July 28, 2025 – Market Analysis

The United States and Japan have finalized a sweeping trade agreement that promises to ease economic tensions and deliver critical stability for U.S. exporters, particularly those in the dairy industry.

Finalized on July 22, the deal includes several key provisions:

- Tariff Adjustments: The U.S. will reduce proposed tariffs on Japanese imports from 25% to 15%, covering sectors such as automobiles, auto parts, and a broad range of other goods — including agricultural products.

- Japanese Investment: Japan has pledged $550 billion in investment into the U.S. economy, largely through loans and guarantees to support more resilient, diversified supply chains.

- Market Access: The agreement also enhances access for U.S. goods entering Japan, particularly automobiles, rice, and other agricultural exports.

The agreement materialized just in time. With an August 1 deadline looming, the U.S. administration had signaled it was prepared to impose higher tariffs if talks failed. The breakthrough follows weeks of high-stakes diplomacy, set against the backdrop of Japan’s political upheaval and rising domestic economic pressure, including inflation concerns and trade vulnerability.

A Lifeline for U.S. Dairy

While the deal has broad implications, few industries stand to benefit as directly as U.S. dairy.

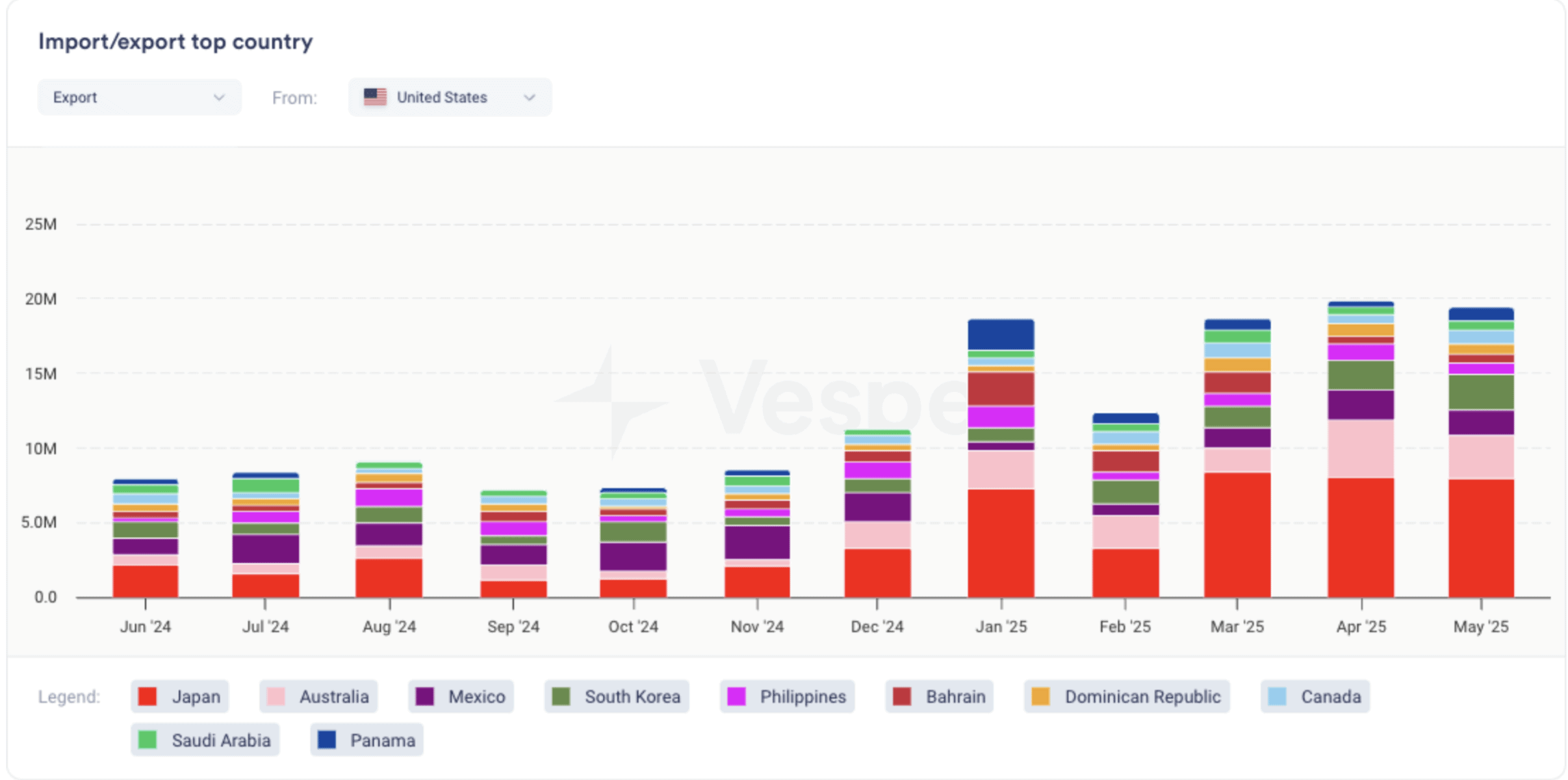

In recent months, the U.S. dairy market has struggled with oversupply, price pressure, and increasing uncertainty around trade policy. Japan’s role in this equation is vital: it is the largest overseas market for U.S. Cheddar and American-style cheese, the second-largest importer of high-value whey proteins (WPC/WPI), and the fourth-largest buyer of U.S. lactose, see figure below.

For an industry facing a softening domestic market and global competition from the EU and Oceania, retaining tariff-free access to Japan is a major strategic win.

“This isn’t about a few containers,” said one analyst. “This is about preserving a high-value, high-volume trade lane that underpins the economics of several U.S. dairy segments — especially specialty proteins and value-added cheese.”

The agreement effectively shields U.S. dairy from the kind of tariff shocks that could have damaged relationships with Japanese buyers or diverted demand toward other global suppliers. At a time when dry whey prices are sagging, and production remains historically high, export stability could help ease the domestic supply overhang.

As the August 1 deadline approaches, the U.S. dairy industry and the broader agricultural export community is watching closely to see who might be next to sign on.

Read the full market analysis on the U.S. dairy market here: https://app.vespertool.com/market-analysis/2131?commodity=dairy