Ocean freight rates from Asia to Europe increased in recent weeks, with carriers managing capacity tightly as 2026 contract negotiations begin.

Spot rates from Shanghai to Rotterdam rose 3% while Shanghai to Genoa climbed 4%, according to recent market data. Carriers are implementing capacity controls through blank sailings and strategic route management.

Contract negotiations underway

The rate increases are occurring as carriers and shippers begin discussions for 2026 annual contracts. Industry analysts note that carriers are managing capacity strategically to strengthen their negotiating position, though weak underlying demand may limit how long elevated rates can be sustained.

If planned rate increases hold, Asia-Europe spot rates could rise further within weeks. European importers of dairy ingredients, vegetable oils, sugar, and other agricultural commodities should prepare for potential upward pressure on short-term pricing and possible effects on contract negotiations for 2025.

Transpacific rates decline

Asia-US routes show a different pattern. Shanghai to Los Angeles rates dropped 12% while Shanghai to New York fell 15%, indicating soft underlying demand in the US market.

After carriers implemented General Rate Increases on November 1st for Asia-US trades, gains were quickly offset by discounts, demonstrating competitive pressure on these routes.

Red Sea route remains cautious

The Red Sea shipping situation continues to create uncertainty for Asia-Europe supply chains. MSC recently sent an Ultra Large Container Vessel through the Suez Canal for the first time since the crisis began, signaling some carriers are cautiously testing the route.

The Middle East has become more stable, and some carriers have reopened services from the Middle East to the Mediterranean. However, for Asia-Europe routes, risk remains higher. Many vessels originally scheduled for the Red Sea continue to divert last-minute via the Cape of Good Hope. Bookings through the Red Sea remain limited, and any transit still carries operational risk.

Industry sources indicate a large-scale return to Suez is unlikely in the near future. Most carriers indicate they need stability before rerouting, with a gradual return expected no earlier than after Chinese New Year. Booking possibilities for Red Sea transits will stay limited, and shippers should prepare for schedule changes and continued reliance on the Cape route.

Congestion risks from route transition

If carriers switch back to Suez quickly, ships currently spread along the Cape route could arrive in Europe at the same time as vessels already scheduled via Suez. This overlap could create major port congestion, similar to 2021 with the Ever Given incident.

Up to 1,000 port calls may be affected in the first month, causing delays, empty container shortages, and temporary spikes in spot freight rates. Ultra Large Container Vessels can carry over 10,000 containers, meaning even a few overlapping arrivals can overwhelm terminals. Carriers will need to coordinate closely to avoid several vessels hitting the same ports at once.

Once the shift happens, there may be a brief increase in spot rates and longer transit times due to congestion. After this period, capacity will likely increase again, pushing rates down. Carriers are expected to respond with strategies like slow steaming, blank sailings, and vessel lay-ups.

European road freight rates edge higher

European road transport rates have also risen slightly compared to the third quarter of 2024. Contract rates increased 1.4% year-on-year, while spot rates went up 2.4%.

This is partly driven by seasonal holiday demand, but also by a gradually improving economic outlook. Analysts note early signs of recovery: manufacturing is stabilizing and consumer demand remains solid. However, the recovery is uneven across Europe. Germany continues to face headwinds, while Spain is showing stronger momentum. Overall, the outlook is cautiously positive, but full market stability has not yet been reached.

Capacity adjustments continue

Container markets remain soft as carriers continue to trim East-West capacity. Between mid-November and mid-December, 7% of scheduled sailings (50 out of 717) have been withdrawn.

Most cancellations are concentrated on Asia-America routes (62%), followed by Asia-Europe/Mediterranean (24%), and Europe-America (14%).

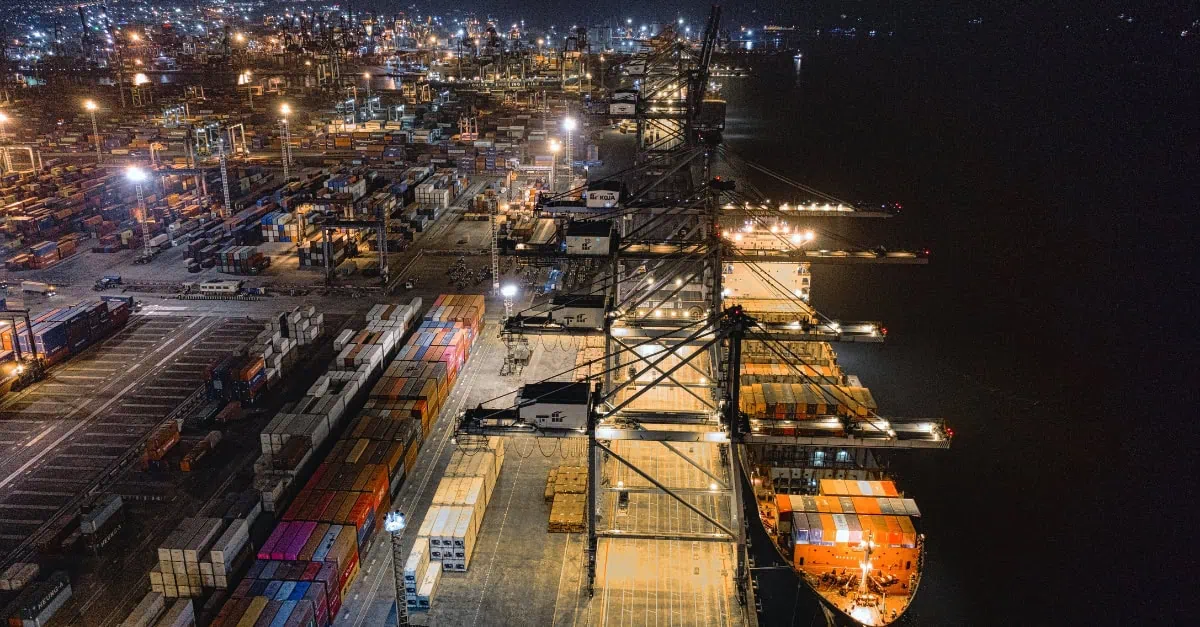

Port congestion persists at major European gateways, with Rotterdam experiencing average delays of around four days and Antwerp around two days.

Track real-time freight rate trends by route and mode on the platform: app.vespertool.com