As the founder and CEO of the Vesper Platform, Alexander has always focused on bringing transparency and efficiency to the dairy industry. With the launch of the Vesper Marketplace, a digital trading platform that connects verified dairy buyers, sellers, and traders, he shares the vision behind this new product, explains why the timing is right, and discusses how digital trading will shape the future of the dairy industry.

1. What sparked the idea for the Vesper Marketplace?

There was a clear gap in the market. While other marketplaces existed, most were either auction-based or single-seller platforms, which only represented one company’s view of the market. We believed we could create something fundamentally different: a true, anonymous, multi-party marketplace that reflected the broader dairy market.

We also noticed that buyers and sellers were increasingly frustrated with extreme volatility and lack of transparency. Since Vesper has always been an information provider, we knew that the best possible information is actual transacted market prices. The marketplace enables us to deliver this in real time, not just for the spot market, but also forward-looking up to a year in advance.

2. Why launch a marketplace now, rather than earlier or later?

A marketplace only works with sufficient liquidity. We had to build a critical mass of trusted clients before we could launch successfully. After years of growing the Vesper platform, building the Vesper Price Index, and establishing trust with large and small industry players, we finally reached the point where the timing was right.

Strategically, this was also about moving deeper into our customers’ workflows. Our tools were already being used for information and intelligence. By adding a marketplace, we allow customers to act directly on that information within the same ecosystem, making Vesper even more relevant and indispensable.

3. What convinced you that the market was ready for this product?

The idea grew out of six years of conversations with industry players. Lack of transparency has always been a pain point, which is why we launched the Vesper Price Index in the first place. Over time, the trust we built with customers, our network, and our technical expertise made it clear we could deliver a scalable, secure marketplace.

As a former trader myself, I know how inefficient it is to call dozens of people for prices. Ultimately, the combination of industry demand, client trust, and technical readiness convinced us the timing was right.

4. Why did you start with butter and SMP? And how are you prioritizing which commodities to add next?

We began with dairy because it’s our strongest network, it’s where Vesper started and where we already had a large client base. We specifically chose butter and SMP because they are standardized commodities. Marketplaces work best with products that are uniform and widely traded, not with highly customized products that have narrow specifications.

Starting small was also deliberate. By focusing on a handful of core products in Europe (where butter is heavily traded), we could prove the model, build liquidity, and expand from there. Cheeses have since been added for the same reason: they’re standardized and broadly traded.

Looking beyond this, our approach is pragmatic. We only add commodities that make sense for a marketplace: standardized, broadly traded, and with significant transparency issues.

5. Where do you see the Vesper Marketplace in 3 years, just dairy, or across other categories?

The vision is broader than dairy, but we are cautious. Any expansion must be into markets that are highly opaque and suited for standardized commodities. The first step is proving long-term success in dairy. Beyond that, we see opportunities in other industries where transparency and efficiency are lacking, and where we already have traction with the Vesper platform.

6. What’s your vision for how dairy trading should work in 2030?

We believe a significant share of dairy trading will be digital by 2030. Many large players have told us they expect a substantial portion of their volumes to be managed online within the next 5–10 years. Companies face increasing demands with the same headcount, so they need tools that make procurement more efficient. A transparent, digital marketplace will play a central role in how the industry operates by 2030.

As companies face rising demands with limited resources, digital tools will be essential to making procurement more efficient. By 2030, a transparent, digital marketplace will be a central pillar of the industry — complementing, rather than completely replacing, traditional trading channels.”

7. How do you ensure Vesper remains truly independent when facilitating trades between such large industry players?

Unlike platforms that act as both operator and participant, we do not trade ourselves, meaning we never compete with users or profit from price swings.

