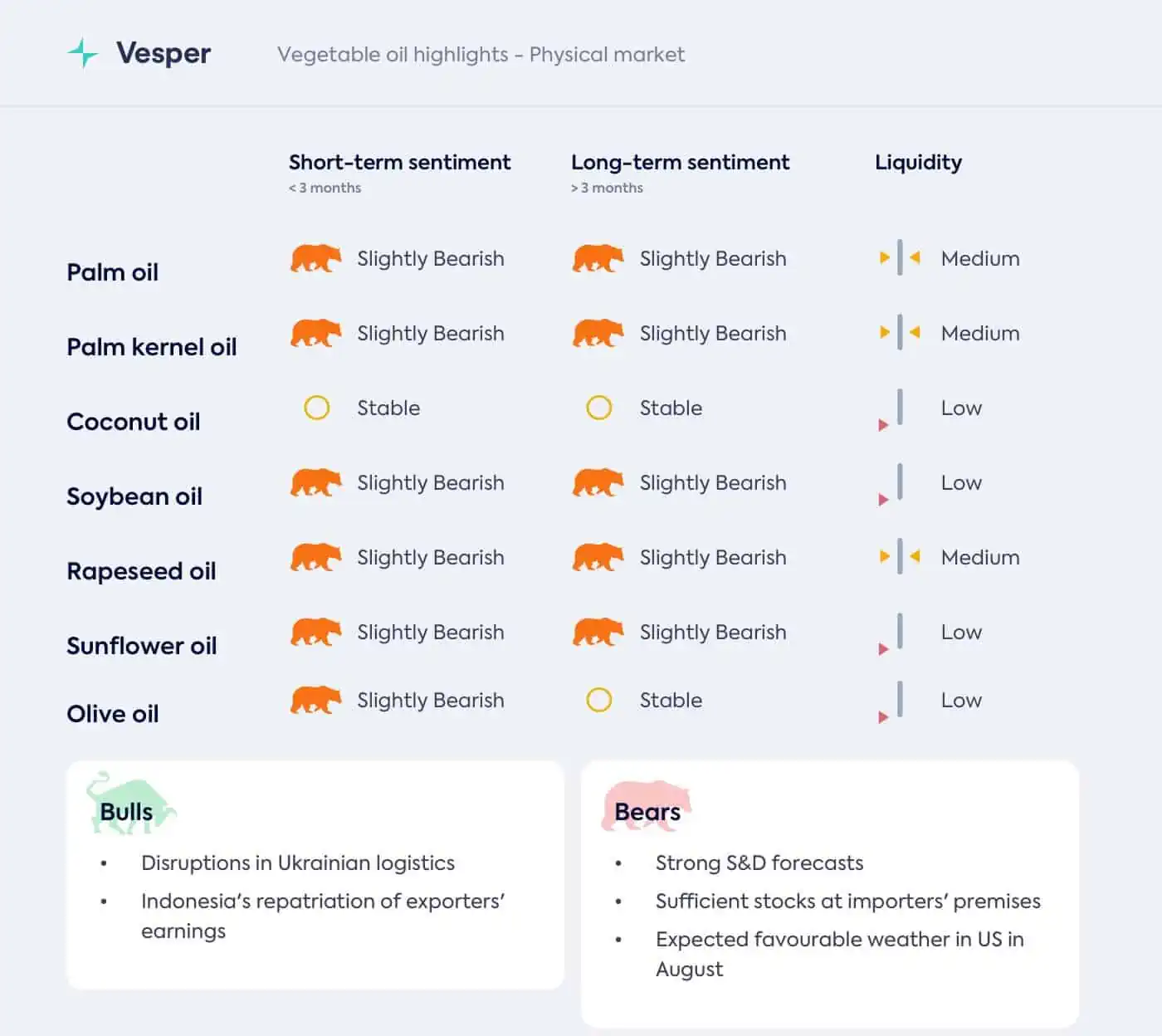

The vegetable oil complex experienced fluctuations this week, influenced by a series of global events. As the situation in the Black Sea cooled down, Ukrainian traders reported lower import appetite, while Russia’s suspension of the Black Sea Grain Deal prompted Ukraine to seek solutions for its logistics problems, albeit at a potentially higher cost.

In the United States, the National Oceanic and Atmospheric Administration (NOAA) published a favourable weather forecast for August. According to the updated forecast, the Corn Belt is expected to receive much-needed rain, with moderate temperatures. This news exerted pressure on soybean oil prices and the broader vegetable oil complex.

On the international front, the palm oil market witnessed a slight decrease in importers’ appetite for Malaysian palm oil due to a strengthening Malaysian ringgit. Meanwhile, the US dollar weakened following reports of slower inflation in June and expectations that the recent Federal Reserve rate hike was the final one.

Quick side note: Our Oils and Fats calculators are on hand for free, i.e. helping you make sense of Crude Vegetable Oil Refinery Cost.

In the rapeseed oil sector, prices experienced a correction after significant price increases in recent weeks. Traders suggested that these price hikes were not justified. However, the EU food sector reported an upswing in demand for rapeseed oil, signaling positive prospects for the market.

As we continue to monitor global developments, these factors are likely to impact the vegetable oil complex in the coming weeks. Stay tuned for further updates and analyses as the situation evolves.

Want to access the full market analysis with a deep dive into palm, soybean, rapeseed, sunflower, coconut, and olive oil? Start your free trial here.