With cocoa butter prices remaining volatile, currently hovering around €14,748 per metric ton after peaking in December 2024, food manufacturers are under growing pressure to protect margins without compromising product quality. One increasingly discussed strategy? Substituting part of the cocoa butter with shea butter, more specifically, using CBE (Cocoa Butter Equivalent), a shea-based fat blend compatible with cocoa butter, which is currently trading at around €5,500 per metric ton.

Major consumer brands such as Guylian, Hershey, and Cadbury (in select products) have already adopted shea butter, demonstrating its commercial and functional viability. In many markets, its use goes completely unnoticed by consumers, as it’s typically labeled simply as “vegetable fat” or “CBE” to maintain clean-label compliance.

So, should your brand consider making the switch?To answer that, we need to examine pricing, performance, regulatory constraints, and supply considerations more thoroughly to determine whether shea butter makes sense for your product line, margins, and long-term procurement strategy.

What’s the price difference between cocoa butter and shea butter per metric tonne?

Before comparing prices, it’s important to clarify that “shea butter” is not a single product in the food industry. Different forms have different functions, processing steps, and prices, and not all are suitable for chocolate or cocoa butter replacement.

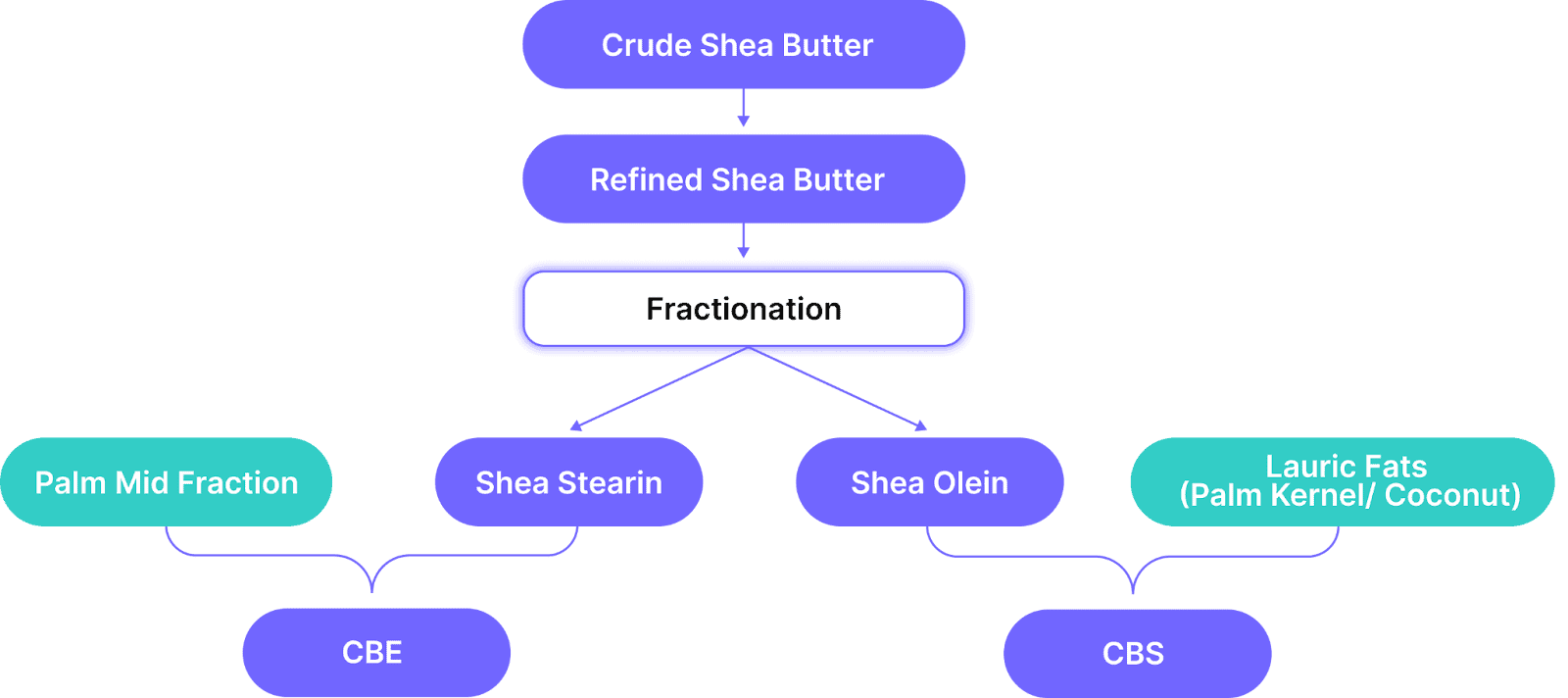

From raw shea nuts to chocolate fats, the value chain looks like this:

