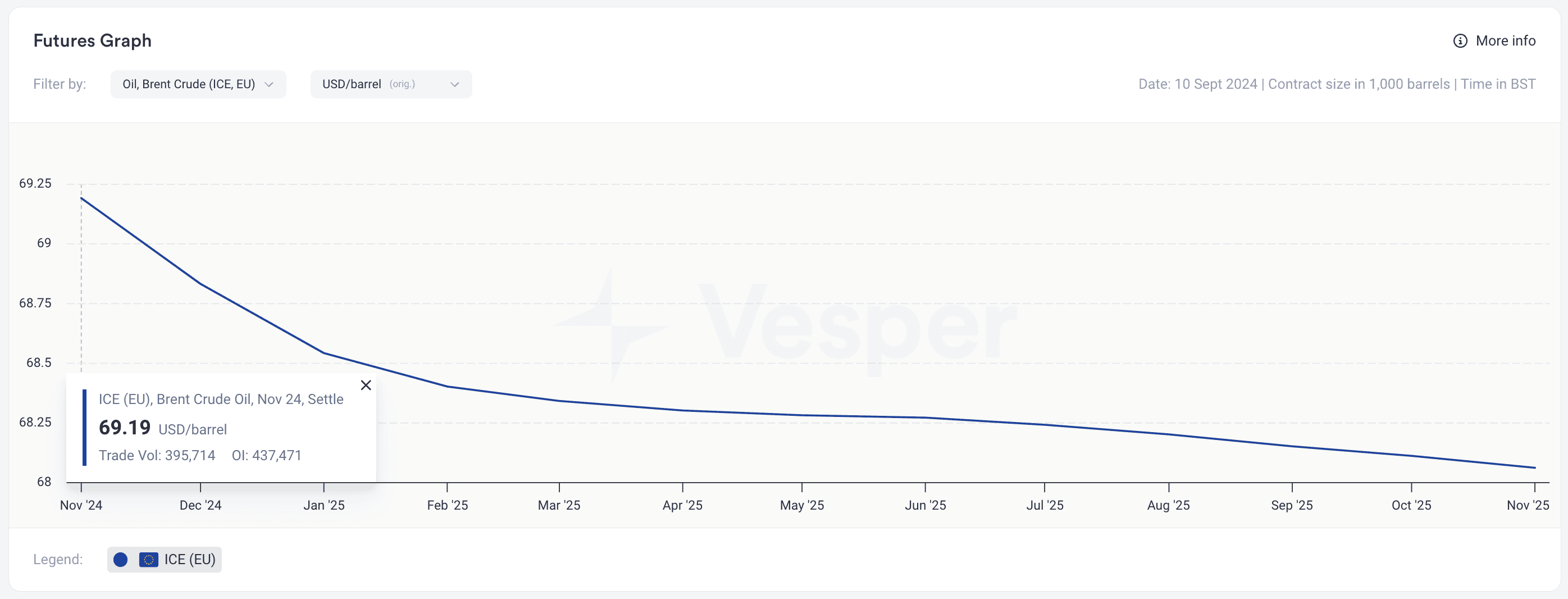

Vegetable oil benchmarks have declined following a drop in Brent crude oil prices, which hit a yearly low of $69.19 per barrel for November 2024, as shown in the figure below. This decline is driven by expectations that Libyan oil production may resume soon, with rival factions moving closer to resolving their dispute, which has disrupted exports. Additionally, concerns over demand from China and the U.S. are weighing on the market.

Figure 1: Brent Crude Oil Prices in USD/barrel

Palm Oil

Palm oil prices have fallen over the past week due to the sharp drop in Brent crude oil prices, sluggish Malaysian exports in September, and rising stock levels in August. According to the MPOB Malaysian Palm Oil Supply & Demand report, August 2024 compared to July 2024 (in metric tons):

- Production: 1,893,859 (+2.87%)

- Exports: 1,525,115 (-9.74%)

- Ending stocks: 1,883,214 (+7.34%)

Early estimates from Intertek Testing Services indicate that Malaysian palm oil exports from September 1-10 were down 15.7% compared to the same period in August.

Vesper’s West EU Forward Price Index for Crude Palm Oil (as of 2024-09-09) dropped to €948 | $1050/mt (CIF Rotterdam, November) from €970 | $1072/mt on 2024-09-02, see figure below.

Figure 2: Forward Vesper Price Index in USD/mt

Soybean Oil

In a unique market situation, CBOT soy oil prices are falling alongside the drop in Brent crude oil, while Argentine soybean oil prices remain firm due to strong demand. This is partly due to rising palm and sunflower oil prices in August. Additionally, soybean benchmarks are supported by robust demand from China, which could increase if China imposes restrictions on canola imports from Canada. Weather concerns in the U.S. are also providing price support.

In Brazil, the Senate has approved the “Fuels of the Future” bill, mandating a 15% biodiesel blend in diesel starting March 2025. In both Brazil and Argentina, biodiesel is primarily produced from soybean oil. Argentina may also increase its biodiesel production and consumption, according to sources.

Vesper’s VPI for Argentinian Benchmark (October 2024, FOB Up River) rose to $974/mt from $948/mt the previous week, resulting in a $23/mt premium over CBOT.

Rapeseed Oil

News of China launching an anti-dumping investigation into Canadian canola imports has caused concern in the market, as China is a key buyer. Traders fear that if Chinese imports are restricted, Canadian canola could flood other markets, including the EU. At the same time, the EU is already receiving significant volumes of Ukrainian rapeseed, with Ukraine exporting 500,000 metric tons to the EU in August.

This increase in supply has pressured rapeseed and canola prices, although rapeseed oil (RSO) remains strong. Vesper’s West EU Forward Price Index for Crude Rapeseed Oil (as of 2024-09-09) increased to €950/mt from €943/mt the previous week. However, we expect RSO prices to follow the downward trend in seeds, alongside declines in other vegetable oils.

Sunflower Oil

Prices at destination markets have softened due to bearish sentiment in the vegetable oil sector, while prices at origin remain firm. Vesper’s West EU Forward Price Index for Crude Sunflower Oil (as of 2024-09-09) decreased to €957 | $1060/mt (FOB 6 Ports, Oct-Nov-Dec) from €981 | $1085/mt on 2024-09-01.

Crushers are facing high sunflower seed prices from farmers, keeping prices elevated despite the weakening at destination markets. Current sunflower seed prices exceed the level that allows processors to maintain a margin, forcing crushers to reduce their purchase prices unless global prices for meal and oil rise. Many crushers also face inadequate coverage, but they anticipate a price correction as harvest progresses and more supply becomes available.

For prices on other vegetable oils like coconut and olive, visit Vesper’s platform for free.