The prices for Palm Oil and Chicago Soybean Oil have seen an increase since the last week’s report, driven by a bullish MPOB report and higher LS Gas Oil (ICE, EU) prices:

- Crude Palm Oil (Feb 24) settlement price (BMD) rose to €762 | $823 / mt (2024-02-12) from €746 | $804 / mt on 2024-02-05.

- The Vesper West EU Forward Price Index for Crude Palm Oil (2024-02-12) increased to €899 | $970 / mt (CIF Rotterdam, Apr) from €881 | $950 / mt on 2024-02-05.

- The Vesper West EU Forward Price Index for Crude Palm Kernel Oil (2024-02-12) increased to €968 | $1045 / mt (CIF Rotterdam, Apr-May) from €956 | $1030 / mt on 2024-02-05.

- Soybean Oil (Mar 24) settlement price (CBOT) rose to €958 | $1034/ mt (2024-02-12) from €927 | $999 / mt on 2024-02-05.

The latest MPOB report indicates changes in MY palm oil production, exports, and ending stocks, with actual figures deviating from market expectations. The report shows a 9.59% decrease in production, a 0.85% decrease in exports, and an 11.94% decrease in ending stocks. The market had anticipated a 12.5% decline in production, an 8.3% reduction in exports, and an 8.7% decrease in ending stocks. The unexpected higher exports and lower stocks are expected to support prices.

