Mead Johnson China Business Group is an original American company at the forefront of infant formula production both mainland China as well as Hong Kong & Taiwan, renowned for its flagship products, Enfinitas & Enfamil. Today, we are talking with Robert Hazenberg, Procurement Director Direct Materials, at their Nijmegen office in the Netherlands. Robert has an impressive tenure that spans over two decades. During this time, he took also a five-year assignment and lived in Singapore from 2012 to 2017. In that role, Robert was responsible for sourcing a wide range of dairy products, such as Whole Milk, skimmed milk, WPC’s and lactose. He enthusiastically shares, “Vesper empowers me to effortlessly evaluate global price indexes, ensuring that we secure the most advantageous terms in our supplier contracts, mitigating potential risks for the next two to three years.”

Unveiling the sequence of success

Robert continues that he monitors Vesper on a weekly basis to stay updated on market developments. This is crucial for conducting regular financial reviews, minimizing risks, and adhering to their budget. He explains that at the beginning of each year, there is often a disparity between the European and Oceania market prices regarding whole milk. Observing the prevailing price levels, Robert notices that Europe’s prices tend to drop similarly to those in Oceania. “We can use this data to predict what type of ingredients we should use at which location, considering our substantial usage of whole milk in Europe”. To achieve their key performance indicators (KPIs), Robert and his team rely on a sequence of five features on the Vesper platform:

- Outlook Page

The Outlook page includes price, production and stock forecasts that can forecast up to 3 months in advance. Together with the market drivers overview, which provides insights into whether the market is exhibiting a bullish or bearish trend and the underlying reasons behind it, it’s te first Vesper feature Robert looks at. “It’s the most interesting thing to watch for a quick scan of the market, and it impacts my behaviour to do more research”, Robert begins, “I’m eager on getting a better grasp of direct and indirect price drivers and getting a deeper understanding of potential risks in Q3 and Q4. This information helps me assess whether it’s necessary to propose internal hedging options.” - Price Indexes

The second step that Robert takes involves comparing various price indexes. He emphasizes the importance of this comparison, as their contracts directly reference these indexes. Since Mead Johnson does not engage in extensive negotiations with suppliers, it becomes crucial for them to strategically determine the index to include in their contracts for the upcoming 2 to 3 years. “When creating contracts, we assess whether to opt for the GDT index, the EEX, or refer to indexes such as AON or Sweet Whey Europe when it comes to lactose. Robert’s team conducts comparisons of different commodities across various indexes. “This analysis sometimes provides valuable insights, leading to supplier switches as well as transitions to like-to like products. For instance, in Europe, the decision to change suppliers was driven by negotiations based on a US index, as we believed it would provide greater stability and risk mitigation.” - Milk Production

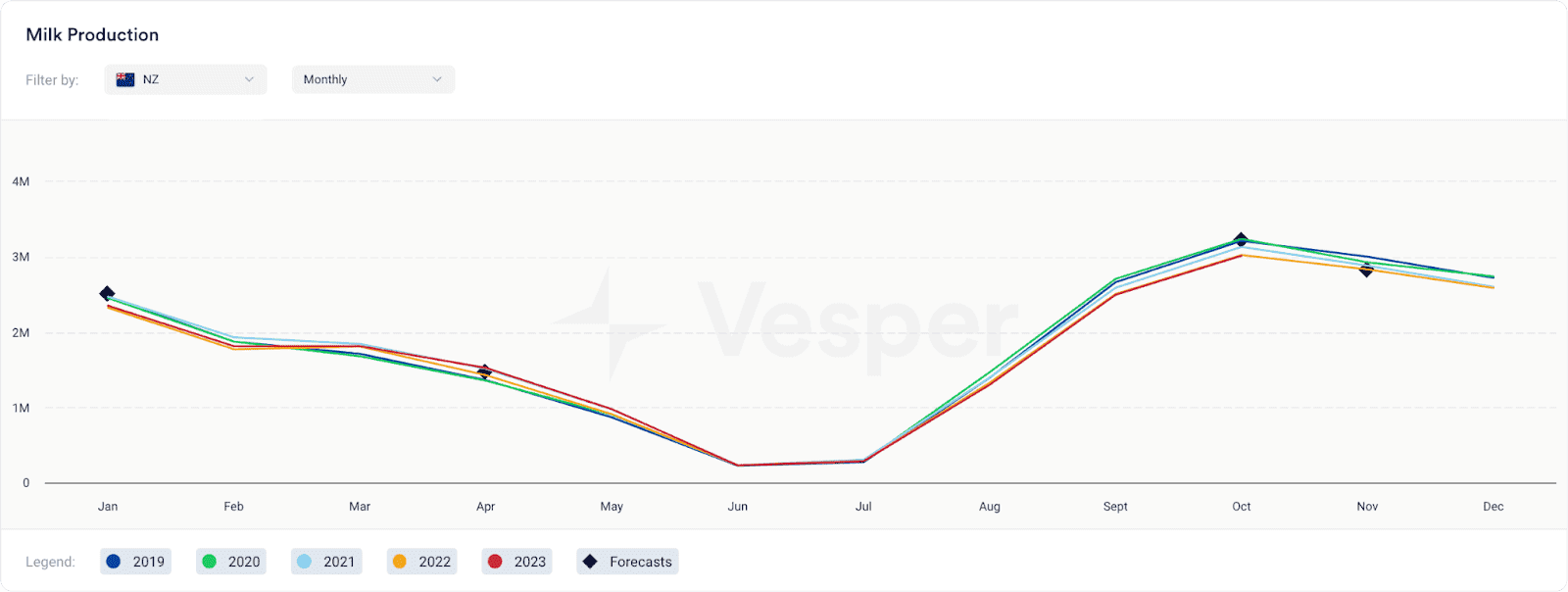

Vesper’s carefully calculated milk production figures provide Procurement Managers with a significant advantage. These figures allow you to identify the duration of the flush period and assess any potential impact on milk prices. For instance, as demonstrated in the figure below, the monthly milk production volumes for New Zealand indicate that we are approaching a low season, meaning less milk coming in and more pressure on prices. According to Robert “90% of the market fundamentals are covered by the production output of milk, and China’s ending stocks”.