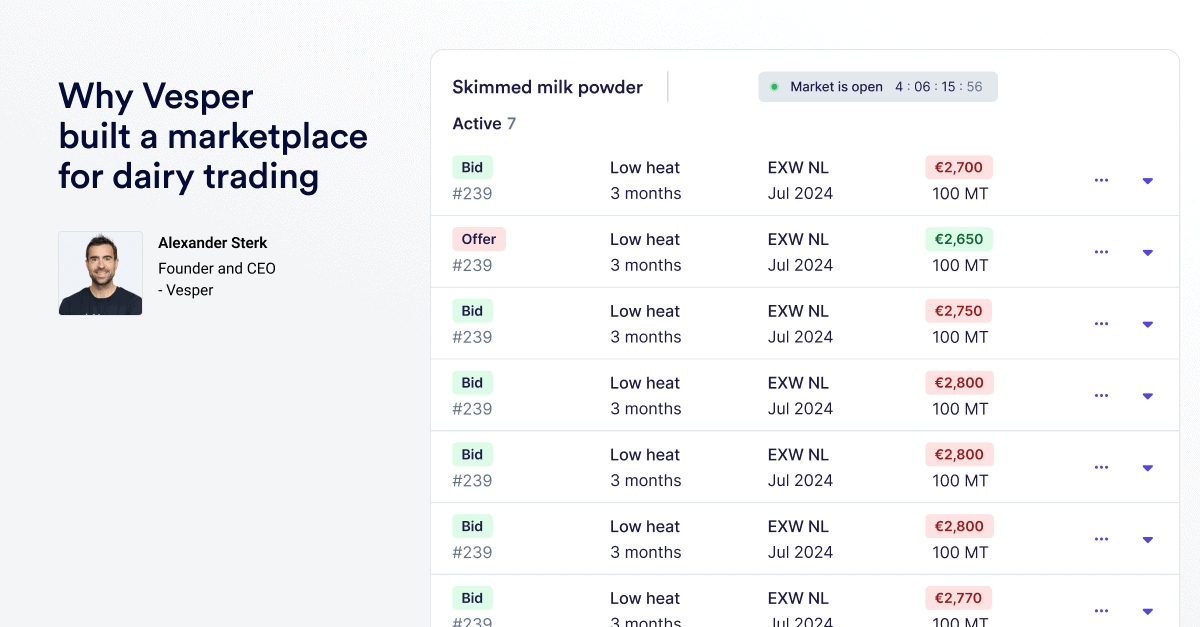

Our technology is built to remain neutral. Buyers and sellers choose which bids or offers to engage with; we simply provide the platform that connects them. Every bid, offer, and deal on Vesper’s Marketplace is binding, not indicative, ensuring prices reflect real transactions and preventing false signals.

Our role is to provide the infrastructure and uphold fair rules of engagement, much like an exchange. The moment we tilt the playing field, we lose the trust that makes the system work. Independence isn’t just good ethics, it’s the foundation of our business model.

8. How do you measure the success of the marketplace?

I think transaction volume is the most important indicator, because actual trades are proof that the market is functioning at a certain price level. But it’s not the only metric. We also look at the number of listings, bids, offers, and negotiations taking place. Even when a deal isn’t closed, those signals reveal market sentiment, whether spreads are tight or wide, where buyers and sellers see value, and how competitive the market is. That information is extremely valuable to participants and shows us how well the marketplace is serving its role.

9. Could you describe a real-life case in which the marketplace delivered clear benefits to a buyer or supplier?

From the seller’s side, Geoffrey Paulus at Solarec summed it up well: “The marketplace centralizes buyer bids; we’re now selling to a wider range of buyers, including some we hadn’t heard from in months.” Instead of relying on the same familiar contacts, his team can now post a single offer and have it instantly reach more than 100 qualified buyers. That visibility has helped Solarec reconnect with past customers, discover new relationships, and shift from waiting for the phone to ring to actively reaching the full market.

On the buyer side, Jean-Olivier Quentin, Chief Procurement Officer at The Magnum Ice Cream Company shared how the marketplace enhanced price discovery “We don’t have to wonder: What if we missed a better price? The Vesper Marketplace eliminates that. My buyers reach our supplier base with one click, anonymously. When they close deals, they know they’ve thoroughly tested the market.”

10. What convinced over 100 first adopters to switch from traditional trading methods to the Marketplace?

For decades, dairy trading relied on information silos; buyers calling around for prices, sellers unsure of missed demand. That model no longer works in fast-moving markets.

What convinced these companies wasn’t just technology, but the outcomes transparency delivers. Buyers see real market conditions and make smarter decisions. Sellers reach their full network instantly instead of playing phone tag. Deals close in minutes, not days.

We’re not digitizing old habits; we’re removing the friction and opacity that held this industry back. These 100+ companies are leading the shift from “I hope I’m getting a fair deal” to “I know this is the market.” That confidence changes everything.

Want the operational perspective?

Hear from Sebastiaan Laurenceau on how the Marketplace actually works in practice here. He leads the rollout and shares the real challenges of getting 100+ traditional dairy companies to trade digitally; from onboarding hurdles to training procurement teams, building liquidity in a conservative industry, and what a typical trading day looks like now versus the old way of calling 40 suppliers individually.