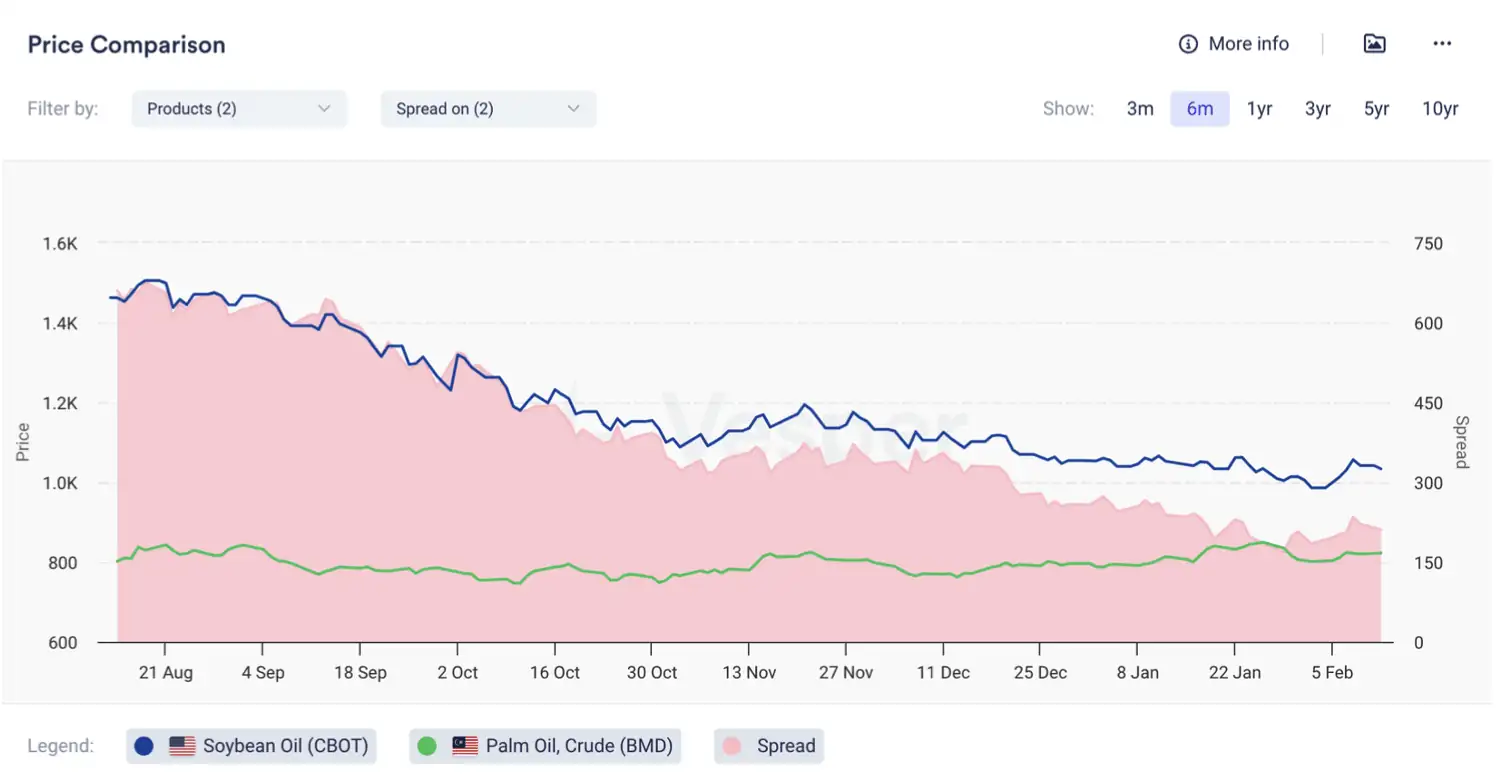

Additionally, higher LS Gas Oil prices have widened the POGO spread to -$90 and slightly increased the POBO spread by $10, see Figure 1 and 2. Palm oil is perceived as expensive in Europe and Asia, with negative refining margins reported in India and increased interest in rival oils. Despite the approaching Ramadhan, demand in Malaysia (MY) and Indonesia (ID) has not picked up, and palm oil in Europe remains more costly than its competitors.

Figure 1: POGO Spread by Vesper, in USD/mt

Figure 2: POBO Spread by Vesper, in USD/mt

While soybean oil prices increased, the Soybean (Mar 24) settlement price (CBOT) slightly declined to $438 / mt (2024-02-12) from $441 / mt in the previous week. Brazilian beans also decreased due to abundant supplies flowing to export terminals. A bearish USDA report on soybeans last week impacted bean prices, while the report was neutral for soybean oil. The USDA adjusted its Brazilian soy harvest forecast and raised its global supply projection to a record high. Forecasts for rain in Brazil and Argentina eased concerns about crop stress. China’s weakening demand for animal feed due to a shrinking pig herd also contributed to soybean market dynamics.

According to the USDA, end stocks for 2023/24 (mmt) are at 116.03 compared to trade estimates of 112.48 (109.00-115.00). Argentina’s 2023/24 Soybean production is estimated at 50.00, slightly below trade estimates of 50.84 (50.00-52.00), while Brazil’s 2023/24 Soybean production is projected at 156, above trade estimates of 153.15 (148.00-157.00). These forecasts differ from estimates by Brazilian crop agency Conab and Safras & Mercados. The USDA also reported lower-than-expected export sales of U.S. 2023/24 soybeans in the week ending Feb. 1.

Outlook

The market doesn’t seem to have any obvious bullish drivers on the horizon. Market attention remains focused on the ongoing tensions in the Middle East, although changes in the supply chain, such as increased shipping costs and delivery times, have been absorbed primarily by passing the costs to sellers, as buyers have the upper hand. An interesting read is the effect of the Red Sea attacks on palm oil prices and soybean oil prices, to read here.

Additionally, weather conditions in Argentina and Brazil are currently favourable, which is being closely monitored by the market. “For oilseeds values to change trajectory, there will need to be either a fundamental change in medium-term demand or renewed issues with crops somewhere around the world”, said AHDB.

Palm Oil: Among the supportive factors, we have a slightly bullish MPOB report and an anticipation of an increase in demand due to the Muslim Holy month of Ramadan in March. Among the bearish factors, we have the narrow discount of palm to rival oils (in Europe, it’s even traded at a premium), which is likely to limit any increase in the palm price. We are neutral-slightly bullish short term.

Soybean complex: Last week’s USDA report was seen as quite bearish for soybeans due to the strong supply numbers. This is combined with the slower China’s demand due to the slower hog sector. The only bullish hope is a weather deterioration in Brazil and Argentina with subsequent lower yields. However, so far, the weather looks okay. Thus, we are neutral-slightly bearish.

For more insights into the global Palm Oil and Soybean Oil Prices, download our latest Vesper Highlights for free.