July 28, 2025 — Market Analysis

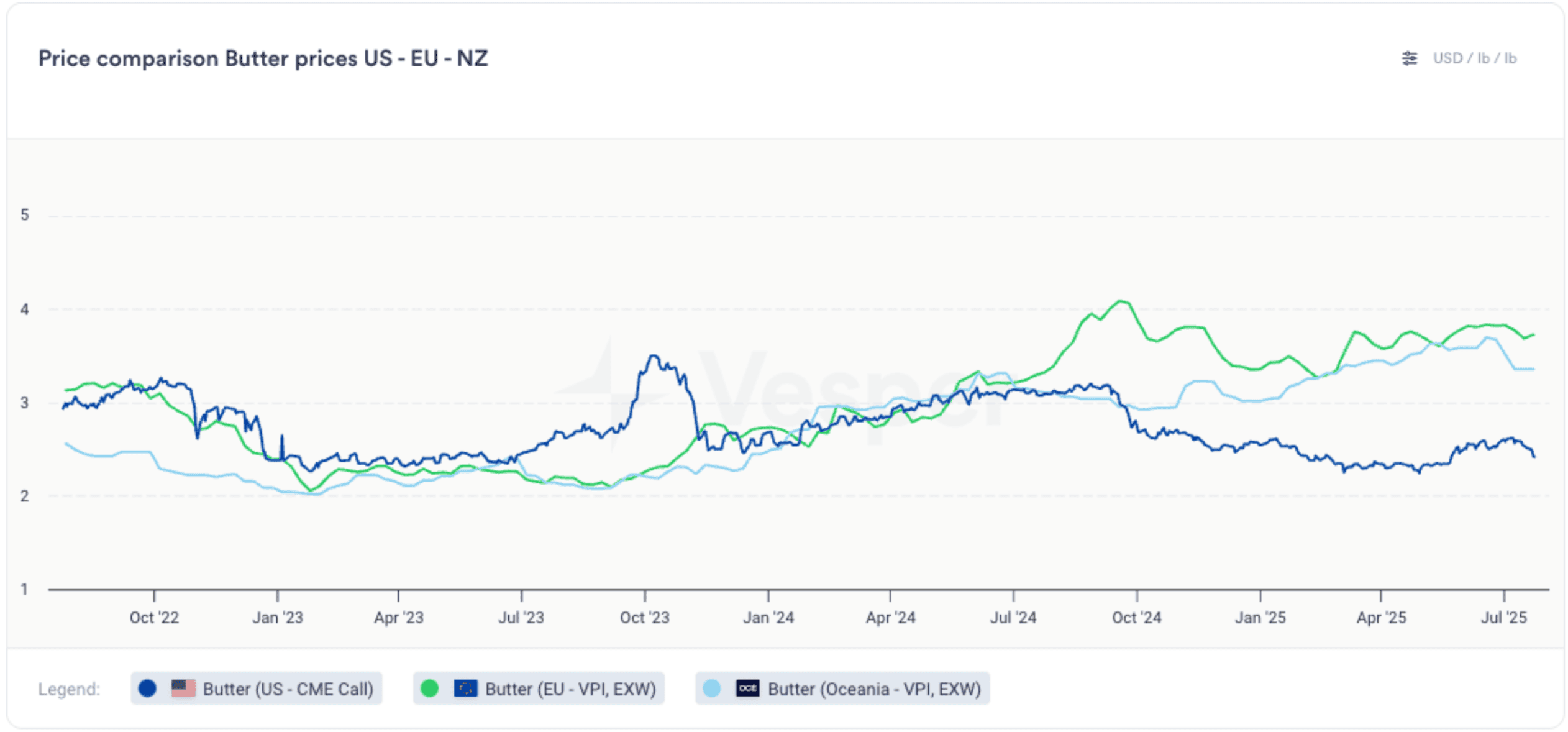

Butter markets across the globe are moving in dramatically different directions. In the United States, prices have fallen sharply in recent weeks, while Europe and New Zealand continue to see elevated levels, highlighting how supply dynamics, export strategies, and consumer demand are shaping three distinct market realities, see figure below.

🇺🇸 U.S. Butter prices face downward pressure

The latest U.S. dairy production data confirms what traders already suspected: milk and butter output remain historically high, even as seasonal peaks have passed. Year-to-date volumes are now over 1.2 billion pounds ahead of 2024, and the oversupply is dragging down prices across the board.

- CME butter prices have dropped significantly, dipping below $2.50/lb in July.

- Strong cream availability and slowing foodservice demand add further pressure.

- Producers and processors are caught in a margin squeeze, with dry whey and even value-added whey proteins like WPC80 also losing pricing power.

This is a classic supply overhang story: too much product, not enough pull-through, and limited export acceleration to absorb the surplus.

🇪🇺 Europe holds steady on strong Demand, weaker output

In contrast, European butter prices have stayed relatively firm, supported by a mix of solid internal demand and underwhelming production.

- Weather variability and feed costs have constrained output across several EU countries.

- Domestic consumption remains healthy — especially in retail and value-added formats.

- Europe’s internal market structure helps shield it from export volatility.

This has created a pricing floor that’s allowed European butter to remain competitive globally, even as U.S. prices have softened.

🇳🇿 New Zealand’s export machine keeps prices elevated

Then there’s New Zealand, where butter has become a symbol of both export success and domestic frustration.

- NZ exports up 11.3% in the first five months of 2025.

- Shipments to China (+18.7%), Saudi Arabia (+30.8%), and the U.S. (+29.2%) have surged.

- Prices remain high, reflecting strong global demand for grass-fed, premium butter.

But this success has come at a local cost: Kiwi consumers now pay more than Australians for their own domestically produced butter, fueling a cost-of-living debate that’s making front-page news.

Read the full market analysis on the U.S. dairy market here: https://app.vespertool.com/market-analysis/2131?commodity=dairy