Why we use CBE in this article

Because all examples in this article are based on a maximum 5% cocoa butter substitution, in line with EU regulations for chocolate, the correct product to reference here is CBE (Cocoa Butter Equivalent).

CBE is designed for partial cocoa butter replacement, it is compatible with cocoa butter, so you can blend the two without causing fat bloom or tempering problems.

CBS (Cocoa Butter Substitute), on the other hand, is not compatible with cocoa butter. It’s used when you want to replace cocoa butter completely, such as in compound coatings, bakery decorations, molded novelties, and ice cream bar coatings. CBS delivers gloss, snap, and bloom resistance without tempering, but cannot be mixed with cocoa butter in real chocolate recipes.

Types of shea-derived fats and their uses

| Product | Description | Typical Use in Food | Cocoa Butter Compatibility |

| Crude Organic Shea Butter | Unrefined, minimal processing, strong flavor, yellowish color | Traditional African cooking, niche natural products | ❌ |

| Shea Stearin | Refined, deodorized, fractionated solid fat | Ingredient for CBE/CBS production | ✔ (when used in CBE blends) |

| CBE (Cocoa Butter Equivalent) | Shea stearin blended with non-lauric fats (e.g., palm mid fraction) | Partial cocoa butter replacement in chocolate (≤5% in EU) | ✔ |

| CBS (Cocoa Butter Substitute) | Shea stearin or other vegetable fats blended with lauric fats (e.g., palm kernel, coconut) | Compound coatings, chocolate-like products without cocoa butter | ❌ |

