The lactose market is seeing a notable rise in prices as supply tightens in key regions while demand remains strong, especially from Southeast Asia and China. According to the latest data from the EU and US Vesper Price Indices, prices for 100 mesh food-grade lactose have increased, reflecting growing pressure on global availability.

The European Vesper Price Index for 100 mesh lactose climbed to €800 per metric ton ($877/mt or $0.4/lb) EXW as of October 9, 2024. This increase is being driven by a significant tightening of supply, with several European producers reporting that they are sold out for the fourth quarter of the year. The limited availability of lactose is expected to keep pushing prices upward as 2024 progresses.

In the US, the Vesper Price Index has also risen, reaching €753 per metric ton ($826/mt or $0.38/lb) EXW. Although US production has increased steadily, with August output up by 3.55% year-over-year, much of this growth has been in lower mesh lactose rather than the higher-quality 100 or 200 mesh varieties. As a result, lower availability of finer mesh lactose is causing upward pressure on prices in the US market as well.

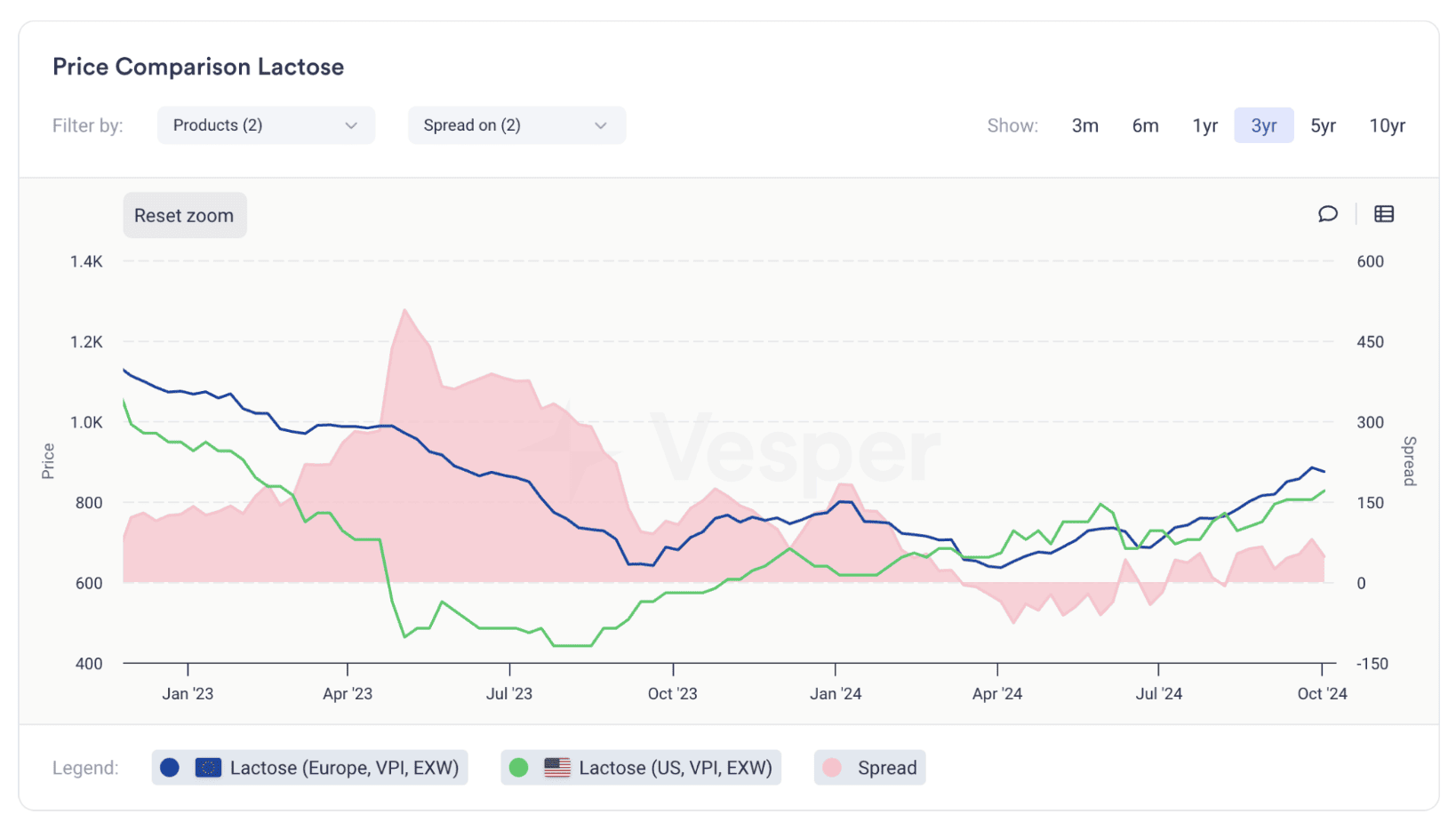

The price gap between European and US lactose has remained relatively narrow in 2024, with European lactose being cheaper at certain points in the year, see Figure below.

This price dynamic has led to a 1.04% increase in European lactose exports from January to August compared to last year. Meanwhile, US exports have decreased by 9.42% over the same period, with more of the product being used domestically.

Outlook

As demand remains strong and availability continues to tighten, lactose prices are likely to keep rising toward the end of 2024. The availability of milk may increase in some regions, but it is not expected to lead to a significant boost in the production of whey protein concentrate (WPC), and ultimately lactose.

For more prices and analyses on dairy derivatives, visit Vesper for free.