As the global sugar market navigates through fluctuations in production and weather-related challenges, two key producing regions—India and Brazil—have released their latest production figures and forecasts, offering a glimpse into the dynamics that could shape the market in the coming months.

ISMA’s Projection for India: Slight Decline in 2024/25

The Indian Sugar & Bio-energy Manufacturers Association (ISMA) has provided a preliminary outlook for the 2024/25 sugar season, which reflects a slightly reduced production forecast. Gross sugar production is expected to reach 33.3 million metric tonnes (MMT), representing a 2% decrease from the previous season. This decline is primarily attributed to a projected 6% reduction in sugarcane acreage, which is forecasted to drop to 56.08 lakh hectares due to adverse weather conditions over the past year.

Despite this reduction, India is anticipated to start the 2024/25 season with a substantial opening stock of 9.05 MMT. It is expected that the total availability of sugar for the season will be around 42.35 MMT. This projection is based on the estimated domestic sugar consumption of 29 MMT and the ethanol diversion, which reached 2.0 MMT during the 2023/24 season. With the government’s Ethanol Blending Program, this diversion is anticipated to increase further in the 2024/25 season, although official numbers have not yet been released. The closing stock is projected to be approximately 13.35 MMT, which is more than sufficient to meet domestic needs and support the country’s Ethanol Blending Program, as well as potential exports in early 2025.

Brazil’s Disappointing Production: First Half of July 2024

In contrast to India’s relatively stable outlook, Brazil’s sugar production has faced significant setbacks in the first half of July 2024. According to the latest data from UNICA, the cane crush during this period reached 43.170 MMT, marking an 11.07% decline compared to the same period last year. This decrease is largely attributed to unfavourable weather conditions, particularly light rains that disrupted harvesting and milling activities in key regions like Paraná, Mato Grosso do Sul, and parts of São Paulo.

The Total Recoverable Sugar (TRS) rate saw a slight year-on-year increase of 1.85%, reaching 143.27 kg/tonne. However, the sugar mix fell marginally by 0.15 percentage points to 49.88%, leading to a 9.70% year-on-year decrease in sugar production, which totalled 2.939 MMT. Ethanol production also saw declines, with anhydrous ethanol down by 13.39% and hydrous ethanol by 1.02%.

This downturn in production has raised concerns about the overall sugar output from Center-South Brazil, a region that plays a crucial role in the global sugar market. The market is closely monitoring these developments, particularly as the prolonged drought and lower sucrose content in cane could further challenge production in the coming months.

Impact on Global Sugar Prices: What to Expect

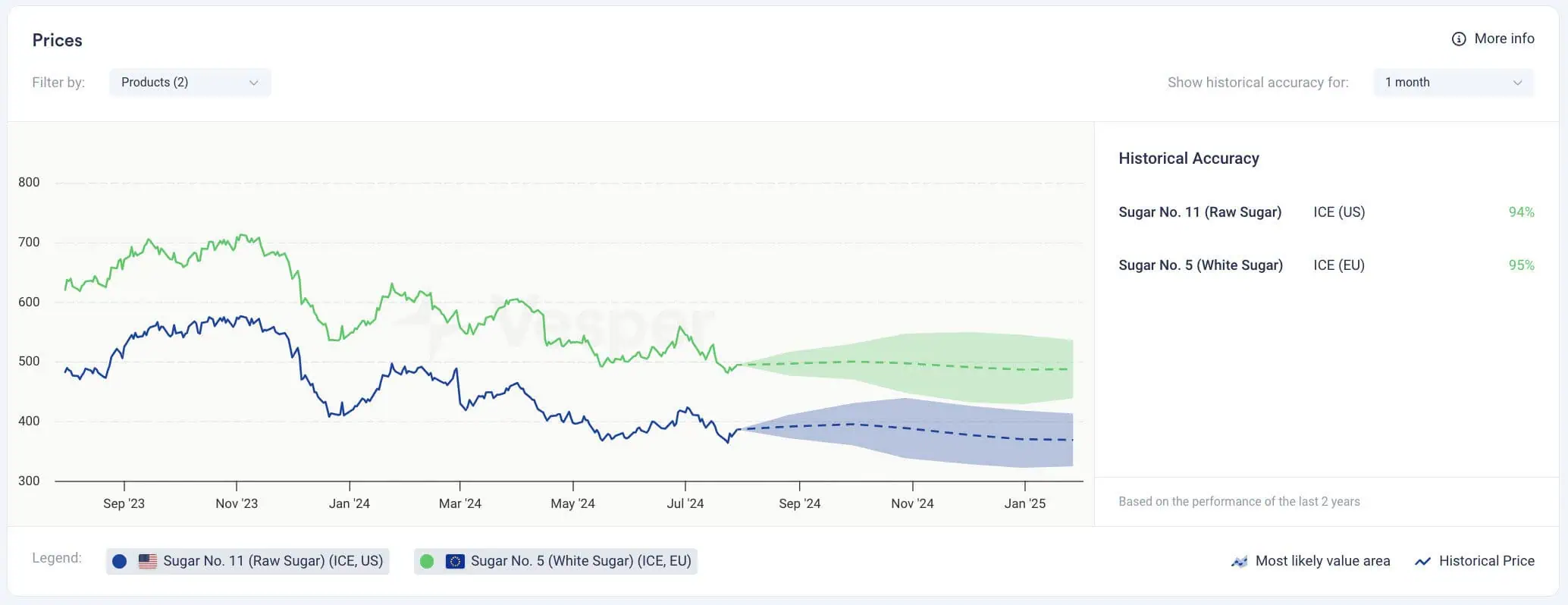

India’s slight reduction in sugar production, coupled with its robust opening stocks suggests a relatively stable domestic market. This stability is reflected in the price forecasts, which show a moderate and steady price trend for Sugar No. 5 (White Sugar), and Sugar No. 11 (Raw Sugar) as represented by the dotted green and blue line.

*Figure 1: 6 month price forecast for Sugar No. 11 (Raw Sugar) and Sugar No. 5 (White Sugar) in EUR/mt

On the other hand, Brazil’s significant production setbacks have introduced uncertainty into the global market. The decline in cane crushing and sugar production in Brazil, a key exporter, has led to concerns about supply constraints.

All in all, while prices may experience short-term declines, there is potential of increased volatility should Brazil’s production challenges persist.

* Vesper’s price forecasting model can handle over 4,000 time series and updates in real-time with each new data point, ensuring it stays current and adaptable to changing market conditions. By combining both technical and fundamental analysis, the model offers a more accurate and comprehensive market outlook, capturing both short-term trends and long-term economic factors.