.5 mmt, UkrAgroConsult at 13 mmt, UGA at 12.8 mmt, and Ukraine’s Ministry of Agriculture at 12 mmt. These are all below 14.2 mmt produced in the previous season. In Russia, Fastmarkets estimates a harvest at 15 mmt, and ProZerno also forecasts 15 mmt, down from 17.25 million metric tons in 2023/24. Forecasts for Romania, Moldova, and Bulgaria are also lower. According to Strategie Grains, the global sunflower seed stocks-to-use ratio is expected to be 5.7% in 2025/26, compared to 6.6% in 2023/24.

For more Sunflower Oil Prices, visit our platform for free.