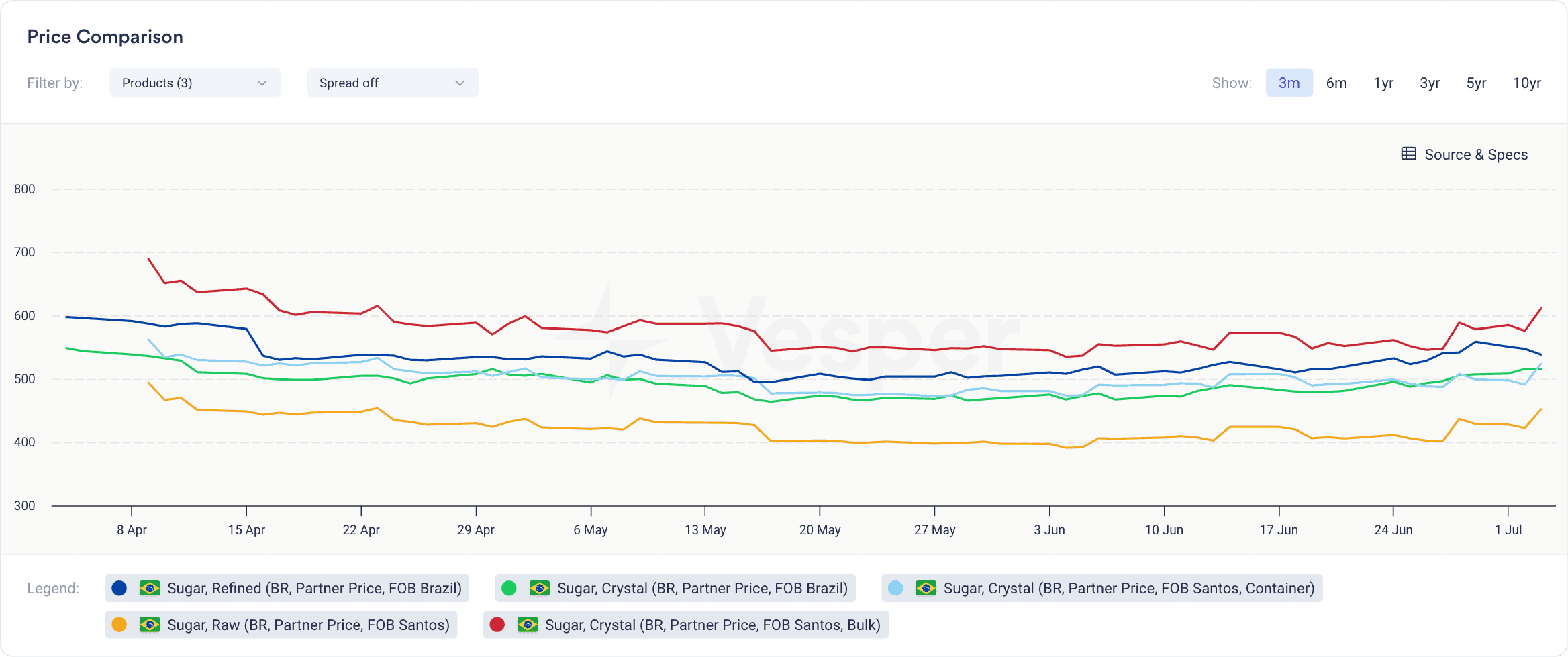

The sugar market is experiencing a price increase due to concerns that CS Brazil’s 24/25 sugar output could fall short because of early drought symptoms. On 02/07/2024, Crystal Sugar (BR, Partner Price, FOB Brazil) rose to 554 USD/mt, Refined Sugar (BR, Partner Price, FOB Brazil) increased to 588 USD/mt, and Raw Sugar (BR, Partner Price, FOB Santos) went up to 453 USD/mt ($20.56/lb), as shown in Figure 1.

Figure 1: Price comparison between crystal, refined, and raw sugar for Brazil, according to our partner prices in EUR/mt

The latest UNICA report highlights struggling Total Recoverable Sugar (TRS) levels and the need to harvest younger canes, raising quality concerns despite a higher level of cane crushing compared to last year. For the first half of June, UNICA reported a cane crush of 48.99 MMT, up 20.48% year-on-year (YoY), with a TRS rate of 134.5 kg/tonne of cane (TC), down 0.6% YoY, and a sugar mix of 49.7%, an increase of 0.85 percentage points (pp) YoY. Sugar production was 3.12 MMT, up 21.9% YoY, while ethanol production reached 2.24 million cubic metres (Mcbm), up 18.1% YoY.

In addition to the issues in Brazil, India’s agricultural agency has reported the spread of red rot fungus in Uttar Pradesh, a key sugar-growing region. Below-normal monsoon rains in some parts of India have also raised concerns about reduced sugar output. The Indian Meteorological Department has noted a significant rainfall deficit, affecting production.

Despite these challenges, India’s outlook for 24/25 appears stable, with production projected at 31.7 MMT, driven by a shift towards a 20% ethanol blend in gasoline. Favorable La Niña conditions and normal monsoon rains are expected to support sugarcane growth. Meanwhile, domestic consumption remains steady at 29-30 MMT, and India is not expected to relax sugar export restrictions until at least October, with the decision depending on the progress of sugarcane planting for the upcoming season.

Consult Vesper, for more insights into the global sugar market.