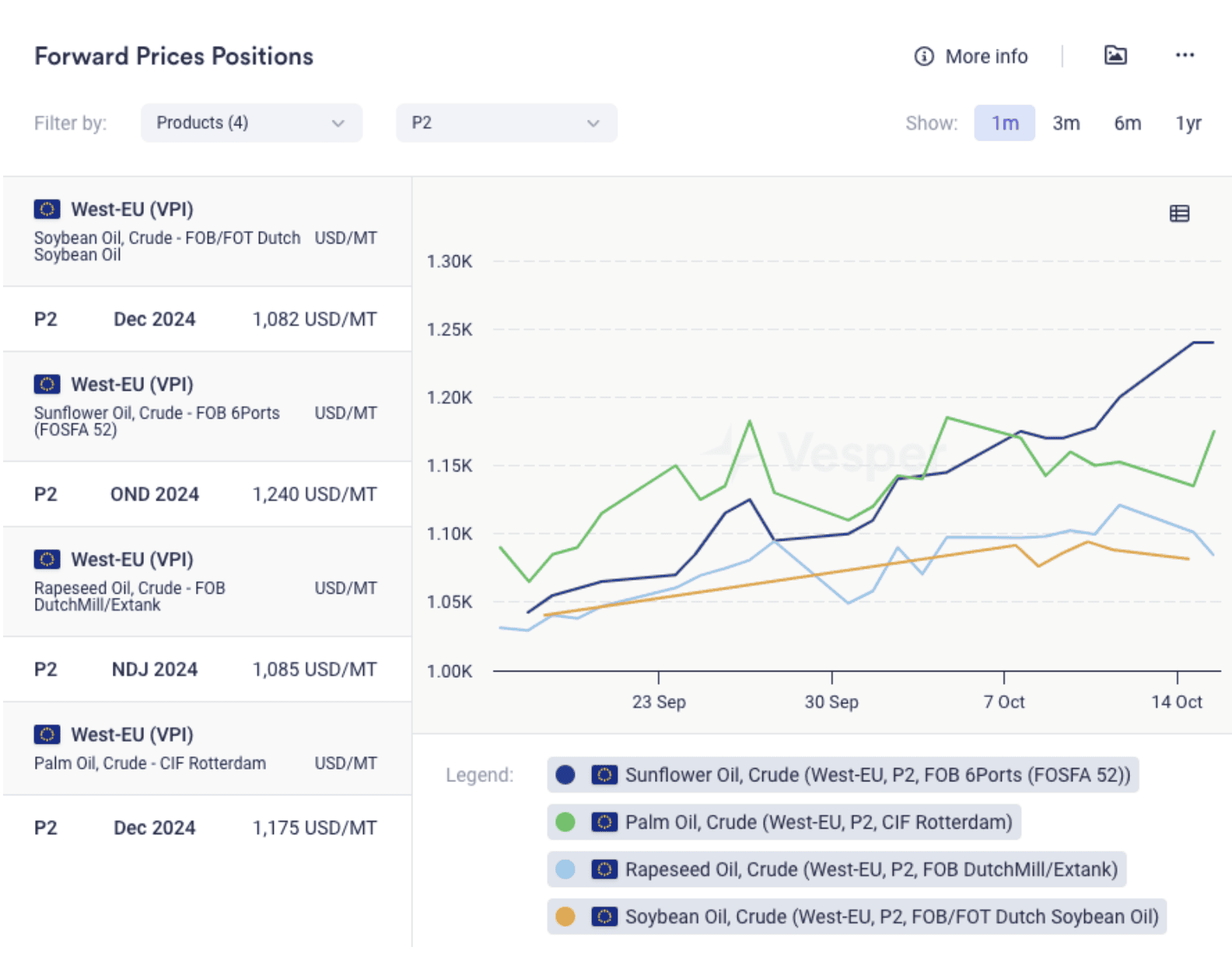

Crude Sunflower Oil (SFO) prices have sharply increased, overtaking rival oils, as the tight supply at origins pushes the market upward. The latest pricing data from the Vesper West E.U. Forward Price Index shows the price of Crude Sunflower Oil (as of October 14, 2024) rising to €1,137 or $1,240 per metric ton (FOB 6Ports, FOSFA 52, OND), a significant jump from last week’s €1,071 or $1,175 per metric ton. With this rise, SFO is now considered a premium oil, outpacing its competitors as demonstrated in the figure below.

Figure 1: Forward Prices for key vegetable oils (USD/mt)

This surge is largely fueled by soaring origin prices, as sunflower seed prices reach multi-month highs due to farmers holding back on sales, further driving market instability. According to APK data, the bid price for Crude Sunflower Oil (FOB Ukraine) rose by $30/mt to $1,040/mt last week, while the ask price increased by $20/mt, settling at $1,050/mt. In Russia, bid prices also saw a significant rise, with an increase of $25/mt bringing the FOB Crude Sunflower Oil price to $990/mt, and ask prices similarly rose to $1,035/mt.

In Ukraine, the bid price for sunflower seeds reached new highs, hitting UAH 22,900/mt ($510/mt), as market participants report exceedingly tight supply conditions across the sunflower complex. Numerous plants in both Ukraine and Russia are reported to have only weeks’ worth of seed coverage, and with crushing margins turning negative, sunflower seed prices are exacerbating concerns of market overheating.

The FAS USDA additionally reduced its forecast for Turkish sunflower seed production by 300,000 mt, bringing the total to 1.25 million mt—the lowest level since the 2015-2016 season. Meanwhile, the estimate for Turkish imports raised by 100,000 mt, bringing it up to 550,000 mt. This indicates a significant supply gap, as Black Sea suppliers are increasingly focused on exporting value-added products, such as oil and meal, rather than raw seeds. According to market participants, Turkey will have to offer competitive prices to attract seed imports.

Globally, the sunflower seed crop is expected to decline, with the USDA forecasting total production to hit 50.7 million mt, a drop of 5.4 million mt from last year. This decrease is primarily attributed to a smaller harvest in the Black Sea region, exacerbating supply constraints.

In other news, Russia continues to strike the Odessa region, including its port, with several more ships reported to have been damaged

Outlook

Looking ahead, Vesper’s machine-learning-driven price forecast shows a continued upward trend in the short and long term for FOB Ukraine Crude Sunflower Oil prices, see Figure below.

Figure 2: AI driven price forecast for Sunflower Oil Ukraine (USD/mt)

Minimal harvest pressure is being observed due to limited farmer sales; many farmers have secured cash from earlier crop sales and are now holding onto their remaining stocks, anticipating even higher prices. However, these stocks will eventually need to be sold, which could lead to a cooling off in both seed and oil prices over the next three months, followed by a seasonal price increase.

For the market to stabilize, sunflower seed prices will need to cool down considerably. Market players in Russia and Ukraine are warning of potential contract defaults and bankruptcies if the current conditions persist.

Go to Vesper’s platform for more insights of the sunflower oil market and rival oils.