In the dynamic landscape of food prices, chocolate prices have significantly increased mostly due to poor cocoa harvests, notably impacting the cost of end products.

In the Netherlands, this has translated to higher supermarket prices. A 200-gram bar of Côte d’Or pure chocolate now costs almost 50 cents more at Albert Heijn, Jumbo, and Plus than it did at the start of the year, reflecting a 12% price increase. Similarly, a Tony’s Chocolonely caramel sea salt bar costs 95 cents more at Jumbo and 54 cents more at Plus, with Albert Heijn having implemented the price increase last year.

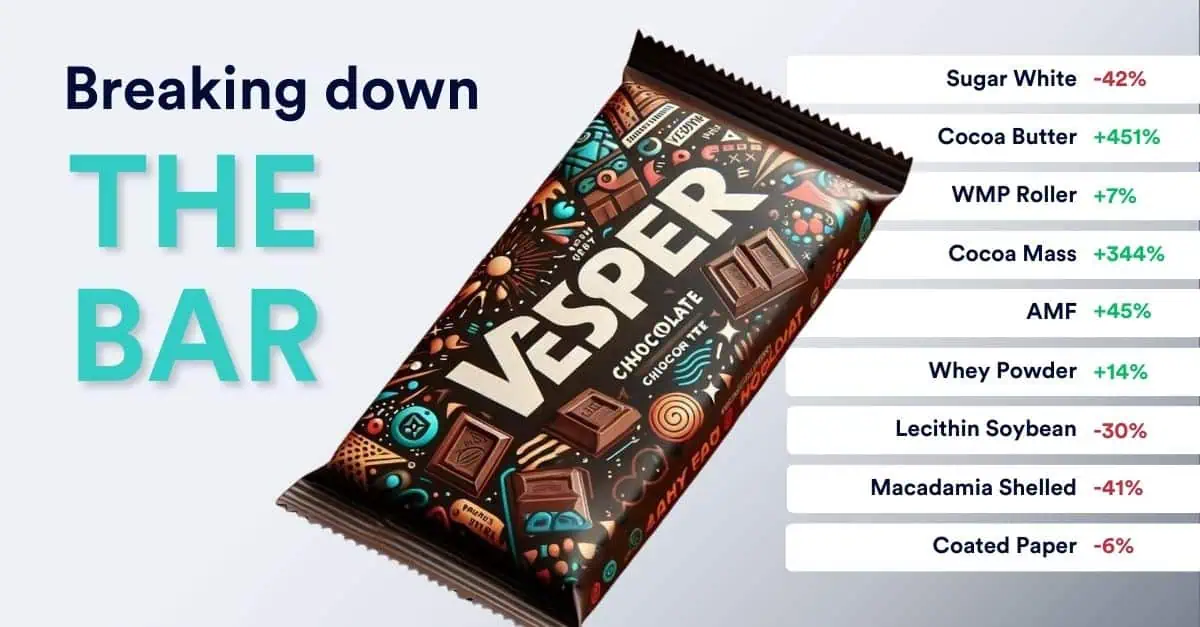

This article examines the significant year-over-year price fluctuations for the ingredients in a chocolate bar and the driving forces behind these changes.

Understanding these price fluctuations is essential for making informed decisions in the chocolate industry. By analyzing the factors driving these changes, companies can better navigate the market, optimize procurement strategies, and adjust pricing effectively.

Sugar White: – 42%

In the first half of 2024, the white sugar market experienced significant price fluctuations due to several key factors. Initially stable in early 2023, prices dropped sharply by November. This decline was primarily driven by higher-than-expected production in major regions like India and Brazil. In Europe, prices fell by 41% year-over-year (YoY) (see Figure 1), with similar decreases seen in Brazil (15% YoY), Thailand (30% YoY), and Sugar No. 5 (20% YoY).

Figure 1: White Sugar prices for West-EU in EUR/mt

India’s sugar production played a significant role. Despite adverse weather conditions, India managed to achieve higher-than-anticipated production levels. The country produced 32.8 million metric tons (MMT) of sugar in the 2023/24 crop season, surpassing earlier expectations of around 30 MMT. However, the Indian government imposed an export ban to stabilize domestic prices and ensure adequate local supply, creating uncertainty in the global market.

