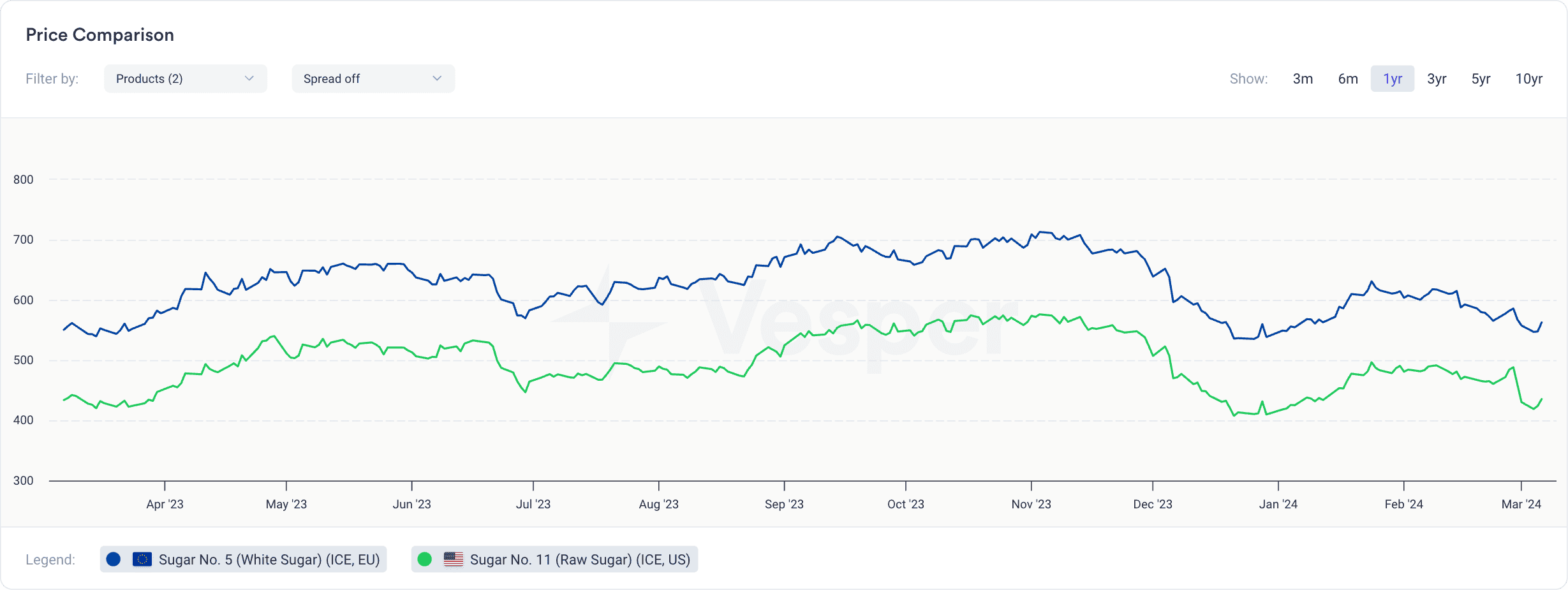

The expiration of the March/24 future contract last week led to a further decline in prices, triggered by a large physical delivery of 1.3 million metric tons (MMT) of Brazilian sugar, see Figure below. This volume, notably high for an off-season period due to increased stocks and port availability, marked a significant rise from the previous year’s delivery of 586,000 tons.

The Sugar No. 11 (Raw) price (05/03/2024) decreased to $20.9/lb (€424 | $460/mt)

