August 1, 2025 – Market Analysis

In a surprising twist for dairy markets, US butter stocks came in lower than expected last week, even as milk production and milk fat levels continue to increase. The unexpected drawdown in June’s butter inventory defies typical trends and signals exceptionally strong demand, both at home and abroad.

Under normal circumstances, higher milk fat (up 5.52% year-over-year in June) would lead to more butter production and, eventually, higher stock levels. But the latest cold storage report from last Friday showed the opposite: stocks actually declined. This suggests that demand is outpacing supply, even with production on the rise.

The news pushed dairy prices higher across the board this week, as traders and buyers adjusted to tighter-than-expected fundamentals. Butter prices, while still well below last year’s peak, gained ground on the back of limited inventory.

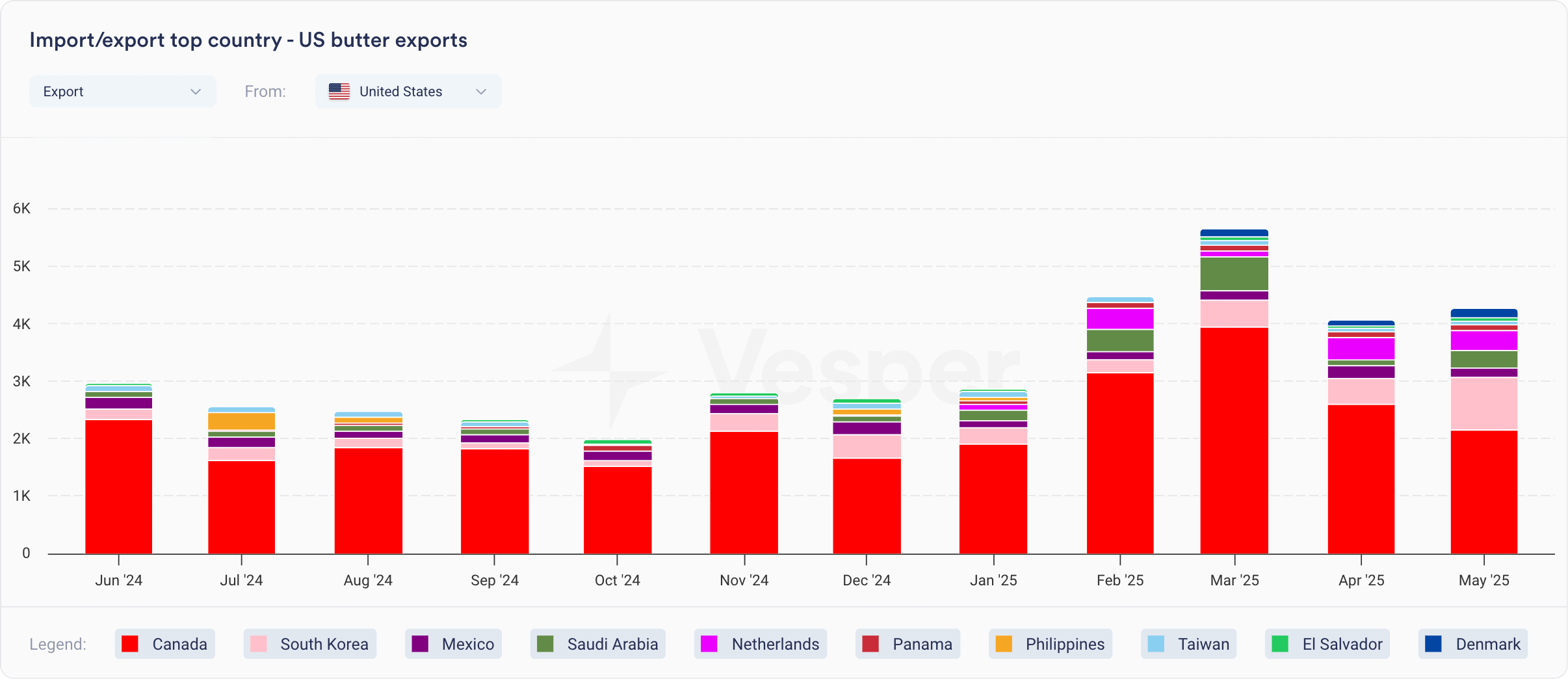

One major factor behind the drawdown? Exports. US butter exports from January through May increased by a remarkable 25 million pounds, more than double the 10 million pound decline in ending stocks. The figures highlight just how much international demand is absorbing domestic supply.

Big picture: A shifting market

Even with strong milk production and lower feed costs, thanks to abundant corn and soybean supplies, stock levels are not building. Instead, robust global demand appears to be soaking up the additional butter, keeping pressure on supplies and lifting prices.

As the US continues to benefit from competitive pricing in global dairy markets, analysts say this gap between supply growth and stock decline could become a defining trend for the rest of 2025.

Read the full market analysis on butter in our market analysis section: https://app.vespertool.com/market-analysis/2151