Global sugar prices have experienced minimal fluctuations in recent weeks, indicating a certain level of market stability as the early harvest in Brazil’s Center-South region approaches. In the futures contract for March, the variation was minimal, with a slight increase observed in other contracts over the last week. Despite some volatility in daily prices, closing figures have consistently aligned around 23 cents dollar per pound.

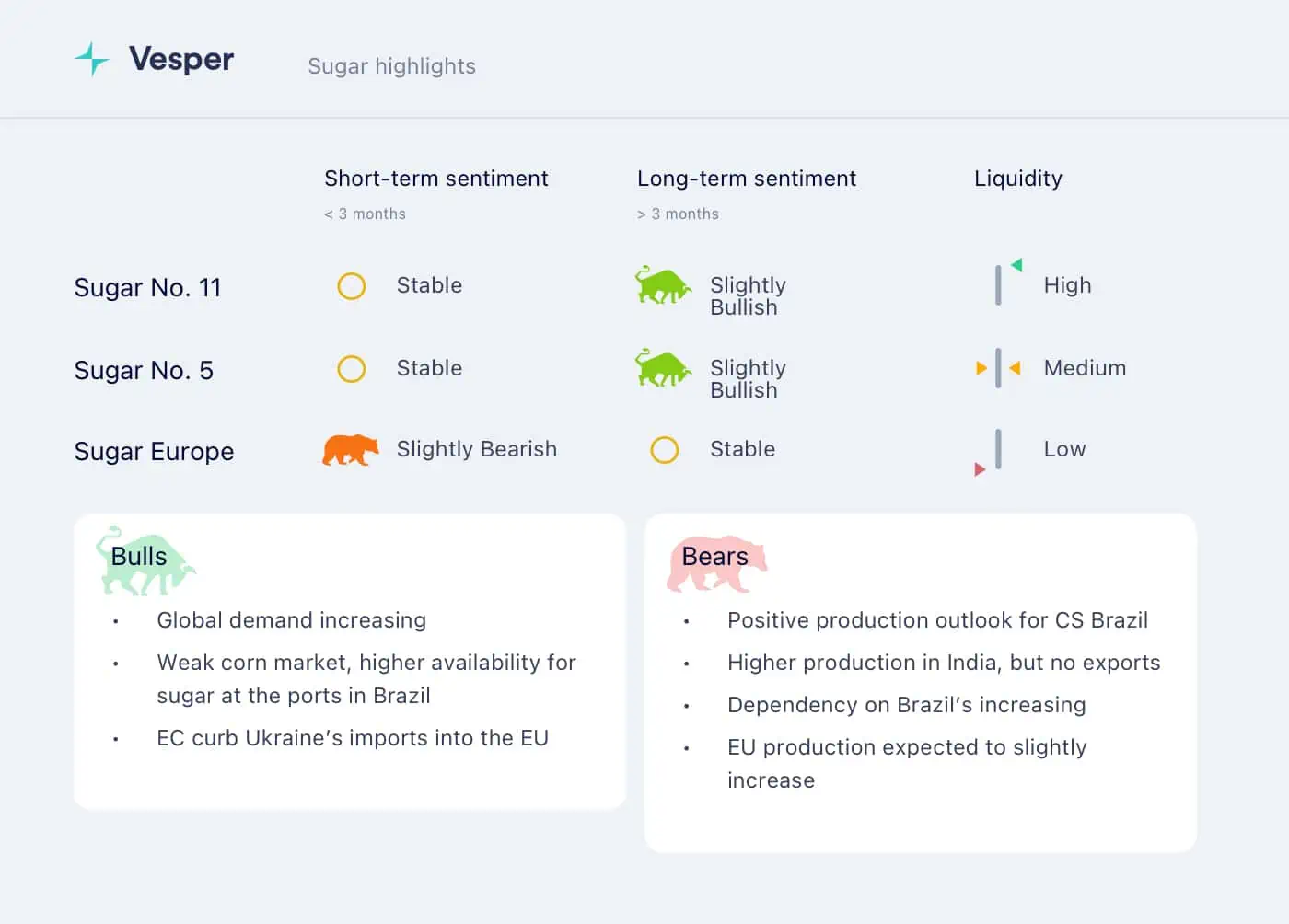

The Center-South (CS) Brazil market continues to exert a bearish influence on the global sugar landscape. Sugarcane production is anticipated to decline from the 23/24 crop, with estimates ranging between 600-620 million metric tons (MMT).

This sugar market outlook remains susceptible to unpredictable weather patterns. However, an increased focus on sugar production is expected to maintain output levels comparable to the current season. Concurrently, the corn market is experiencing a downturn, prompting a shift towards increased ethanol production from corn for domestic consumption. This shift is likely to reduce competition in the export market, allowing sugar exports from Brazil to remain robust and continue meeting global demand more effectively than in the previous year.

On the other hand, if investment funds decide to rebuild a long position in the futures market, they could quickly drive up prices. In summary, the market sentiment is that extremely negative news would be necessary for sugar prices to fall below 22 cents per dollar per pound, but funds or fundamental changes in Brazil could drive the prices to go up.

Meanwhile, in Europe, the EU has swiftly enacted policy changes in response to widespread farmer protests, with an eye on the upcoming European parliamentary elections and the Commission President’s reelection campaign. These adjustments include relaxing the mandate to reserve 4% of land for nature’s recovery, easing the target for a 50% reduction in pesticide usage, and proposing a limit on imports of specific agricultural goods from Ukraine, particularly sugar. The policy adjustments are anticipated to encourage increased beet cultivation.

While the relaxation of pesticide regulations is unlikely to have a major effect on beet farming, the EU has suggested limiting Ukrainian sugar imports to the quantities recorded in 2022 and 2023. The surplus in Ukraine’s sugar production, which is estimated to be at 700 thousand tonnes, coupled with the timing of the EU’s import restrictions, may impact negotiations over prices and quantities within the EU.

The European Commission has established a quota for Ukraine, permitting the export of 320

thousand tonnes of sugar to EU countries in 2024, marking a decrease from the previous year’s quota of 500 thousand tonnes. In light of this reduced quota, Ukrainian companies are anticipated to seek new markets for an excess of 500,000 tonnes of sugar, with potential opportunities in Mediterranean and African countries.

For more regional trends and sugar market outlook projections, download our latest sugar market highlights for free.