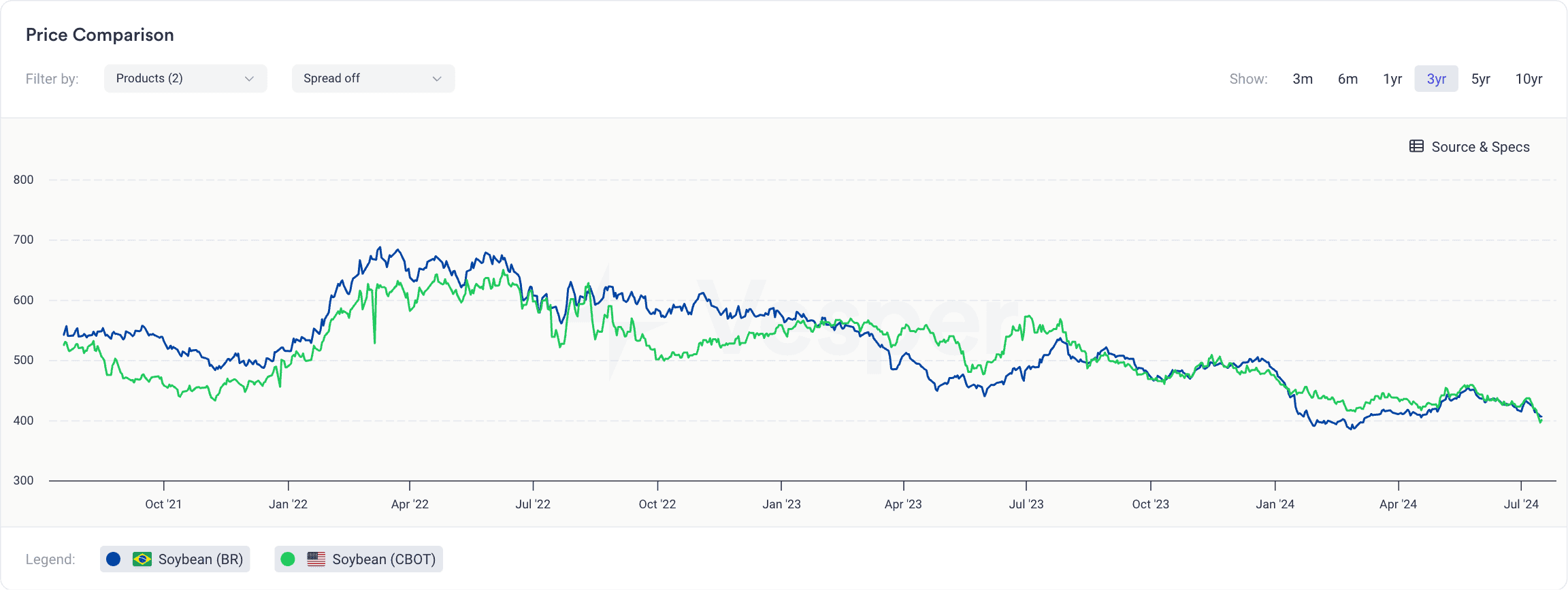

Despite the USDA lowering its projections for soybean production and ending stocks, soybean prices in Chicago and Brazil have hit multiyear lows, see Figure 1.

Figure 1: Soybean Prices in USD/mt

One significant driver of this decline is the increased likelihood of Donald Trump winning the upcoming election, bolstered by recent events, including an assassination attempt. This political shift has reignited fears of a potential resurgence in the U.S.-China trade war, reminiscent of the economic conflict that began in 2018 under Trump’s administration. The previous trade war saw the U.S. impose tariffs on over $360 billion worth of Chinese goods, with China retaliating with tariffs on $110 billion worth of U.S. products. These measures significantly impacted global trade dynamics and disrupted supply chains.

The anticipation of a renewed trade war has led to concerns over decreased demand for U.S. soybeans. Historically, China’s demand for U.S. soybeans is a crucial factor in the global soybean market. A renewed trade war could see China reduce its imports from the U.S., as it did during the previous conflict, thus exerting downward pressure on prices. Despite current geopolitical tensions, recent figures still suggest strong demand from China – China’s soybean import estimate for 2023/24 was increased from 105 million metric tons to 108 million metric tons.

Additionally, current market conditions are compounding these geopolitical worries. Favourable weather conditions in the Midwest and slower bean exports are adding to the pressure on CBOT bean and bean oil prices. The USDA’s report that 68% of U.S. soybeans are in good to excellent condition, coupled with favourable weather forecasts, suggests robust crop yields, which could further weigh on prices.

Further compounding the price pressures, the USDA reported lower-than-expected U.S. soybean export inspection volumes at 168,593 tons, below the trade expectation range of 200,000 to 400,000 tons.

Conversely, the USDA lowered U.S. soybean ending stocks for 2024/25 from 455 million bushels to 435 million bushels, and for 2023/24 from 350 million bushels to 345 million bushels. Global soybean stocks for 2024/25 were also reduced from 128.5 million metric tons to 127.76 million metric tons.

For a future outlook on the soybean oil market, visit Vesper for free.