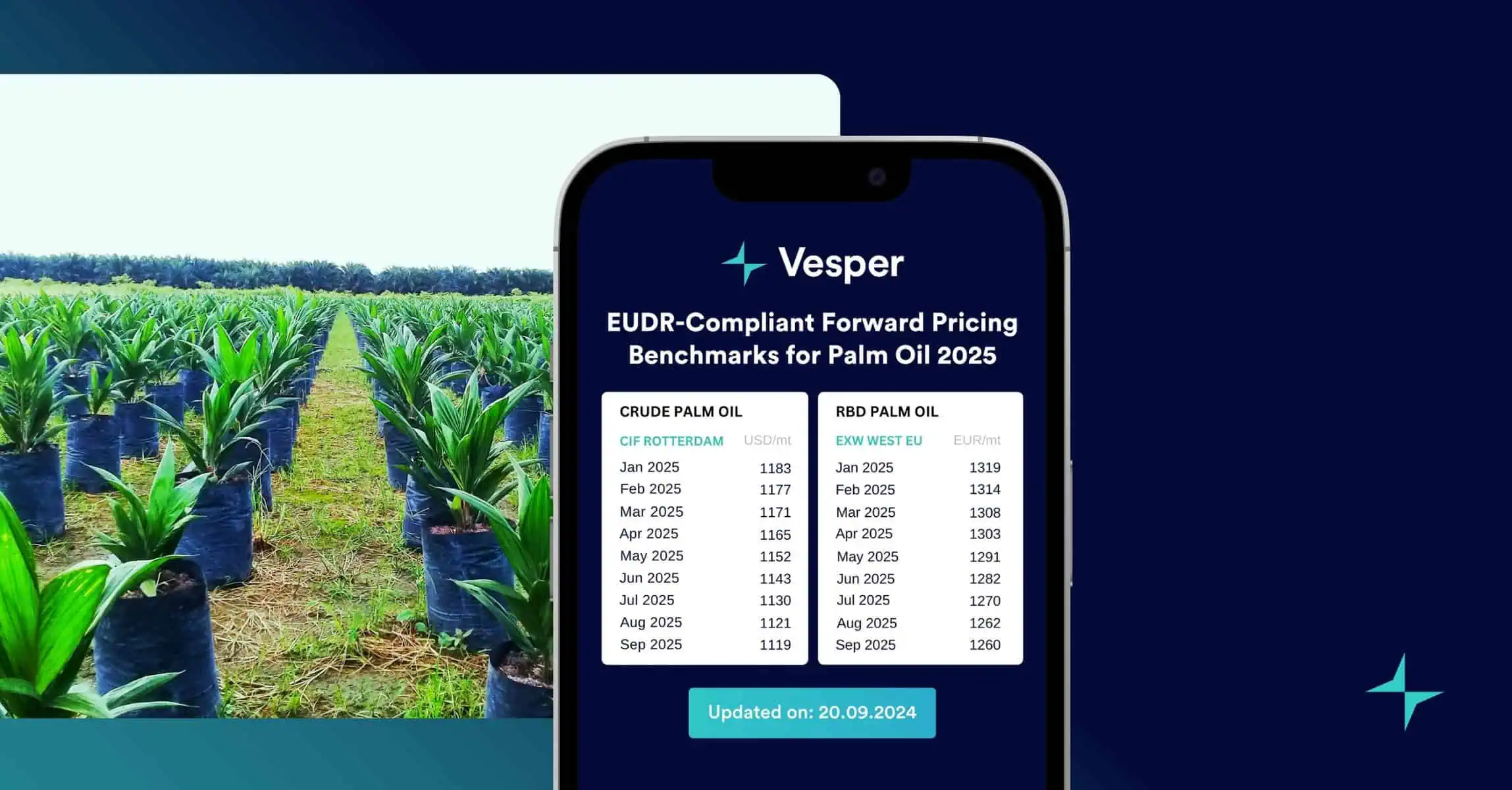

As uncertainty looms over the pricing of palm oil in light of the upcoming EU Deforestation Regulation (EUDR), Vesper steps forward as the first commodity intelligence platform to launch EUDR-Compliant Forward Pricing Benchmarks for Palm Oil 2025. The benchmarks include Palm Oil, Crude – CIF Rotterdam and Palm Oil, RBD (EUDR Compliant) – EXW WEST EU, offering much-needed clarity in a challenging market.

Suppliers are navigating a difficult landscape as the EU has yet to provide clear compliance guidelines on how to comply with EUDR. Furthermore, Indonesia, one of the world’s largest palm oil producers, faces additional hurdles with the regulation’s requirement to link geolocation data to all plantations—data the Indonesian government currently restricts from public release. As a result, companies are factoring in premiums to cover potential compliance risks, while others offer discounts to maintain their client base. Some suppliers are hesitant to provide quotes for 2025 entirely, exacerbating price uncertainty.

The evolving regulatory landscape has led to notable price variability, and liquidity in the Rotterdam paper market is diminishing as fewer suppliers are able to meet the EUDR requirements. This decline in liquidity has caused companies to rely less on traditional paper market benchmarks, prompting a search for reliable alternatives, a gap Vesper aims to fill.

Daily Updated Pricing Benchmarks and Verified Methodology

Vesper’s EUDR-Compliant Forward Pricing Benchmarks for Palm Oil 2025 are updated every day, providing the most current and reliable data for market participants. To develop these benchmarks, Vesper gathered extensive input from key market participants—buyers, producers, traders, sellers, and plantations. After calculating the benchmarks, Vesper shared the results with clients for validation, receiving positive feedback.

The methodology for both CPO and RBD prices is nearly identical, involving the BMD dollar price (shipment month), 8% Malaysian export tax, freight rates (Straits to ARA), and EU premiums (EUDR, RSPO SG, Low Moah). The only distinction is that RBD prices include additional refining costs and 3.8% import duty.

Secure Your Market Position with Vesper’s EUDR-Compliant Benchmarks

Vesper’s forward pricing benchmarks offer critical insight for companies navigating the EUDR’s compliance requirements. For more information or to access the latest EUDR-compliant palm oil prices, book a demo here.