E.U. biodiesel prices have strengthened since the last report (see Figure 1). This increase is primarily due to the rising LSGO price, which hit a two-month high because of projected tighter oil balance and geopolitical tensions in the Black Sea and Middle East. Additionally, discussions about the Dutch Emissions Authority potentially reducing the cap on HBE ticket carryovers have influenced prices. The oversupply of HBE tickets has been pressuring both ticket and physical biodiesel prices, prompting the authority to address the issue.

Figure 1: Outright Biodiesel Prices, FOB ARA (USD/mt)

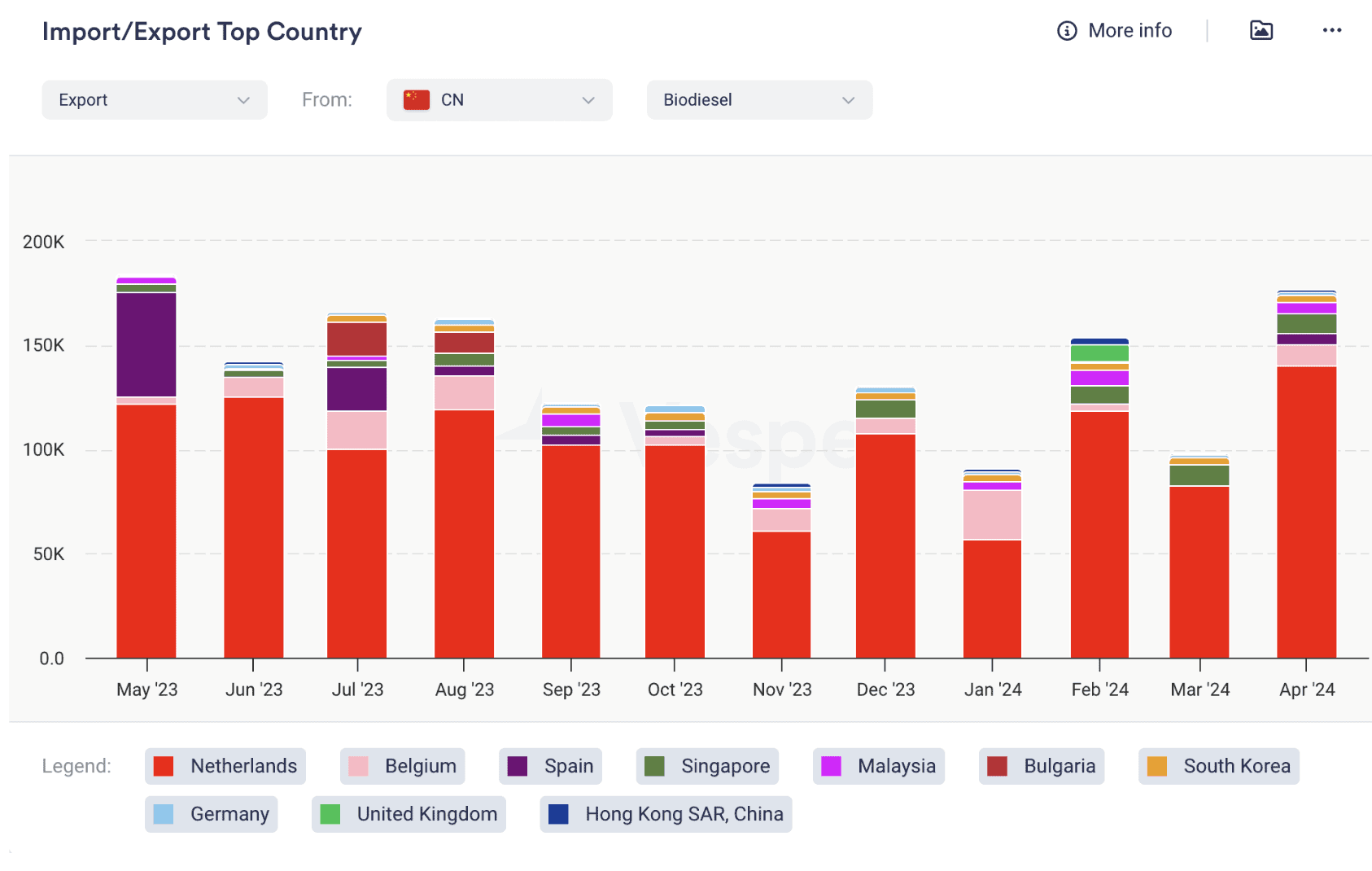

In other news, the European Commission has delayed the pre-disclosure of provisional measures from its anti-dumping investigation into Chinese biodiesel imports by one week, now set for June 28. Provisional measures are expected to be announced on July 29, with a deadline for return comments on August 31, reported market sources citing Quantum. E.U. biodiesel imports increased from 181,699 mt in March to 211,000 mt in April, driven by a rise in exports from China, which totalled 150,000 metric tons, see Figure 2.

Figure 2: China Biodiesel Exports (mt)

Feedstock prices have been mixed. Rapeseed oil prices decreased due to falling rapeseed prices and buyer pressure. EXW Netherlands UCO prices rose as traders took advantage of higher biodiesel prices and slower cargo arrivals into the E.U. in recent months. Chinese UCO prices remained stable with low liquidity as the market awaits anti-dumping decisions by the E.U. Commission. It’s a buyer’s market in Asia, with oil majors mainly looking to sell, reported one broker working with APAC. POME market shows an oversupply, with reduced demand from Italy and China but stronger interest from other E.U. countries, indicating a buyer’s market as well.

Sign up here to receive our biodiesel highlights free for 30 days, with no strings attached.