The current market price of CBE

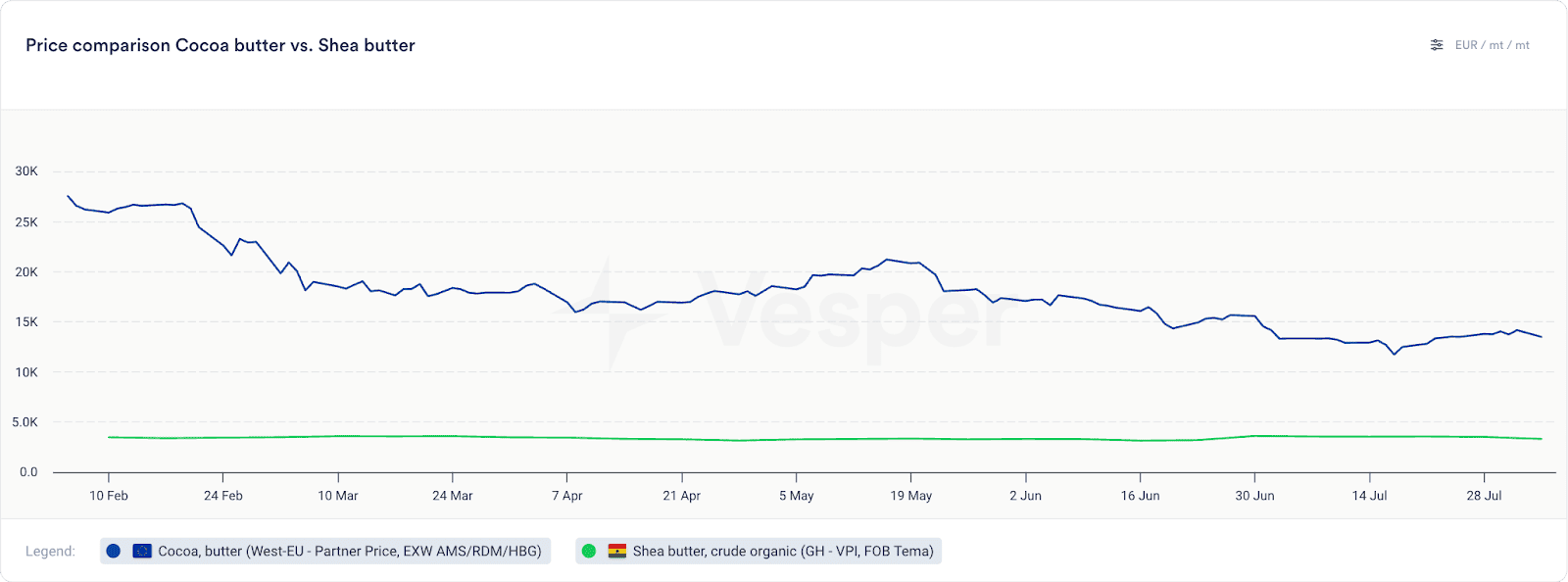

Vesper currently publishes live, verified pricing for crude organic shea butter from Ghana, and while this is an excellent reference point for tracking shea market movements, it is not the direct price you would pay for a chocolate-compatible fat. Crude butter still needs refining, deodorization, and fractionation into shea stearin before it can be used in cocoa butter equivalents (CBEs).

We plan to add live shea stearin and CBE prices to the Vesper platform in the near future. In the meantime, according to our network of buyers, sellers, and traders, the current market price of CBE is around €5,500/mt (lowest actual price heard).

Price comparison with cocoa butter

Imagine you’re producing one metric ton of chocolate in Western Europe. At today’s market rate of €14,174/mt, the cocoa butter portion of your recipe is one of your biggest cost drivers.

Now, let’s say you decide to replace the maximum 5% cocoa butter allowed under EU chocolate regulations with CBE. That’s 50 kilograms out of every tonne of chocolate.

If you stuck with cocoa butter for that 50 kg, it would cost you about €708.50. Swap it for CBE, currently trading around €5,500/mt, and that same portion costs only €275.00.

The result? You’ve just saved €433.50 per tonne of finished chocolate, without changing your product’s tempering profile or breaking regulatory limits. And while that might sound small at first, scale it up to an annual production of 5,000 tonnes, and you’re looking at over €2.1 million in ingredient savings before factoring in any additional efficiencies.

How does shea butter affect the cost per unit/kg of finished product?

Whether substituting part of your cocoa butter with shea butter makes financial sense ultimately depends on your product’s chocolate content and application. Shea butter, in the form of CBE, can be used in a variety of chocolate applications, from coatings and enrobings to inclusions in bakery goods like muffins, donut glazes, croissants, and chocolate bars.

If your product contains only small chocolate inclusions (for example, chips or decorative drizzle), the financial benefit will likely be modest, as the chocolate content is too low to deliver meaningful savings. In such cases, the reformulation effort may outweigh the gain.

On the other hand, products with substantial chocolate mass or coating, like chocolate bars, stand to benefit significantly. Even a small percentage saving on cocoa butter can translate into major procurement wins when scaled across production volumes.

To quantify this, we modelled the cost of producing 1 metric tonne of four well-known products:

