India’s recent decision to raise import duties on edible oils by 20 percentage points is causing a stir in the global vegetable oil market. The new tax rates are 27.5% for crude edible oils, up from the previous 5.5%, and 35.75% for refined oils, up from 13.75%. This move aims to support domestic farmers who are facing low oilseed prices. By making imports more expensive, India is protecting its local producers, which is expected to significantly reduce demand. As a major consumer of vegetable oils, India’s decision is putting downward pressure on global vegetable oil prices.

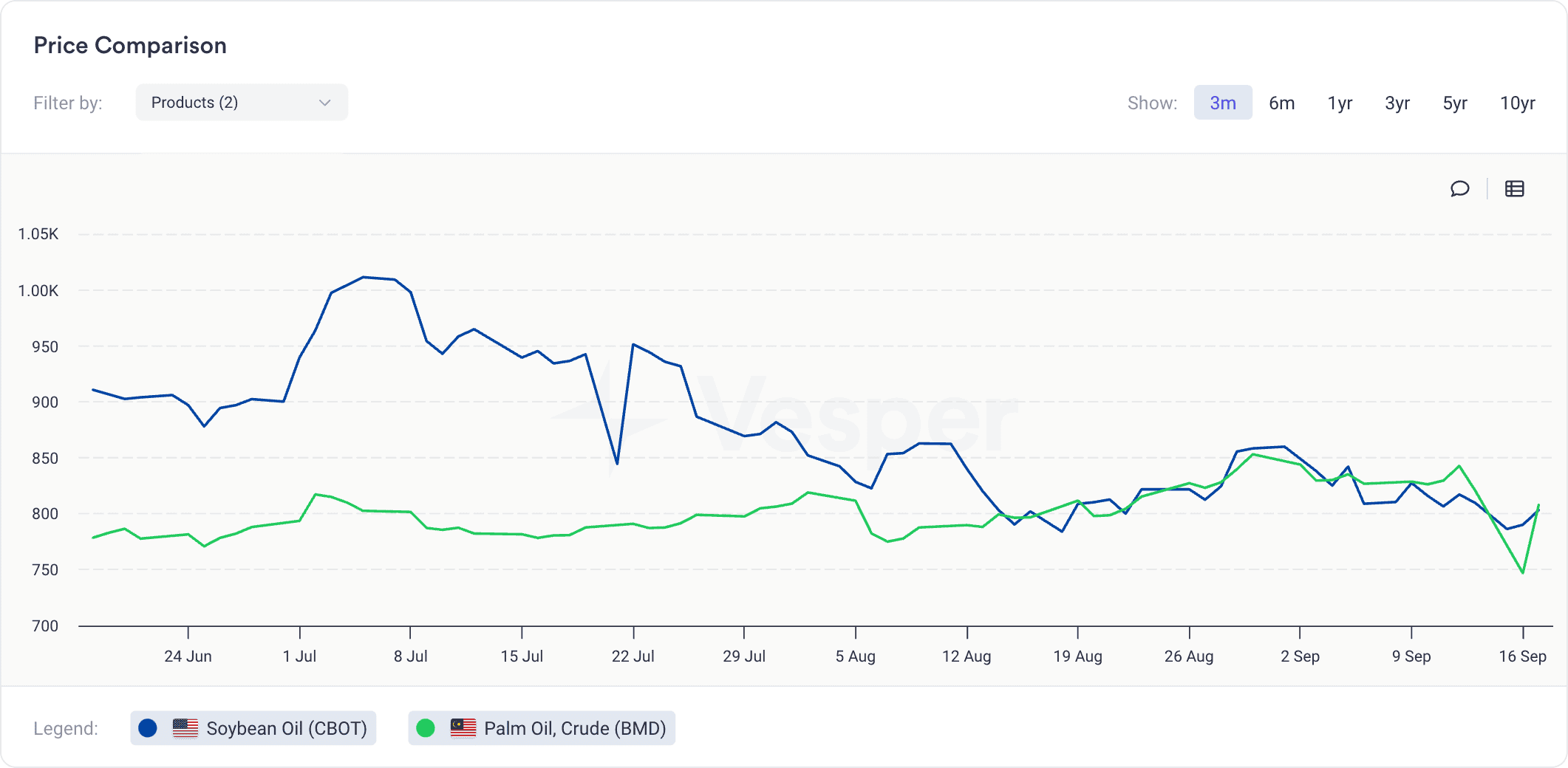

Since over half of India’s edible oil imports are palm oil, this tax hike is likely to negatively affect palm oil prices. The Bursa Malaysia Derivatives (BMD) exchange saw palm oil prices fall to MYR 3,801/mt on September 16, down from MYR 3,897/mt the previous week, see Vesper’s price comparison figure below.

Another factor contributing to lower palm oil prices is the slowdown in India’s imports over the month August. After a surge in purchases in July led to stockpiling, palm oil imports dropped by 26% in August compared to July, totaling 797,482 metric tons. Typically, palm oil is priced lower than soft oils, but for September shipments, it was sold at a $40 per ton premium over soybean oil, according to the Solvent Extractors’ Association (SEA).

The price of soybean oil (Oct 24 CBOT contract) also declined, dropping to €790 | $876/mt on September 16, from €817 | $905/mt on September 9. Besides India’s tariff hike, the rapid progress of the U.S. soybean harvest is also pressuring prices. As of Monday, the U.S. Department of Agriculture (USDA) reported that 6% of the soybean crop had been harvested, 3% higher than the five-year average. The USDA’s latest monthly report met market expectations, showing U.S. ending stocks for 2024/25 at 550 million bushels, down from 560 million, while 2023/24 stocks are now estimated at 340 million, slightly lower than the previous estimate of 345 million. Global ending stocks saw minor adjustments, with 2023/24 at 112.25 million bushels and 2024/25 at 134.58 million.

For a deeper analysis of how India’s import tax hikes are impacting other vegetable oils, download our latest market highlights for free.