The soybean complex continues its downward trajectory as multiple market pressures converge, with CBOT soybean prices hitting new lows at 969 USD cents per bushel.

CBOT crude soybean oil prices have declined to 54.5 USD cents per pound, down from 56.55 USD cents just one week ago. This represents the latest move in a broader pattern affecting the entire soybean value chain.

Key market drivers behind the decline

Several factors are contributing to the current price pressure across soybean markets.

Lower Brent crude prices are reducing support for vegetable oils used in biodiesel production. Meanwhile, favorable weather conditions across major US growing regions are supporting crop development expectations.

Perhaps most significantly, uncertainties surrounding China’s appetite for US soybeans are weighing heavily on market sentiment.

China’s inventory

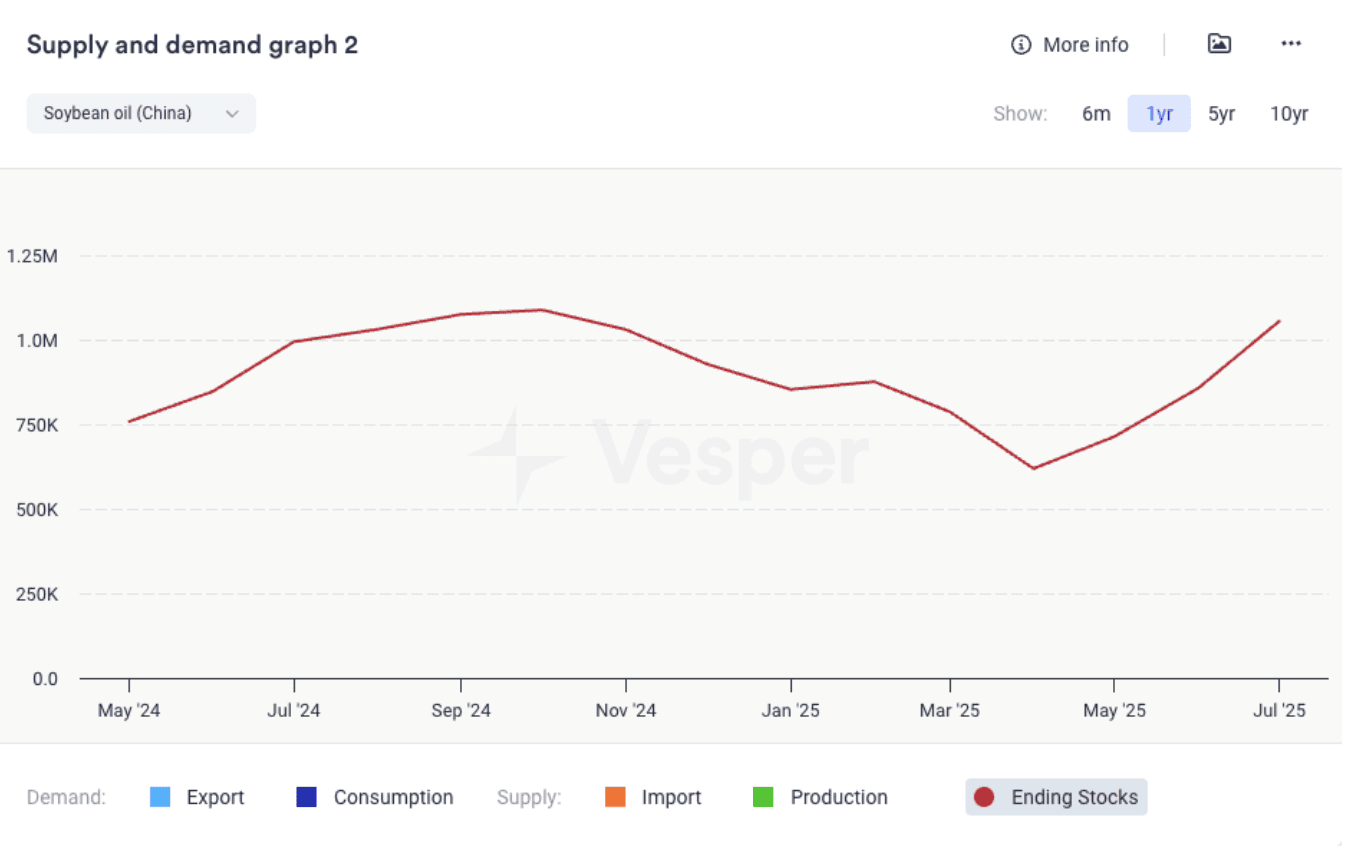

Vesper’s proprietary data reveals important shifts in China’s soybean supply chain dynamics.

Current Chinese soybean oil stocks stand at 1.055 million metric tonnes (mmt), showing an increase from 0.86 mmt in June. For context, stocks were at 0.99 mmt during the same period last year.

Soybean stocks at Chinese ports reached 6.422 mmt in July, compared to 5.956 mmt in June. However, this remains below the 7.689 mmt recorded in July 2023.

Soy meal inventories present another data point worth monitoring. June stocks of 777,000 metric tonnes compare to 290,000 mt in May, though they remain well below last year’s June level of 1.05 mmt.

Chart 4: China’s Soy Oil Port Stocks (mt)

Policy changes reshaping demand patterns

China’s agricultural policy shifts are creating ripple effects across global soybean markets.

The world’s largest pork market is grappling with consumption concerns, while recent soy oil sales to India are adding another layer to trade flow dynamics.

Chinese authorities have announced plans to reduce sow herds and limit new capacity additions in their livestock sector. The goal is stabilizing meat prices after this year’s sharp declines.

More directly impacting soybean demand, China plans to reduce soybean meal usage in animal feed formulations. These combined measures could cut annual soybean imports by approximately 10 million tonnes.

Geopolitical factors add uncertainty

The ongoing US-China trade relationship continues influencing agricultural commodity flows.

These geopolitical considerations, combined with China’s policy changes, could result in reduced purchases of US soybeans during the upcoming peak marketing season.

US supply outlook remains comfortable

USDA projections show US soybean ending stocks for the current season at 9.53 mmt, slightly above last year’s 9.23 mmt level.

This relatively comfortable supply situation, combined with reduced export demand expectations, continues supporting the bearish price environment.

Market outlook through year-end

Vesper’s machine learning model indicates a continued downward trend for CBOT soy oil prices in the near term.

Our analytical team expects August to bring increased volatility as weather-related news becomes a key market driver. Markets will be closely monitoring updates on the US-China trade relationship, which will significantly influence the outlook for US soybean exports and price direction heading into the new marketing season.

September is expected to see additional price pressure as the US harvest gets underway and supply availability increases.

However, the outlook shifts more positive for the final quarter of the year. October and November are anticipated to bring a price recovery, with CBOT soybean oil prices potentially exceeding $1,200 per metric tonne. This expected strength is driven by increased demand from the biodiesel sector as winter fuel blending requirements take effect.

For the full market analyses of week 32 covering all vegetable oils, visit: https://app.vespertool.com/market-analysis/2159?commodity=vegetable-oil