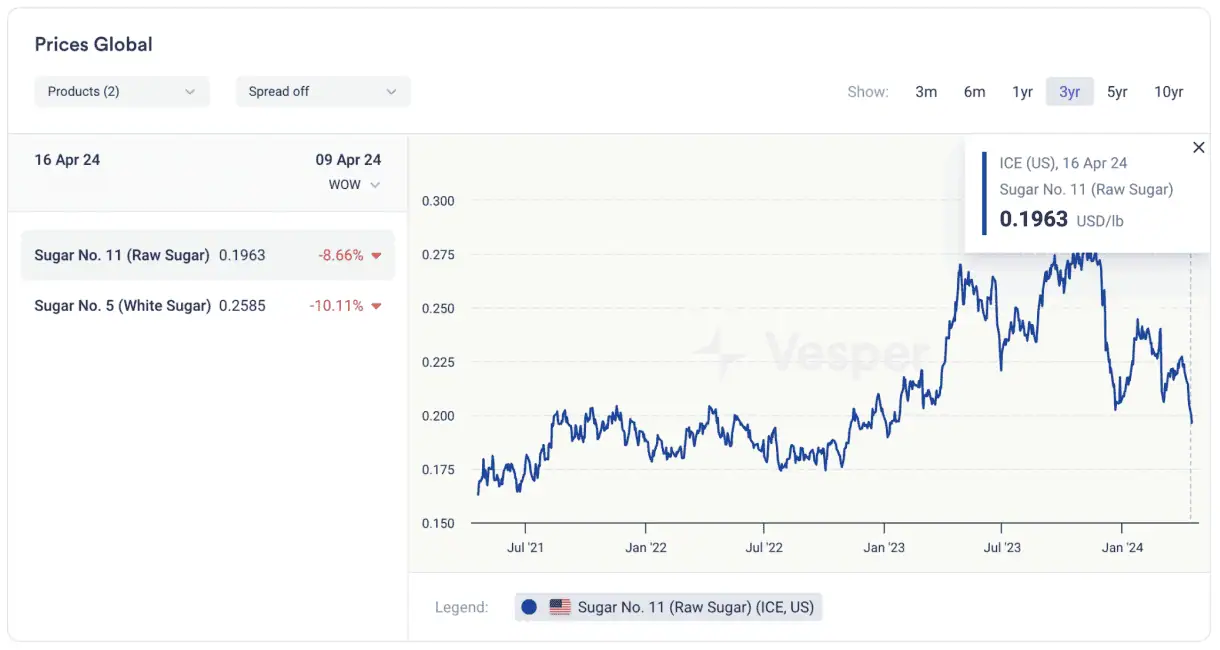

Global sugar prices fell sharply by the end of last week, returning to levels last seen in January 2023, as

concerns over supply diminished.

Figure 1: Sugar No.11 in USD cents/lb

Global Prices

- Sugar No. 11 (Raw) price as of 16/04/2024: decreased to $19.6 per lb, equivalent to $433 per metric tonne.

- Sugar No. 5 (White) price as of 09/04/2024: decreased to $570 per metric tonne.

Europe Prices

- East-EU Vesper Price Index as of 17/04/2024 for Campaign 23/24: decreased to €660 per metric tonne DAP ($701 per metric tonne DAP).

- West-EU Vesper Price Index as of 17/04/2024 for Campaign 23/24: decreased to €670 per metric tonne DAP ($711 per metric tonne DAP).

- South-EU Vesper Price Index as of 17/04/2024 for Campaign 23/24: remained stable at €665 per metric tonne DAP ($706 per metric tonne DAP).

Brazil Prices

- Crystal Sugar (FOB Brazil) as of 16/04/2024: decreased to $532 per metric tonne.

- Refined Sugar (FOB Brazil) as of 16/04/2024: decreased to $570 per metric tonne.

- Raw Sugar (FOB Santos) as of 16/04/2024: decreased to $471 per metric tonne, equivalent to $21.36 per lb.

India Prices

- Crystal Sugar (EXW Kolhapur) as of 16/04/2024: increased to $423 per metric tonne in the domestic market.

Several factors combined to influence this trend. The 23/24 Center-South crop in Brazil concluded with a record-breaking processing of 654.43 million tons of sugarcane. This was the first time records in milling, ethanol production (33.69 billion liters), and sugar manufacturing (42.42 million tons) were set simultaneously, marking a historic high in raw material supply.

Additionally, there is an optimistic outlook for the 24/25 season in Central-South Brazil, both in terms of production and favorable weather conditions.

Contributing to this decline was the weakening of the Brazilian Real, which led to a steep price drop over the week.

In India, the forecast for the upcoming monsoon season suggests above-average rainfall, which is expected to enhance crop conditions throughout the country. This improved agricultural outlook is likely to exert downward pressure on global sugar prices and increase the probability of India resuming sugar exports in the forthcoming 24/25 season, which begins in October.

Download our latest sugar highlights for free to get more insights into the future of the global sugar market.