Market update: CME prices climb on reduced offers while May production data shows record butter and cheese volumes

US dairy markets celebrated July 4th with broad-based price gains across all CME products, driven by congressional passage of major legislation that President Trump called “no better birthday present for America” ahead of today’s ceremonial signing.

CME markets see widespread price inflation

All dairy products traded higher by week’s end compared to Monday’s opening, primarily due to a shortage of seller offers across the board. Cheese prices rebounded after falling over $0.20/lb in the previous two weeks, while dry whey posted the week’s largest percentage gains.

The Dow Jones Industrial Average has now recovered all losses from April’s decline, reflecting broader market optimism around the new legislation. However, questions remain about whether the measures will boost consumer confidence or trigger a new inflation cycle.

Currency and trade factors support exports

The relatively weak US dollar compared to the euro continues supporting American dairy exports, while the pause on trade tariff hikes has encouraged Chinese buyers to return to US whey markets. Non-fat dry milk (NFDM) benefits primarily from the favorable $1.178/€ exchange rate rather than tariff reductions.

With milk powder prices under significant pressure in both Europe and Oceania, analysts expect this weakness could eventually impact US markets as well.

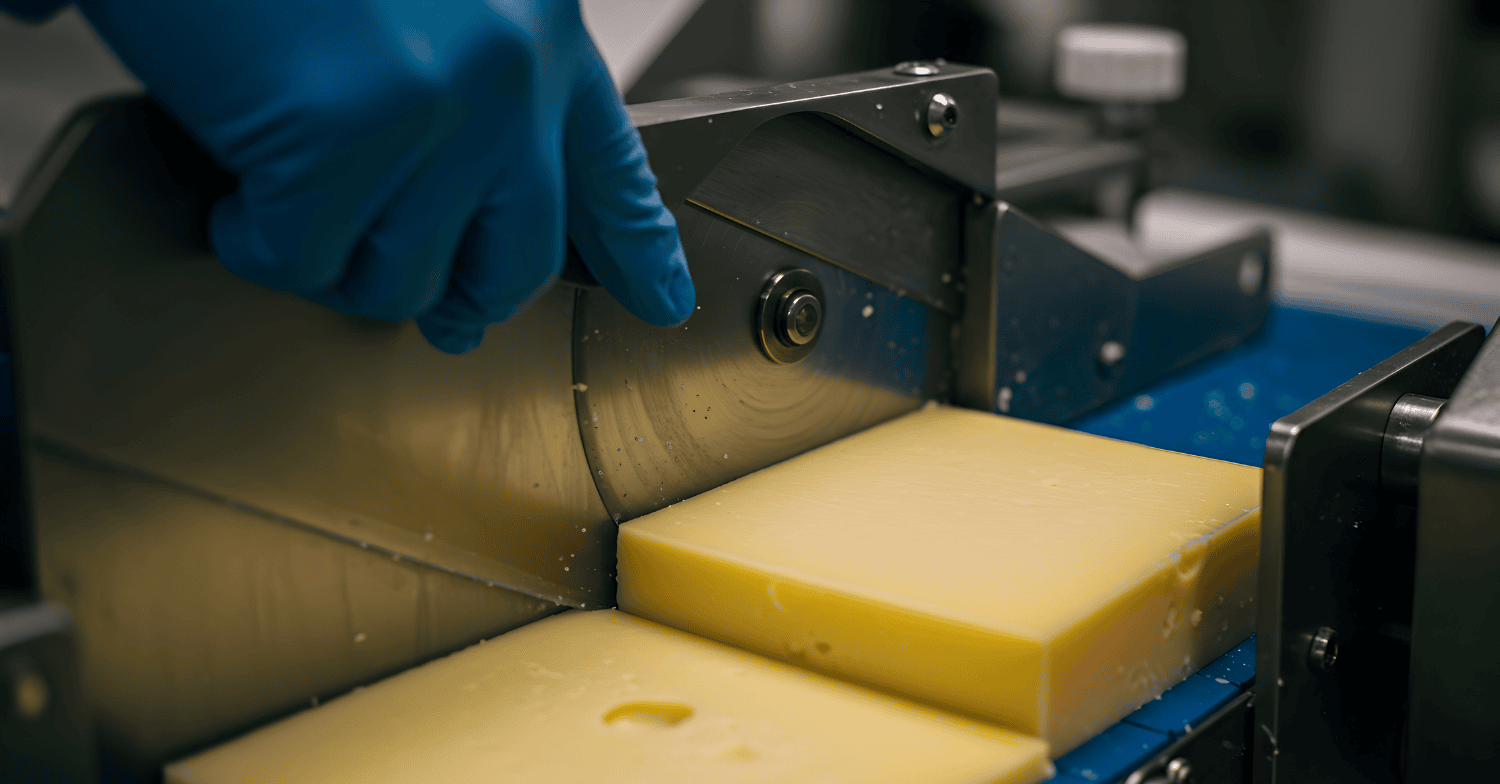

May production data reveals record volumes

May production figures confirmed expectations of strong output following higher milk production numbers, with butter and cheese leading the surge.

Record production highlights:

- Butter production: +3.49% year-over-year, reaching new volume records

- American cheese production: +5.55% YOY increase

- Cheddar cheese: +9.64% YOY (significantly outpacing mozzarella at +0.83%)

- Dry whey production: +6.49% YOY

The cheese production breakdown suggests American burger demand is outpacing pizza consumption, with new cheese facilities focusing heavily on cheddar output.

Whey stream dynamics shift production mix

An additional 40 million pounds of cheese production in May compared to last year generated roughly 300 million pounds of extra liquid whey. This surplus explains the unusual growth in dry whey production, as processors typically divert liquid whey to higher-margin whey protein concentrates (WPC80) and isolates (WPI).

Notably, WPC80 production declined 2.37% in May, potentially reflecting the impact of Chinese tariffs on US production decisions. This demonstrates “the long arm of Beijing” reaching into American dairy manufacturing choices.

Global dairy trade shows weakness

The week’s Global Dairy Trade event brought increased volume and significant price pressure as Fonterra began listing September and October volumes from the upcoming 2025/26 milk season. Demand failed to match this additional supply, resulting in a 5.1% decline in whole milk powder (WMP) prices.

WMP now trades below $4,000/mt, a level that typically translates to lower milk prices in New Zealand and begins a new cycle of global milk price adjustments.

Labor and trade policy developments

The dairy industry faces ongoing labor challenges, with proposals for new temporary work permits for undocumented immigrants already in the country. These permits would bypass the costly H-2A visa system, which industry leaders say is poorly designed for year-round dairy operations.

Meanwhile, Mexico is pushing for milk powder self-sufficiency through revived dairy plants and expanded subsidies, potentially reducing reliance on US imports in this key export market.

Market outlook: optimism tempered by global pressures

While legislative developments and production strength support near-term US dairy market optimism, global price pressures and trade uncertainties remain significant factors. The combination of record domestic production, favorable currency conditions, and renewed Chinese buying interest provides a solid foundation, but sustainability depends on broader economic and trade policy developments.

The coming weeks will reveal whether current price strength can withstand potential inflation concerns and global competitive pressures.

Access the full US weekly Dairy analysis for week 27 on the Vesper platform here: https://app.vespertool.com/market-analysis/2068