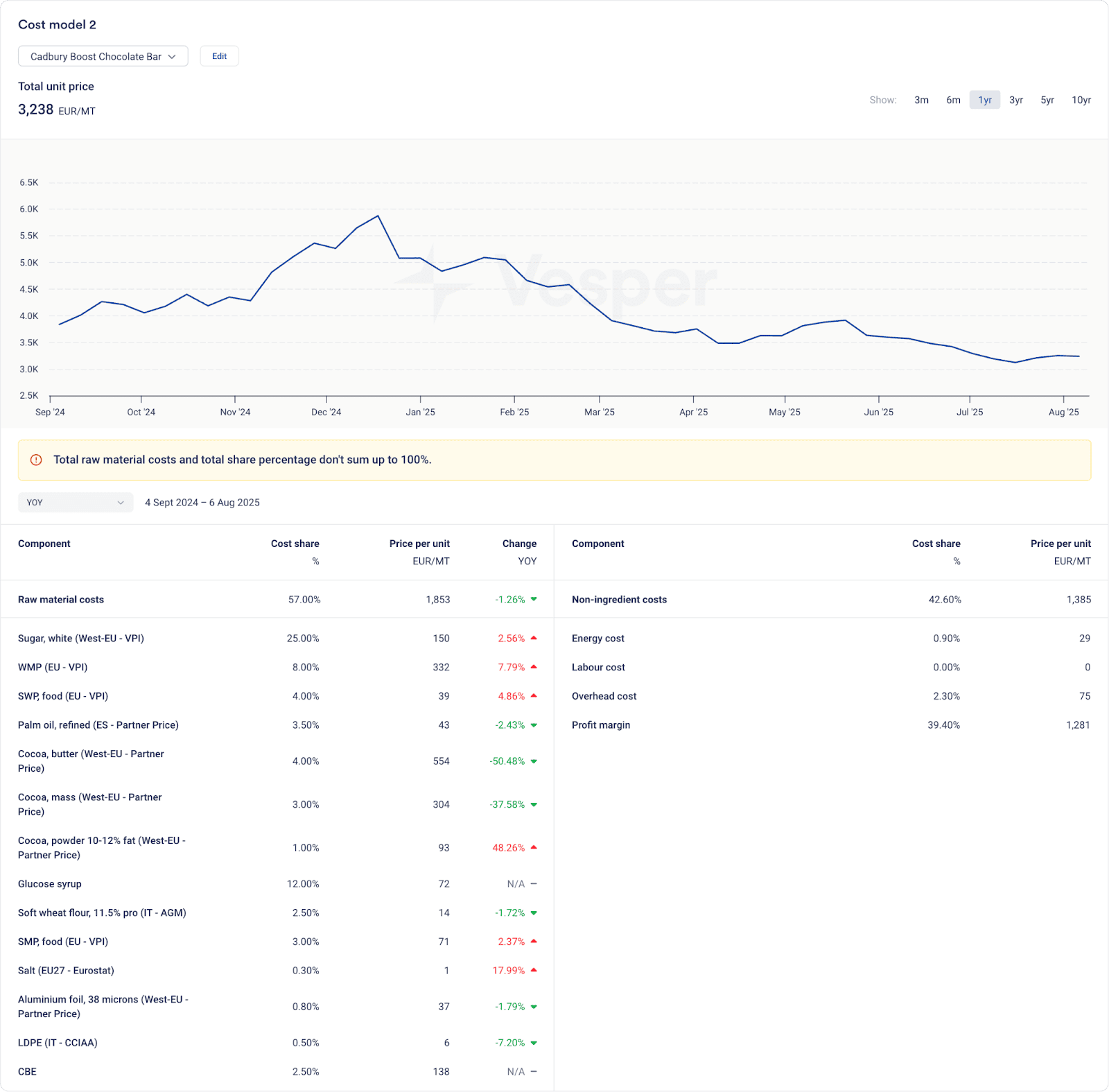

- Cadbury Boost Bar – 11.27% cheaper with original formula including shea butter

- Tupla Bar – 5.79% cheaper with original formula including shea butter

- Choco Leibniz – 3.11% more expensive without shea butter (potential saving if switched)

- Trader Joe’s Chocolate Croissants – 1.97% more expensive without shea butter (potential saving if switched)

Vesper’s proprietary cost models break down the cost structure of consumer food products using live raw material prices alongside non-ingredient factors such as labor, energy, and packaging. This allows procurement teams to see exactly how market volatility or ingredient swaps, like replacing part of cocoa butter with CBE, affect total unit cost.

For the shea butter component, we used the current market price of CBE (€5,500/mt) as reported by our network of buyers, sellers, and traders. All simulations comply with EU regulations, which permit up to 5% of the finished product to consist of non-cocoa vegetable fats such as shea butter, provided they qualify as CBEs.

See the example of the cost model we used for calculating the costs of the Cabury Boost Bar when using CBE below.

Disclaimer: These cost simulations are based on estimations and may not reflect the exact original ingredient lists of the products analyzed. They also exclude minor ingredients such as thickeners, stabilizers, and flavorings, each contributing less than 2% of the finished product.

Key insight:

The products already using shea butter (Tupla and Boost Bar) clearly benefit from it, with savings of 5.79% and 11.27% respectively. For products currently made with 100% cocoa butter (Choco Leibniz, Trader Joe’s Chocolate Croissants), introducing CBE could cut production costs by 3.11% and 1.97% respectively, see snapshots of the simulations below:

Disclaimer: These cost simulations are based on estimations and may not reflect the exact original ingredient lists of the products analyzed. They also exclude minor ingredients such as thickeners, stabilizers, and flavorings, each contributing less than 2% of the finished product.

