Chocolate kruidnoten prices have exponentially increased due to record cocoa costs end 2024/ start 2025. Using Vesper’s cost modeling, Dutch bakeries can explore three strategies to protect margins: thinner coatings, smaller packs, or cocoa butter substitutes like shea butter.

Every November, as the Sinterklaas holiday approaches in the Netherlands, bakeries ramp up production of kruidnoten, the small, spiced cookies that mark the holiday season.

Kruidnoten (also known as pepernoten) have been part of Dutch Sinterklaas celebrations since the 16th century. Traditionally flavored with cinnamon, nutmeg, cloves, and ginger, these crunchy cookies are enjoyed by millions across Europe each year.

Over time, the chocolate-coated version has become the favorite, with each cookie wrapped in white, milk, or dark chocolate. Yet that delicious layer now presents the biggest cost challenge for manufacturers.

Cocoa: the biggest cost challenge

As the largest news organization of the Netherlands NOS reported, chocolate kruidnoten are more expensive than ever due to the increased cocoa prices we experienced end of last year/early this year. End of 2024, cocoa hit above €11,000 per metric ton, nearly five times higher than in 2022, leaving Dutch and European bakeries under immense cost pressure.

Although prices have fallen since their peak, most of the cocoa used for this year’s production was bought when prices were at record highs. This lag means cost savings will take time to reach supermarket shelves.

Meanwhile, structural pressures, rising labor and energy costs and ongoing climate issues in West Africa, suggest cocoa prices will remain elevated in the near future.

Three ways bakeries are managing cocoa price volatility

Procurement managers now face tough choices as cocoa prices remain high:

- Apply a thinner chocolate coating

- Decrease serving size while keeping retail prices stable

- Replace part of the cocoa butter with substitutes such as shea butter

As Miguel Groeneveld from Peppernuts Holland explained: “The cocoa price is high this year, and that puts manufacturers in a difficult position in the run-up to Sinterklaas. Do the kruidnoten get as much chocolate as last year but become much more expensive, or do they get a thinner layer for a more affordable price?”

