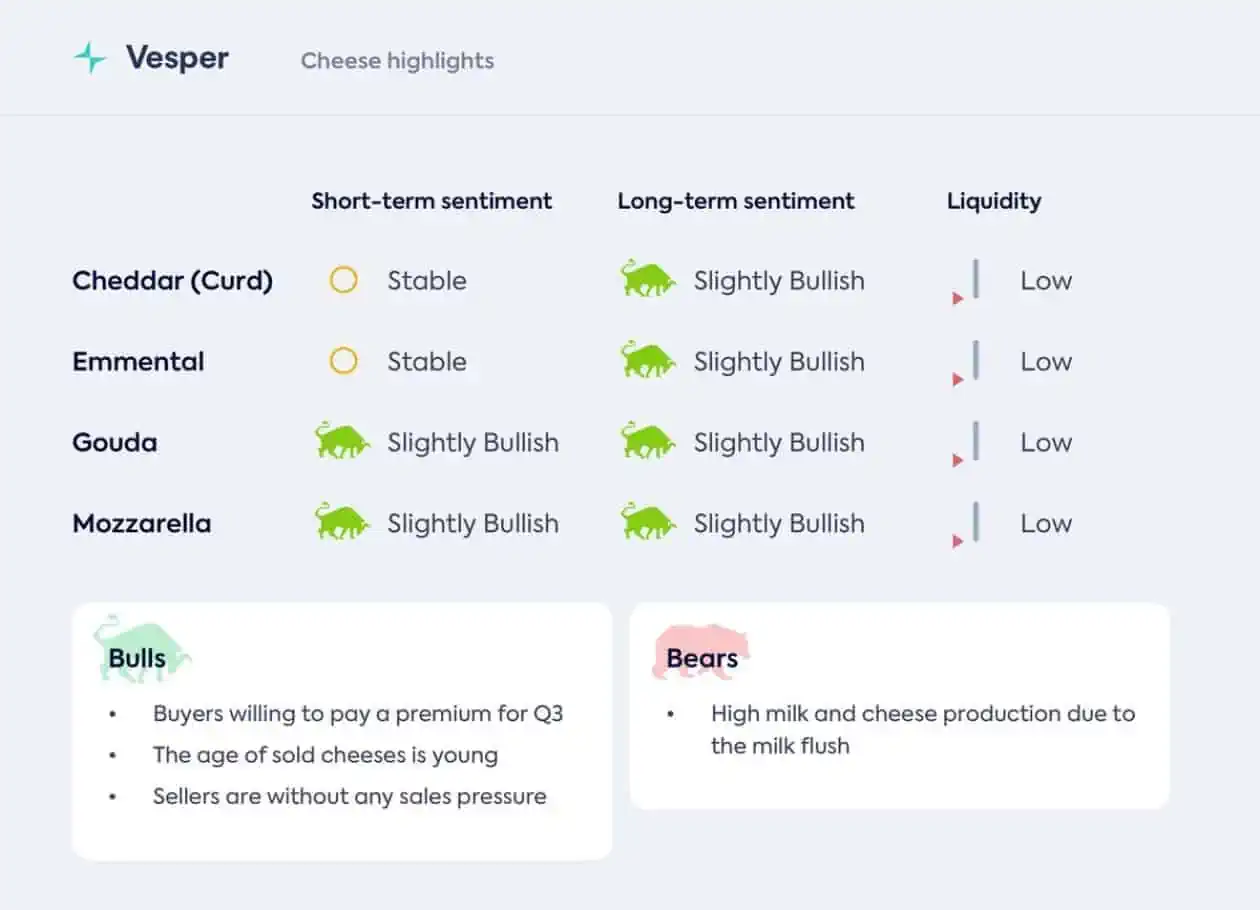

Within all regions, the supply and demand of cheeses were relatively well-balanced in the weeks before, which led to a stable sentiment and only very little price movement. Simultaneously, a lack of traded volumes kept the entire market subdued anyway, waiting for clear signals to follow for price indications.

Premiums for Q3 and on have provided expectations of upward price movement for several months already, which has scared off a lot of buyers before now. Since last week, more and more buyers have been stepping into the market for volumes for Q3, and although premiums had prevented buyers from entering the market earlier, they now seem to have very little choice but to pay. The premium has also caused Q3 coverage to be at a bare minimum, which only leaves open more demand to be met in the weeks to come.

Quick FYI: Use our commodity calculators without incurring any charges to quickly determine a cheese yield estimation based on your input.

Additionally, European tenders for Gouda and Mozzarella, where only a portion of the total demand was closed at prices 10% above the current VPI, have indicated a lack of sales pressure. Suppliers have started to pull back on offers for Q3 and are now aiming at even higher prices than they were doing before.

Start a free trial to access the full weekly Vesper Highlights on the global cheese market.