This reinforces that the potential savings depend heavily on the product type, its chocolate content, and formulation flexibility. High-chocolate-mass products see the greatest benefit, while low-chocolate-content goods will see more modest savings.

Regulatory considerations remain key:

- In the EU, up to 5% CBE can be added without losing the “chocolate” label.

- In the U.S., any non-cocoa fat means the product can no longer be called chocolate — it must be labeled as “chocolaty coating,” “compound coating,” or “chocolate-flavored.”

This distinction can have major branding implications. For example, Trader Joe’s Chocolate Croissants would need rebranding in the U.S. if CBE were introduced, a risk for a premium-positioned product. But if rebranding were already planned, higher substitution rates (20–30% is common in industrial chocolate) could yield substantial savings.

In the EU, those same croissants could incorporate 5% CBE and still be marketed as “chocolate croissants,” reducing procurement costs by 1.97% without any labeling changes.

Can shea butter be used to protect margins when cocoa butter prices spike?

There are valid reasons both for and against using shea butter to protect margins when cocoa butter prices spike. The table below outlines these two sides. That said, in most cases, the argument leans toward yes, primarily due to shea butter’s reduced exposure to speculative trading, its geographically diverse and resilient supply base, and its more flexible harvesting and processing timelines, all of which contribute to greater price stability compared to cocoa butter.

That said, it’s ultimately a trade-off between cost savings and factors like brand image, product positioning, and sensory performance. The right choice depends on your product’s chocolate content, target market, and how much flexibility you have in reformulation.

| Yes – Why Shea Butter Can Protect Margins | No – Why Shea Butter May Not Protect Margins |

| Less exposure to speculative trading – not traded on futures markets | Sourcing complexity – fragmented supply chains, especially for food-grade shea |

| Geographically diverse supply – less risk of country-specific disruptions | Functional limitations – may affect mouthfeel or flavor in premium chocolate |

| More flexible processing timelines – can be stored/processed year-round | Regulatory issues – can’t be labeled as “chocolate” in the U.S. if shea is used |

| Greater price stability – not tied to cocoa bean or powder market dynamics | Limited savings in low-chocolate products – small volumes = minimal impact |

| Can substitute 20–30% of cocoa butter in many applications | Cross-sector competition – cosmetic demand can drive up prices in tight markets |

Can you reliably source food-grade shea butter at scale?

Yes, but planning is essential. Food-grade shea butter, particularly in refined stearin form suitable for chocolate production, is increasingly available at scale. In recent years, significant investments in processing infrastructure across key West African regions (notably Ghana, Burkina Faso, and Nigeria) have improved refining capacity, food safety standards, and traceability, enabling suppliers to meet EU and FDA requirements.

The supply chain is further reinforced by established global ingredient players such as:

- Bunge’s Coberine Shea range, developed specifically for chocolate coatings and compounds

- AAK’s shea-based CBEs, now widely used as cocoa butter replacements in various food applications

However, unlike cocoa butter, which benefits from a centralized and commoditized global trade system, the shea supply chain remains more fragmented. To source reliably at scale and across multiple SKUs or markets, it’s crucial to:

- Establish strong supplier relationships, whether through processors, traders, or cooperatives

- Secure supply contracts or framework agreements to guarantee availability

- Align with food-focused supply chains, as a large portion of global shea production still serves the cosmetics industry

- Consider regional storage hubs to manage lead times and distribution across markets

Leading brands like Cadbury, Hershey, and Guylian already incorporate shea butter in multiple products, proving that multi-market, multi-product integration is both scalable and commercially viable, with the right sourcing setup in place.

How does substituting cocoa butter with shea butter impact shelf life and storage?

When considering a switch from cocoa butter to shea butter, shelf life and storage performance are critical factors, especially for fast-moving consumer goods. Fortunately, shea butter, particularly in its refined stearin form, performs equally well, and in some cases even better, than cocoa butter in key shelf-life parameters.