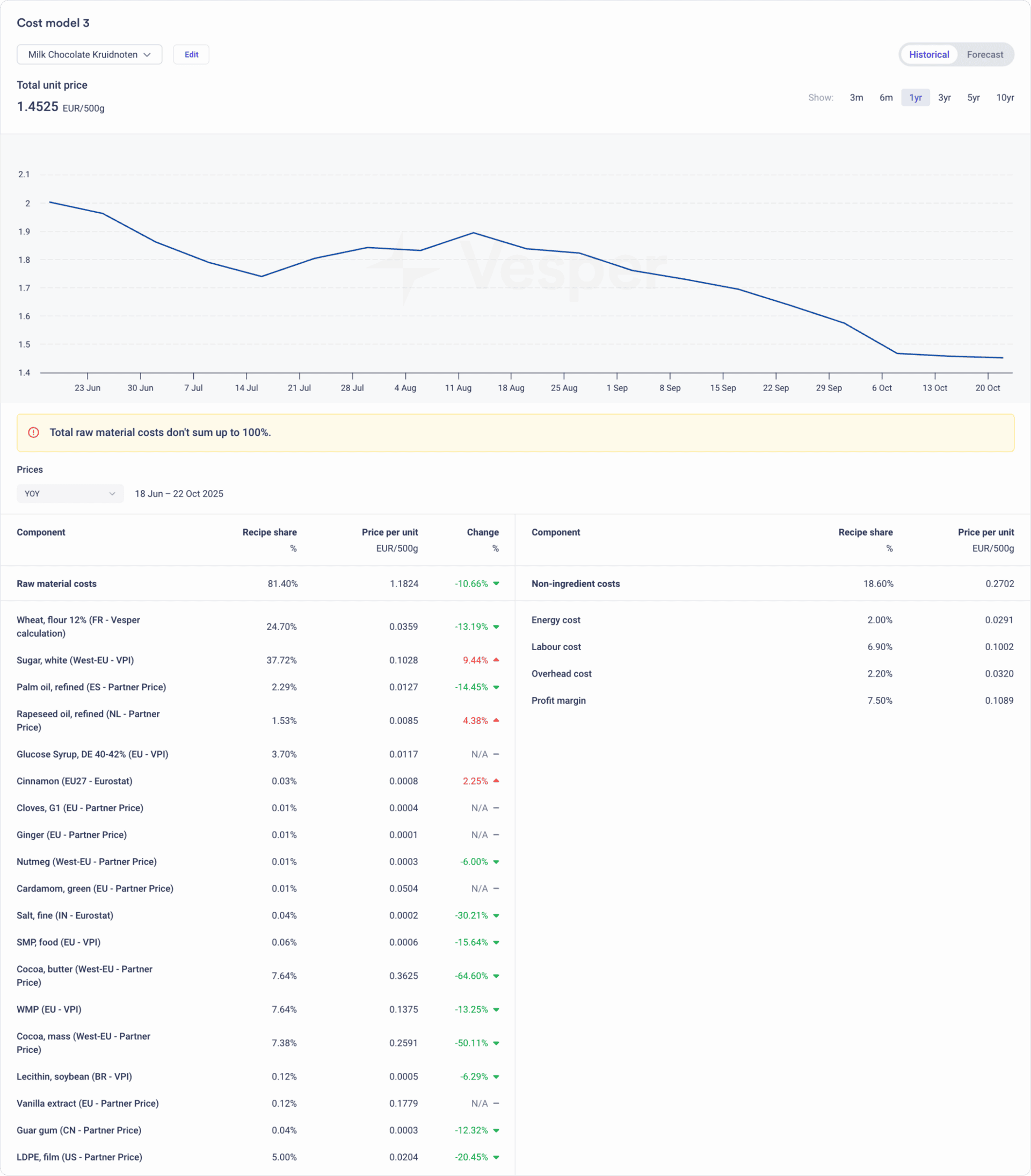

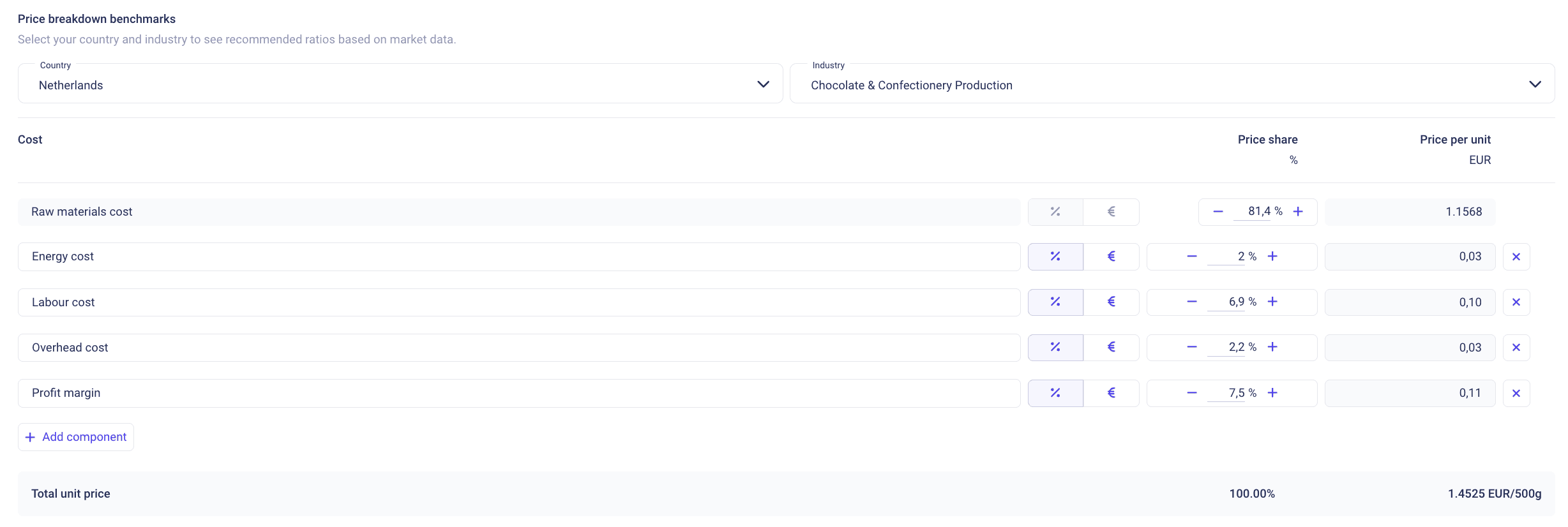

To better understand the impact of these production choices, we based our analysis on a 500-gram batch of milk chocolate–covered kruidnoten. Using Vesper’s Cost Models, we examined how both ingredient and non-ingredient components, such as energy, labor, and overhead, contribute to the total cost under current market conditions.