In Brazil, the Center-South region saw a 25.7% increase in sugar production for the 2023/24 crop season, compared to the previous year, totaling around 38 MMT. This surge significantly impacted global prices as Brazil is a major exporter of sugar. The positive outlook for Brazil’s 2024/25 crop season, despite being slightly lower, still indicated a surplus, further contributing to the bearish sentiment in the market.

All in all, despite some volatility due to adverse weather and export policies in early 2024, the overall trend remained downward, significantly impacting global supply and demand dynamics.

Cocoa Butter: +451% and Cocoa Mass: +344%

In the first half of 2024, cocoa butter prices skyrocketed by 451%, reflecting the broader turmoil in the cocoa market, see Figure 2. This surge was primarily due to poor harvests in West Africa caused by adverse weather conditions, logistical issues, and crop diseases. The reduction in cocoa production and exports from major producing regions like Côte d’Ivoire and Ghana led to a significant shortfall in global supply. Côte d’Ivoire experienced a 35% reduction in exports, while Ghana saw a 49% reduction, further tightening the market.

Speculative buying also played a significant role in driving up prices. Traders, particularly hedge funds, heavily invested in cocoa futures, creating upward pressure on prices by increasing demand for futures contracts. This speculative activity was driven by the predictable need for chocolate producers to secure cocoa supplies, regardless of the price, due to the tight supply conditions. As a result, chocolate manufacturers had little choice but to purchase cocoa at elevated prices to meet production demands, further fueling speculative buying.

Cocoa mass, another derivative of cocoa, saw a significant price increase of 344%, see Figure 2. Similar to cocoa butter, this surge was driven by adverse weather conditions in key producing regions, compounded by crop diseases and logistical challenges. The tight supply situation and high demand from chocolate manufacturers, combined with speculative trading, contributed to the substantial price hike in cocoa mass.

Figure 2: Cocoa Butter and Cocoa Mass prices for West-EU

In the first half of 2024, cocoa butter prices skyrocketed by 451%, reflecting the broader turmoil in the cocoa market (see Figure 2). This surge was primarily due to poor harvests in West Africa caused by adverse weather conditions, logistical issues, and crop diseases. The reduction in cocoa production and exports from major producing regions like Côte d’Ivoire and Ghana led to a significant shortfall in global supply. Côte d’Ivoire experienced a 35% reduction in exports, while Ghana saw a 49% reduction, further tightening the market.

Speculative buying also significantly contributed to driving up prices. Traders, particularly hedge funds, heavily invested in cocoa futures, creating upward pressure on prices by increasing demand for futures contracts. This speculative activity was driven by the predictable need for chocolate producers to secure cocoa supplies, regardless of the price, due to the tight supply conditions. As a result, chocolate manufacturers had little choice but to purchase cocoa at elevated prices to meet production demands, further fueling speculative buying.

According to Willem Zimmerman, VP of Global Cocoa Trading and Sourcing at Barry Callebaut Group, the cocoa industry has been facing an underlying issue. He explains, “Historically, cocoa has been too cheap for too long, especially in Ivory Coast and Ghana, which account for 60 percent of the global supply. These low prices have led to a lack of investment. This lack of investment has resulted in an ageing cocoa tree stock, which has a life cycle of up to 50 years. As the tree stock ages, yields decrease, necessitating replanting and the use of inputs to maintain productivity.

Cocoa mass, another derivative of cocoa, saw a significant price increase of 344% (see Figure 2). Similar to cocoa butter, this surge was driven by adverse weather conditions in key producing regions, compounded by crop diseases and logistical challenges. The tight supply situation and high demand from chocolate manufacturers, combined with speculative trading, contributed to the substantial price hike in cocoa mass.

In summary, the cocoa market’s upheaval in 2024 has been driven by a combination of adverse weather conditions, logistical challenges, ageing tree stocks, and speculative trading. These factors have led to significant price increases in both cocoa butter and cocoa mass, posing challenges for chocolate manufacturers and traders alike.

Whey Powders: WMP: +14%, and WMP Roller: +7%

Whole milk powder (WMP) prices increased by 14% compared to the previous year (see Figure 3). This rise can be attributed to increased demand from export markets, tighter supply conditions, and strategic stock management by key producers.