Figure 1: New Zealand Monthly Milk Production in MT

4. Ending Stocks

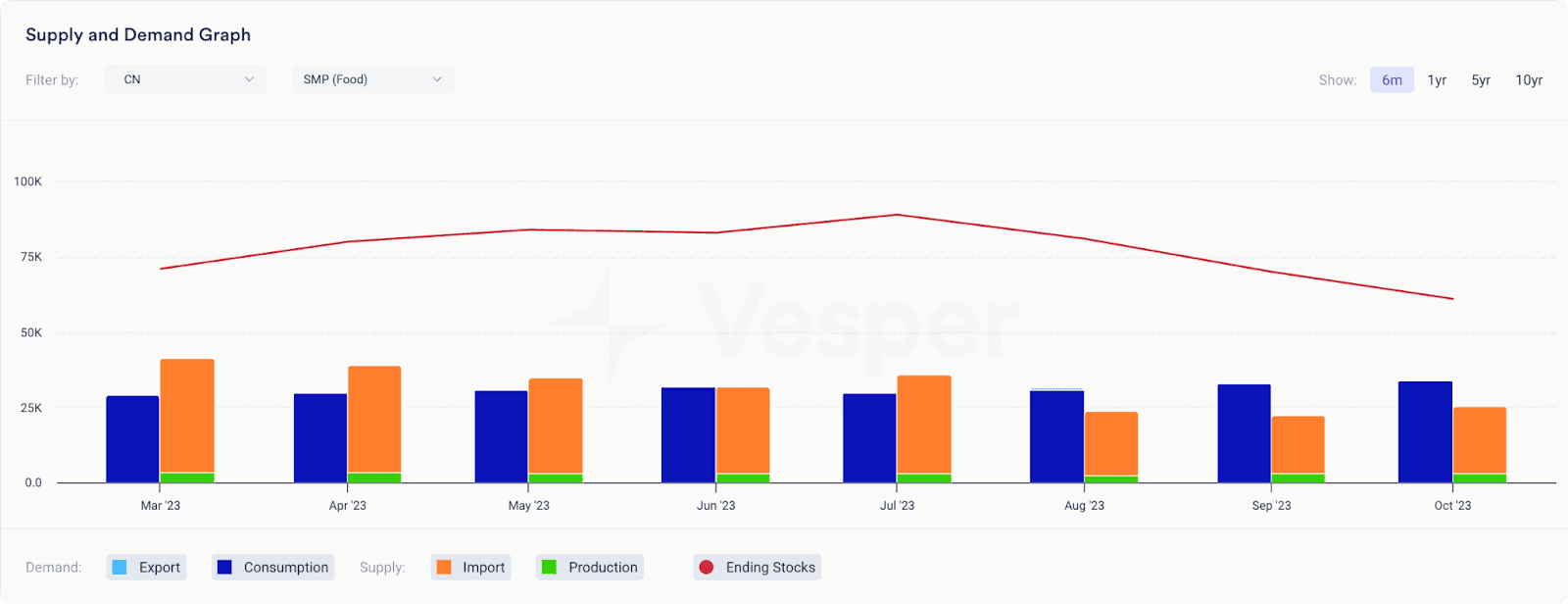

According to Robert, analysing the ending stocks of Skimmed Milk Powder (SMP) and Whole Milk Powder (WMP) for China is a crucial factor in determining market sentiment, whether it leans towards bearish or bullish. “Given China’s substantial market size, this impact can be immensely influential.” Vesper’s Supply and Demand graph provides valuable information, including ending stocks. As shown below, you can observe how China responded to low prices of SMP by increasing its imports, leading to stock levels exceeding 60,000MT.

Figure 2: Chinese SMP (Food) Supply and Demand in MT

5. Vesper Highlights

The final step that Robert takes involves accessing Vesper’s market analysis page, which presents the most up-to-date information on local and global market trends. These insights are curated by our in-house market analysts. “Due to time constraints, we don’t have the luxury to read lengthy novels, so Vesper’s Highlights feature is highly valuable.” It offers a concise overview of the market, enabling them to make informed decisions efficiently, both in the short-term and long-term. As Robert puts it: “Vesper helps us make decisions quicker, as it’s easier to substantiate our decisions with our R&D or Finance department”.

An unbiased opinion

In addition to relying on Vesper’s data, Mead Johnson conducts their own research and seeks guidance from their broker to assist with hedging execution. As Vesper doesn’t buy or sell, Robert feels that Vesper’s data is a good independent representation of the market. “I’m not saying all consultants are biased, but they have the tendency to write reports from a sales-oriented perspective and often talk about ‘bad’ milk prices when for us, the milk prices look favourable.” Vesper’s independent data plays a significant role, contributing to one-third of Mead Johnson’s decision-making process. Robert emphasizes its importance, stating that it is crucial for their department to maintain a realistic approach. “We are evaluated based on the discrepancy between our budgeted price and the actual price. We can’t afford making decisions solely based on human advice or gut feelings.”

Discover the power of Vesper’s commodity intelligence by starting a 14-day free trial, and start optimising your procurement strategies. No strings attached.