Here’s a practical comparison:

| Factor | Cocoa Butter | Shea Butter (Stearin) |

| Fat bloom resistance | Moderate | Often better |

| Oxidative stability | High (when pure/refined) | Comparable (when refined) |

| Shelf life impact | Long (12–24 months) | Similar or better |

| Storage requirements | Cool, dry, light-protected | Same |

All in all, if you’re using high-quality, refined shea stearin and replacing cocoa butter in the right type of application (e.g., compound chocolate, bakery coatings, or glazings), you can expect no negative impact, and potentially improved shelf-life stability. Just be sure to validate through real-life shelf-life studies and work closely with your supplier to ensure product consistency and storage integrity.

How does shea butter affect customer perception?

Clean-label compliance is often a top concern, especially for consumer-facing brands. Fortunately, in most markets, including the European Union, substituting part of your cocoa butter with shea butter (as a Cocoa Butter Equivalent, or CBE) is not only legal, but doesn’t require explicitly listing shea on the ingredient label. As long as the total CBE content doesn’t exceed 5% of the finished product, manufacturers can continue labeling it as “chocolate” and simply add a generic phrase like “contains vegetable fats in addition to cocoa butter.”

For some products, whether it’s a chocolate-filled croissant, donut glaze, or muffin inclusion, this subtle change goes completely unnoticed by consumers. They’re typically not scanning for fat sources and are more focused on brand, flavor, and freshness. For that reason, clean-label strategies remain intact, especially in mid-market or mainstream offerings.

That said, if your brand positions itself at the premium or artisanal end, with claims such as “crafted with pure ingredients” or “made with real chocolate”, even a small shift in formulation could raise internal concerns. It may not trigger backlash, but it could weaken the perceived integrity of the brand’s narrative. While consumers likely won’t notice the change themselves, your marketing, quality, or legal teams might hesitate to move away from 100% cocoa butter if the brand’s equity is tightly linked to purity.

Will consumers notice a difference in taste?

When the right form of shea-derived fat is used, in this case CBE (Cocoa Butter Equivalent) made from shea stearin blended with non-lauric fats like palm mid fraction, it performs extremely well in both chocolate and bakery applications. Whether used in chocolate compounds, fillings, drizzles, or glaze systems, CBE provides a solid cocoa butter mimic: good snap, stable fat crystallization, and a smooth melt.

Unlike premium chocolate bars where mouthfeel and melt curves are highly noticeable, bakery formats dilute the impact of the fat phase. Chocolate is often a component rather than the star, used in small quantities or paired with doughs, batters, fillings, and frostings. In these contexts, consumers will not taste the difference, particularly when substitution levels remain within the 5% (EU chocolate) to 30% (compound coatings) range.

Taste and aroma integrity depend heavily on sourcing. Refined food-grade shea stearin from reputable suppliers like AAK or Bunge is virtually flavorless and odor-neutral, ensuring it doesn’t interfere with the product profile. Poorly refined grades, however, could introduce subtle nutty or earthy notes, affecting flavor in delicate applications, another reason supplier choice and consistency are key.

In short, when CBE is used thoughtfully and within regulatory limits, partial cocoa butter replacement is functionally safe, sensory-neutral, and unlikely to affect consumer perception.

So, when is it a smart move?

If you’re producing mass-market bakery products, like filled croissants, chocolate-coated donuts, muffins with chocolate chips, or compound-coated biscuits, then partially substituting cocoa butter with shea butter is likely a low-risk, high-reward strategy. It helps protect your margins, ensures labeling compliance, and doesn’t compromise consumer perception or taste.

However, the business case often depends on how much cocoa butter you’re actually using. If it makes up only a tiny percentage of your total recipe, for example, just a drizzle of chocolate or a few chips, the absolute cost savings may not justify the effort of reformulating, revalidating, and adjusting procurement flows. Reformulation takes time, QA input, and operational alignment, and when the ingredient has minimal impact on cost, it’s worth pausing to ask if it’s worth it.

That said, for high-volume FMCG brands, even small percentages can make a big financial impact when scaled across multiple SKUs and markets. If your product line includes several chocolate-filled or coated items, swapping even a fraction of cocoa butter for shea can translate to meaningful margin protection, especially during periods of cocoa price volatility.

On the other hand, if your bakery brand positions itself in the premium, artisanal, or clean-label niche, where purity and indulgence are part of the brand promise, then the substitution may not align with your strategy. Even if consumers won’t notice a sensory difference, your brand team and your claims might.