Figure 3: WMP roller prices for Europe in EUR/mt

The two main drivers behind the increase in Whole Milk Powder (WMP) prices have been the interplay between higher butter and Skimmed Milk Powder (SMP) prices and supply constraints from New Zealand as the country approached the end of its milk season.

Butter prices increased significantly compared to last year due to a combination of supply and demand factors. Weak milk production in key regions like Ireland, where butter production decreased by 7.97%, led to a notable reduction in supply. Despite prices rising by 44.26% in the EU and 35.29% in the US, retail consumption remained steady. Buyers rushed to secure future volumes, keeping demand high.

Fonterra, New Zealand’s leading dairy cooperative, reduced its offerings, tightening the global supply and creating a bullish outlook for WMP. These combined factors—a mix of increased demand, supply constraints from New Zealand, and broader market trends—contributed to the 14% increase in WMP prices compared to the previous year.

While both WMP and WMP Roller prices are influenced by similar factors, the degree of their impact varies, leading to a 14% increase for WMP compared to a 7% increase for WMP Roller. This discrepancy can be attributed to several nuanced factors in market dynamics. WMP Roller is often used in specific industrial applications that may not have experienced the same surge in demand as standard WMP. Additionally, the production and supply dynamics for WMP Roller can differ slightly, resulting in less immediate impact from broader market trends affecting standard WMP.

AMF (Anhydrous Milk Fat): +45%

Anhydrous milk fat (AMF) prices rose by 45%, driven by increased demand and tight supplies in the dairy market. As global cream and butter prices climbed, AMF followed suit, reflecting the interconnected nature of dairy product pricing (see Figure 4). Cream, AMF, and butter are interconnected through their shared origin and processing stages, with cream being the starting point for producing both butter and AMF.

As mentioned earlier, butter prices saw a substantial increase due to a combination of supply and demand factors. High demand for butter, which relies on cream as a primary input, led to higher cream prices. Despite the higher fat content in milk compared to the previous year, which helped maintain adequate cream supplies, the strong demand still pushed prices higher. Consequently, the increased prices of cream and butter directly influenced the rise in AMF prices, as these products are closely linked in dairy production

Figure 4: butter, AMF and Ceam prices for EU and France, according to the Vesper Price Index in EUR/mt

Lecithin Soybean: -30%

Lecithin soybean prices dropped by 30%, following the general market trends observed in the soybean complex (Figure 5).

Figure 5: Soybean and Soybean Lecithin Prices in EUR/mt

Soybean prices have decreased over the past year due to several key factors. The supply of soybeans has been robust, especially from major producers like Brazil and Argentina. Brazil’s soybean crop performed better than expected, with production estimates between 145 to 154 million metric tons. Argentina’s soybean crop rebounded significantly to around 49-50 million metric tons, compared to just 25 million metric tons last year. Additionally, the USDA projected a substantial global soybean crop for the next year, reinforcing the outlook for strong supply and contributing to lower prices.

Moreover, global demand for soybeans, particularly from China, has fluctuated, with reduced soymeal consumption and a shift towards relying on domestic stockpiles. Another recent factor influencing prices is the increased likelihood of Donald Trump winning the upcoming election. This has reignited fears of a potential resurgence in the U.S.-China trade war, which could decrease demand for U.S. soybeans, exerting downward pressure on prices.

Macadamia Shelled: -41%

Macadamia nut prices have decreased by 41% over the past year due to a significant increase in global production. Major producers such as Australia, South Africa, and China have reported higher yields. According to The Australian Macadamia Society (AMS) the forecast for 2024 global macadamia production has been revised up to 339,200 tonnes (in-shell at 3.5% moisture), a 7.5% increase on the 2023 crop. South Africa, China and Australia are expected to deliver the lion’s share of the global crop at 27%, 20% and 16.5% respectively.

The increase in global production is attributed to favorable weather conditions, expanded cultivation areas, and improved agricultural practices. This significant increase in supply, coupled with slower demand recovery, has driven prices down to unsustainable levels for producers. As a result, many farmers have been forced to sell their macadamia nuts below production costs.

Figure 6: Macadamia Shelled prices for EU27, in EUR/mt

Interested in tracking these prices in real time? Visit Vesper for free, or schedule a complimentary demo with one of our commodity experts.