The Sugar No. 5 (White) price (05/03/2024) decreased to $594 | €548/mt

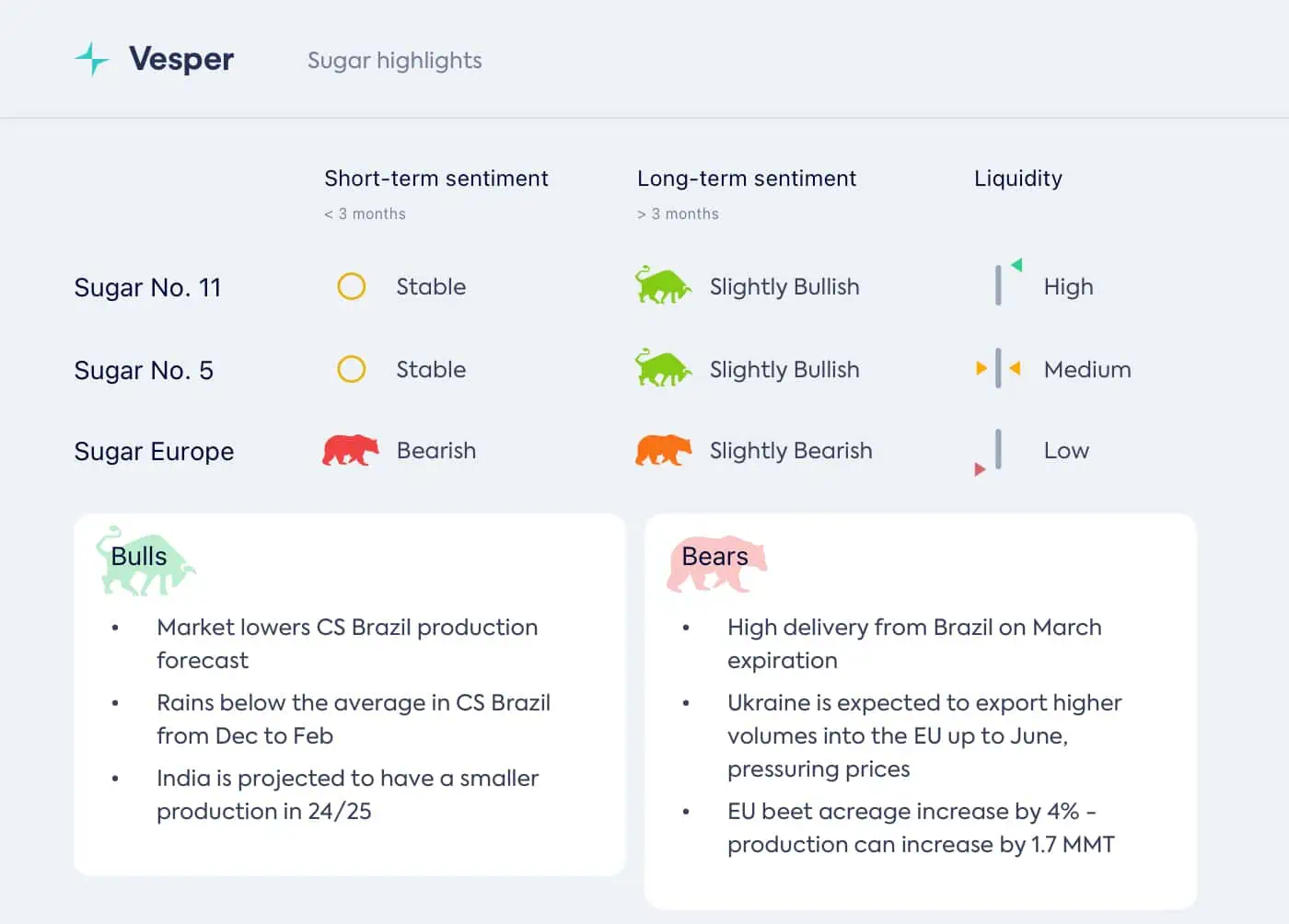

Amid this downward pressure, the market’s mid to long-term outlook is becoming increasingly bullish. Concerns are growing over the impact of below-average rainfall from December to February on cane availability and sugar production in Central-South (CS) Brazil. As a result, Projections are indicating a 9.6% decrease in sugarcane production in the region, dropping to 598 MMT.

Despite a drop in sugarcane production, there’s a strategic shift towards using a greater share of sugarcane for sugar over ethanol – Sugar mix is set to increase from 48.8% to 51.4%, which can result in a 4.4% decrease in sugar output to 40.8 MMT for the 24/25 season, pointing to a larger global deficit.

While it’s still early to make definitive predictions, as March and potential upcoming rains could positively influence these figures, the market is actively speculating on these developments.

Today is the last day of The Dubai Sugar Conference and Datagro event, which has brought up to light a more pessimistic outlook on CS Brazil’s sugar production. Companies are revising their views due to adverse weather conditions.

For more insights into the global sugar market, download our latest highlights for free.