The base cost model below reflects the latest data for milk chocolate kruidnoten, showing a total unit price of €1.4525 per 500g. It highlights how each cost driver, from cocoa butter and milk powder to fixed expenses, shapes the final production cost.

This model serves as our baseline for testing three cost-management strategies—each offering a different approach for manufacturers to navigate cocoa price volatility.

Option 1: A thinner layer of chocolate

Reducing the chocolate coating by 10% can help manage ingredient costs. Our cost model adjusted the key chocolate ingredients such as cocoa butter, cocoa mass, sugar, and milk powder.

The result: a total cost drop from €1.5217 to €1.3811 per 500g. This reduction primarily stems from decreased cocoa butter and milk powder use. However, the change might slightly affect texture and flavor, so manufacturers must balance cost efficiency with sensory quality.

Option 2: Decrease serving size while maintaining price

Another strategy, known as shrinkflation, is to reduce pack size while maintaining price points. According to NOS, Bolletje, for example, reportedly reduced 1 kg kruidnoten bags to 950 g to stay under €4.

In our simulation, cutting a 500 g bag to 475 g (a 5% reduction) lowered the cost per unit from €1.517 to €1.4403, without changing the retail price.

This tactic protects margins but may influence consumer perception if buyers notice smaller quantities.

Option 3: Substitute cocoa butter with CBEs

A third cost-saving option is to partially replace cocoa butter with Cocoa Butter Equivalents (CBEs) like shea butter. These vegetable fats have similar physical properties and can mimic cocoa butter’s melting behavior.

Under EU Directive 2000/36/EC, manufacturers can substitute up to 5% of cocoa butter with CBEs (shea, illipe, palm mid-fractions, or sal fat) while still labeling the product as chocolate.

In our updated cost model, replacing 0.38% of cocoa butter with shea butter (priced around €5,100/mt) slightly reduced total unit cost from €1.4525 to €1.4423 per 500 g.

The savings remain modest due to the substitution limit, but going beyond 5% would remove the “chocolate” classification and may alter flavor or texture. For more insights on whether your brand should substitute part of its cocoa butter with shea butter, read: Should Your Brand Substitute Part of Its Cocoa Butter with Shea Butter?

The complete picture: Fixed costs and forecasting

While ingredients like cocoa butter and milk powder dominate attention, they only represent part of total costs. Roughly 18–20% of kruidnoten production costs come from fixed factors such as labor, energy, and overhead, costs that remain stable regardless of commodity prices.

That’s where Vesper’s Cost Models, built in partnership with ICIS, offer a significant edge. The models automatically integrate verified non-ingredient costs like local labor rates, energy, and overheads, ensuring an accurate, location-specific total cost breakdown.

For milk chocolate kruidnoten:

- 81.4% = raw materials

- 18.6% = fixed costs (6.9% labor, 2% energy, 2.2% overhead)

