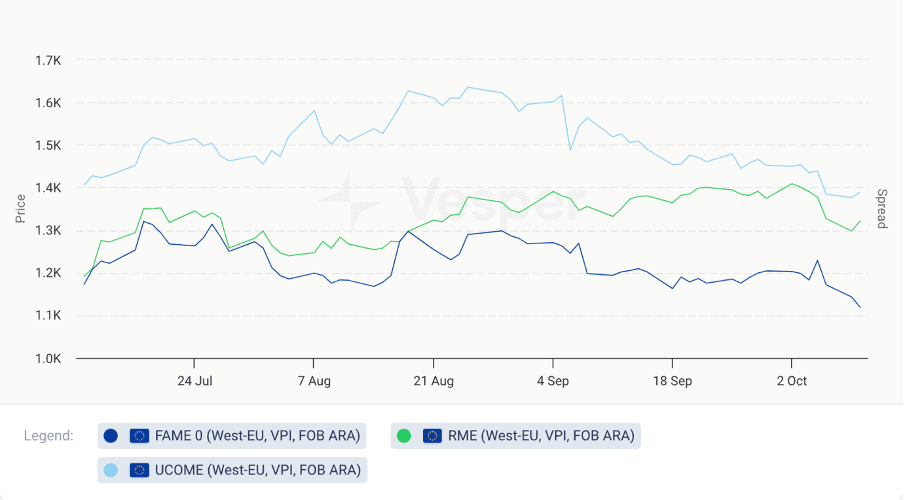

The European biodiesel market has experienced a substantial decline since our previous report, as depicted in Figure 1. Specifically, RME (FOB ARA) saw an 8% decrease, settling at $1317 per metric ton on October 10, 2023, compared to the previous week. UCOME (FOB ARA) also declined by 6%, reaching $1384 per metric ton on the same date. FAME 0 (FOB ARA) registered an 8.7% weakening in its price on the same date, underscoring the downward trend.

Figure 1: Vesper Spot Outright Biodiesel Prices (USD/mt)

Processing margins for RME and UCOME thinned sharply as outright biodiesel prices decreased quicker than feedstock prices. The key reason for the outright price decrease is a sufficient drop in LSGO prices last week, coupled with low diesel demand.

A representative from a major oil company commented, “here is less demand for diesel in the Western E.U. Germany is in recession. Maybe the demand will recover in Q.” Another industry source pointed out “The main production volume in Germany is going into exports. In Germany, we don’t see much biodiesel/diesel trade physically – if you are talking to local producers, they are not happy with the current situation and outlook.”

In addition to a price decline in the palm oil sector, the CBOT price for soybean oil, as of October 10, 2023, fell to $1190 per metric ton from $1311 per metric ton during the same period the previous week, influenced by lower Brent prices and favorable weather conditions that permitting quicker U.S. soybean harvesting. Meanwhile, MATIF also experienced a drop, decreasing to $444 per metric ton on the same date from $468 per metric ton a week earlier, mirroring developments in the CBOT and BMD.

Furthermore, there has been some pressure on rapeseed prices stemming from discounted sales in Eastern Europe and good stockpiles at crushers’ facilities in Western Europe. The Vesper West E.U. Forward Price Index for crude rapeseed oil, dated October 10, 2023, slid to $967 per metric ton (FOB DutchMill, FMA contract) from $994 per metric ton during the corresponding week, due to moderate demand and competition from lower-priced rival oils. Sunflower oil (across six ports) saw a went up in price but eventually returned to the levels of the previous week, influenced by the accelerated harvesting activities in Ukraine.

For more detailed information, please refer to yesterday’s Oils and Fats highlights.

LSGO futures (Settle December 23) experienced a decrease to $852 per metric ton on October 10, 2023, down from $889 per metric ton during the previous week, as illustrated in Chart 2.

Figure 2: ICE LSGO – Settle Dec 23 (USD/mt)

This decline is attributed to Russia partially lifting its fuel export ban and concerns regarding reduced demand due to the following prevailing macroeconomic headwinds. Russia recently allowed diesel exports through pipeline-supplied ports, but the government still mandates that at least 50% of diesel must be sold domestically. Persistent concerns about the impact of high-interest rates on global economic growth and fuel demand, despite commitments from Saudi Arabia and Russia to cut supply. The oil market has witnessed increased volatility as participants grapple with the possibility of supply disruptions arising from turmoil in the Middle East.

In a separate development, Palestinian Hamas militants from Gaza launched an incursion into Israeli towns on a Saturday, resulting in casualties and abductions. In response, Israeli forces initiated a retaliatory campaign, including a complete blockade of the area. The United States also threatened to impose stricter sanctions against Iran, which supports Hamas.

Despite these factors, biodiesel prices remained below last week’s levels. Supply worries helped LSGO, and as a result, biodiesel prices this week a bit, but last week’s losses haven’t been recovered.

Start a free trial and discover more data on biodiesels.