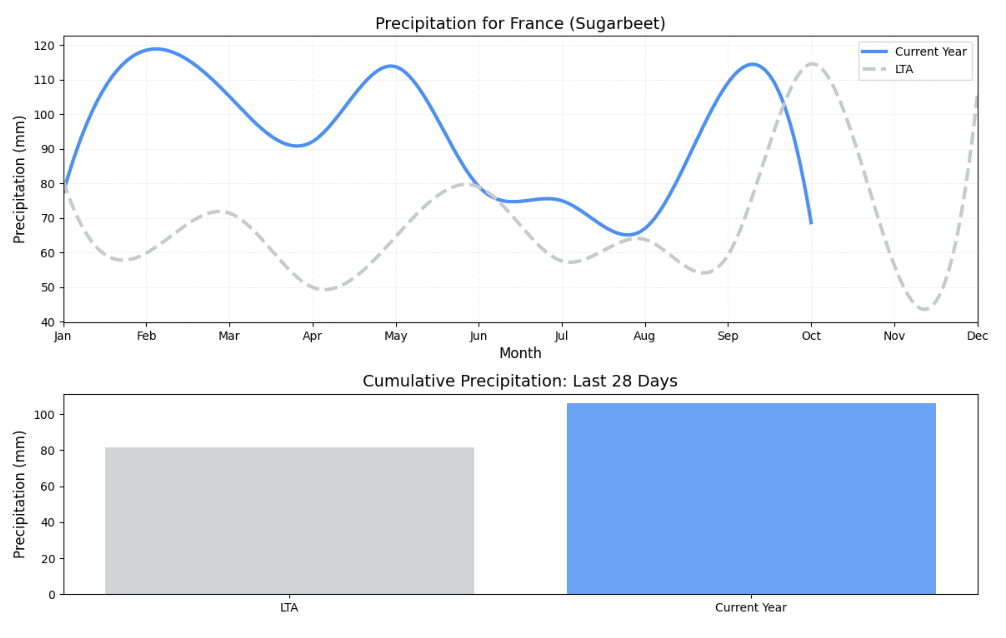

In Germany, prolonged wet conditions have led to a decline in sucrose levels, falling below the 5-year average despite higher crop yields. Heavy rainfall has diluted the sugar content, affecting the quality of the sugar beets. Similarly, in France, persistent rain and high humidity have reduced yields, with the spread of Cercospora disease further compromising sugar beet quality, see Figure below. These developments are critical to monitor over the coming weeks as it remains too early to determine if they will result in a significant production reduction.

The European sugar market, however, remains stable overall. In the East, there has been a slight decrease in prices, while prices in the South remain steady, and the West-EU region has seen a slight increase. The latest West-EU Vesper Price Index, as of October 23, 2024, has risen to €493/mt DAP for Campaign 24/25. The South-EU Vesper Price Index remains unchanged at €513/mt DAP, and the East-EU Vesper Price Index has dropped to €473/mt DAP for the same period.

Currently, there are no significant market movements or ongoing negotiations, and no major price shifts are expected in the coming months.

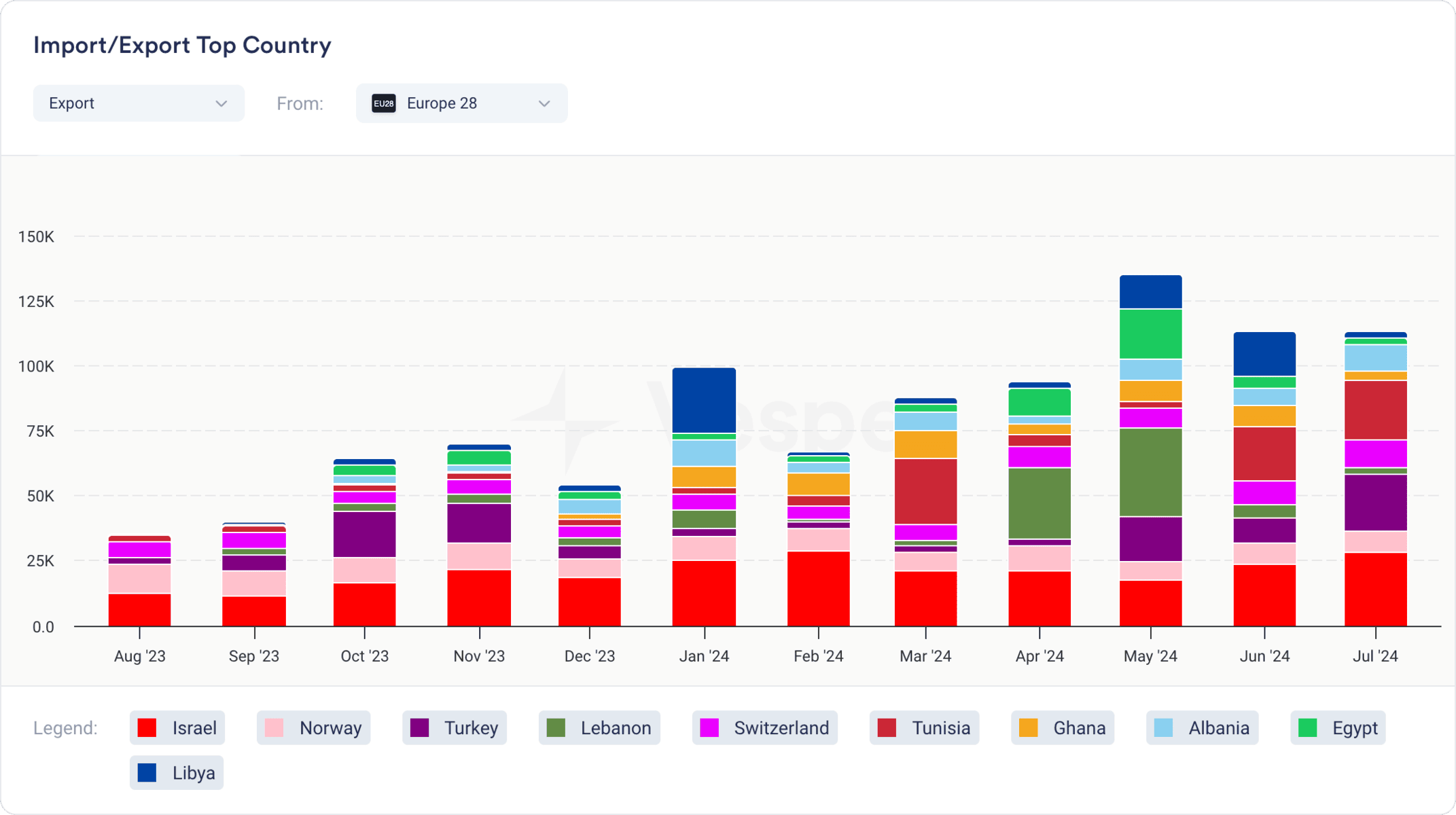

To manage oversupply, EU producers are focusing on exporting to key markets such as Turkey, Tunisia, Israel, and Lebanon, where they compete directly with Ukraine, see Figure below. A cautious approach to exports is essential, as overly aggressive actions could lead to price declines, potentially followed by a rebound later in the year.

For global sugar market insights, roam around Vesper for free.