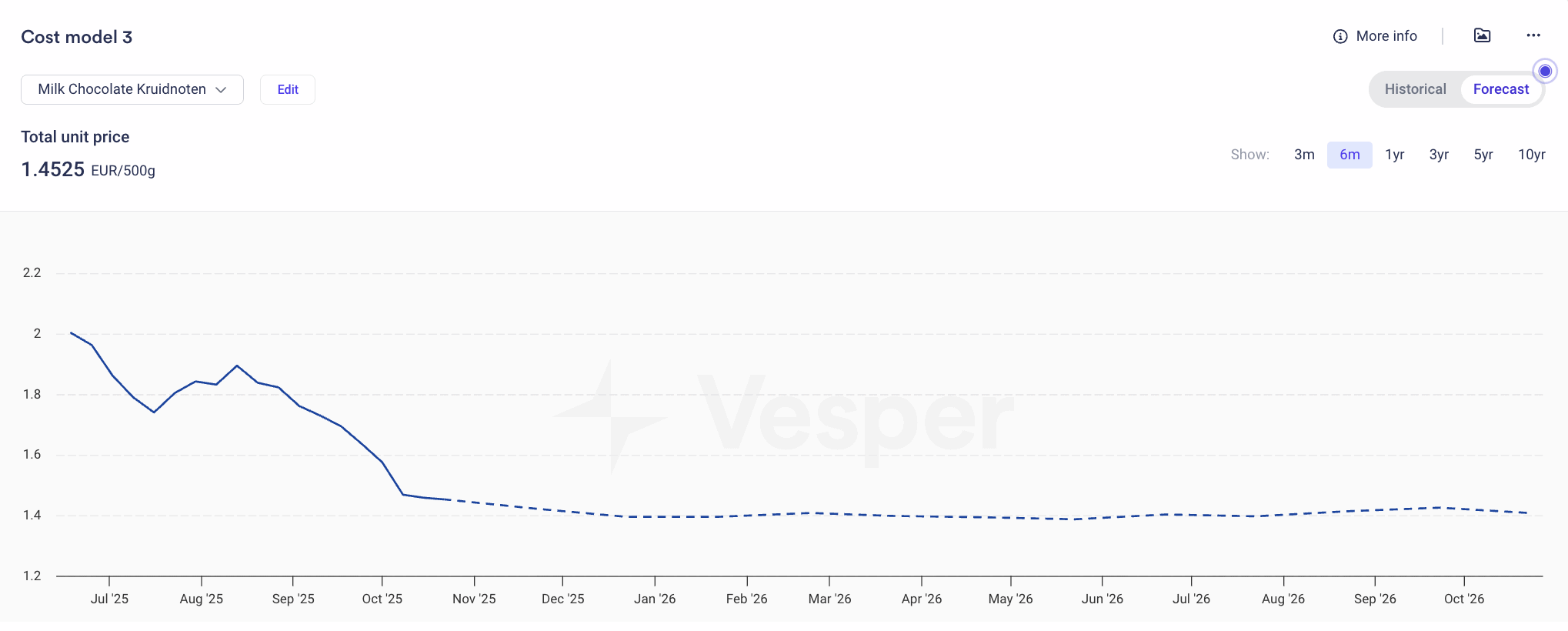

Additionally, Vesper’s forecasting feature in the cost model enables procurement teams to simulate future production costs. The latest projections show no significant cost increases ahead, providing a stable outlook for the coming months. This visibility helps procurement managers plan budgets with greater confidence, align contract renewals with market trends, and adjust reformulation strategies proactively to remain competitive during the next Sinterklaas season.

Which option delivers the biggest savings?

Based on our cost model analysis using realistic market prices, reducing the chocolate coating by 10% delivers the strongest impact, lowering total costs from €1.52 to €1.38 per 500 g batch, a 9.2% reduction.

Shrinkflation (reducing pack size by 5%) follows with 5.3% savings, while CBE substitution within legal limits provides minimal effect at just 0.7%.

These figures represent example scenarios under current market conditions. In practice, the “best” solution depends on your formulation, brand positioning, and consumer expectations:

- Thinner coating: Highest savings, but may affect taste and texture perception.

- Smaller packs: Protects margins without recipe changes, but risks consumer backlash if noticed.

- CBE substitution: You can replace more than the 0.38% modeled, EU regulations allow up to 5% substitution while still labeling it as “chocolate.” Beyond that threshold, you lose the chocolate classification entirely, which could impact premium positioning and consumer trust.

Key takeaways for procurement managers

The kruidnoten case illustrates a broader truth for bakery procurement teams: effective cost control is about strategy, timing, and insight.

With Vesper’s data-driven cost modeling, procurement professionals can:

- Compare cost-saving opportunities with real-time accuracy.

- Forecast ingredient trends and adjust purchasing timelines.

- Adapt reformulation strategies in advance to stay competitive.

In a volatile cocoa market, smart cost modeling is your competitive advantage.

Learn more about cost models: https://vespertool.com/features/cost-models/