Since early December, there has been a notable 25% collapse in sugar prices. This decline is partly a result of demand destruction that occurred last year, when refined sugar prices doubled from their pre-2022 levels, forcing countries to either buy at these high prices or use up their stocks. Additionally, the global market’s dependency on sugar from Center-South Brazil significantly increased, as sugar availability was limited by export capacity issues, further contributing to demand destruction.

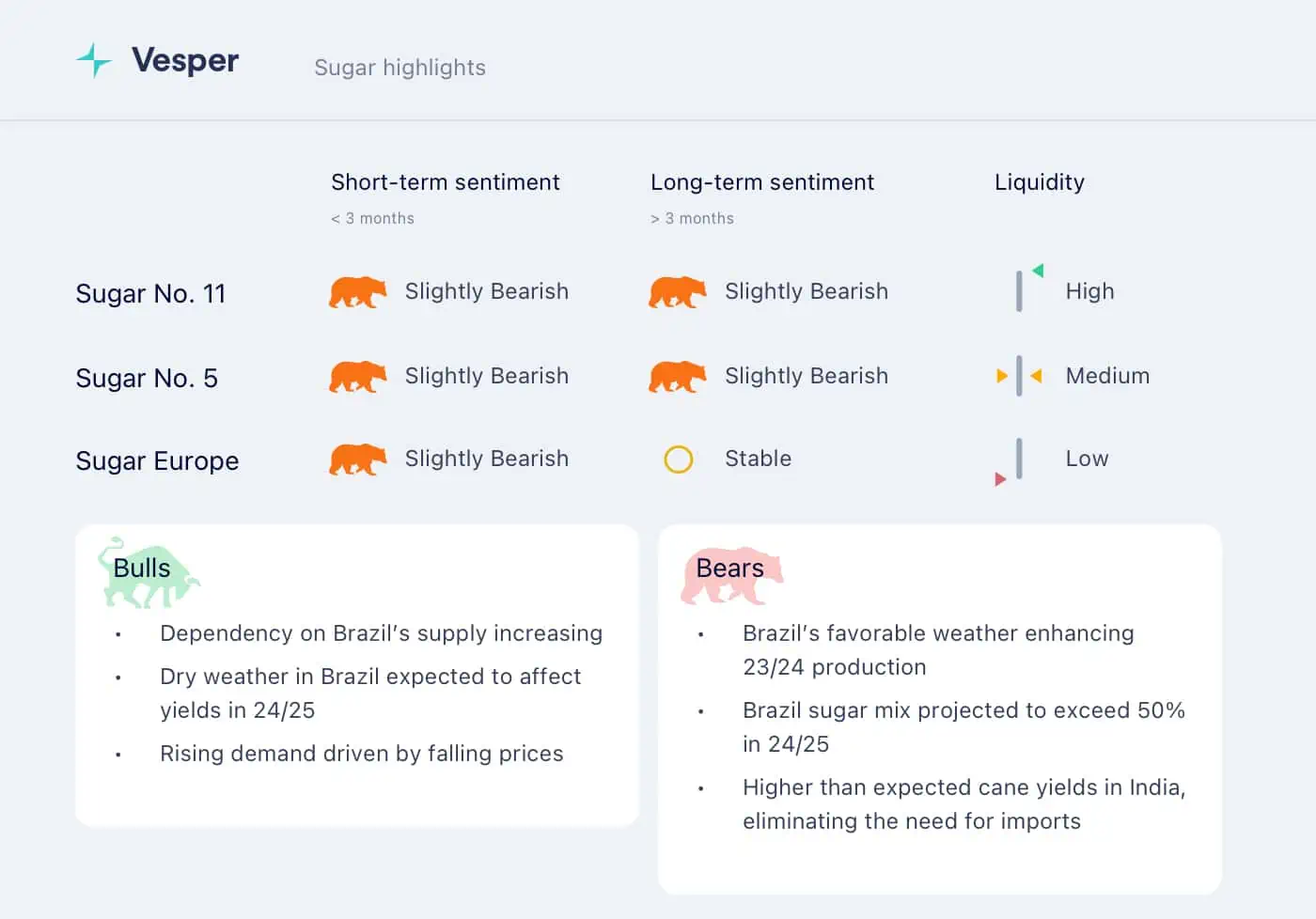

Looking into the sugar market trends 2024, the sugar market is influenced by both bearish and bullish factors. The reliance on Center-South Brazil for sugar supply is expected to continue, potentially leading to price rebounds. This dependency is projected to rise from 40-50% in Q1 to 60% and persistently increase throughout the year, especially as India is not expected to export and Thailand’s supply diminishes. Any supply disruptions from Brazil could therefore significantly impact global prices. On the other hand, improved cane yields in India and efficient logistics in Brazil could stabilize the market. However, the full impact of global sugar demand destruction is still unclear.

Global sugar stocks remain critically low, making the market stretched and vulnerable. Yet, with current sugar prices hovering closer to 20 USD cents per pound, a historically low level, an increase in demand is anticipated for now.

Start a 14-day free trial to access the latest global sugar prices and more sugar market trends 2024.