The South American weather has been a significant factor influencing soybean prices in recent months. The El Niño weather pattern, characterised by warmer sea surface temperatures and resulting in extreme heat both in the ocean and on land, is believed to be the cause of the severe drought in LATAM.

Farmers are grappling with the consequences, being compelled to replant crops, sometimes multiple times, particularly in the case of soybean plants, which may have been replanted three or four times. Aveno BV notes, “Yields are disappointing in the drought-stricken areas as well as in the overflooded areas. But it is still very early and harvest goes on till April so a lot surprises may still pop up. In any case everyone accepts a much lower crop than anticipated and most think it is already priced in.”

In comparison to the previous Monday, the soybean oil complex has generally experienced a weakening trend in this week’s soybean oil market update. This week’s main factors contributing to market pressure include adverse Brazilian weather, a stronger US dollar, and subdued demand for US soybeans. Market sources say that the recent rainfall has provided assurance that South America won’t face significant supply limitations in the latter part of this marketing year. This will subsequently alleviate the demand for US-origin soybeans. According to the USDA, US soybean export sales for the week ending December 28, 2023/24, were reported at 201.6 Kt, falling below trade expectations ranging from 500 Kt to 1.3 Mt.

Additionally, Argentina, Paraguay, and Uruguay are expected to make up for the slight deficit in Brazil with year-on-year increases in their soybean crops, with Argentina increasing by 23 million tons, Paraguay by 950,000 tons, and Uruguay by 2.2 million tons. As reported by JJ Hinrichsen SA to Vesper, “With persisting good weather conditions South American 2024 crop is expected to exceed 220 mmt of soybeans. Soybean oil is thus putting a ceiling to palm oil prices which could well be led into lower flat prices from current values”.

All in all, the Chicago soybean complex has experienced a decline due to improved weather conditions in Brazil and sluggish demand for US soybeans. The settlement price for Soybean Oil (Jan 24) on the Chicago Board of Trade (CBOT) dropped to $1046 per metric ton on January 8, 2024, down from $1054 per metric ton during the same period last week. Similarly, the settlement price for Soybean (Mar 24) on CBOT decreased to $455 per metric ton on January 8, 2024, compared to $468 per metric ton in the previous week.

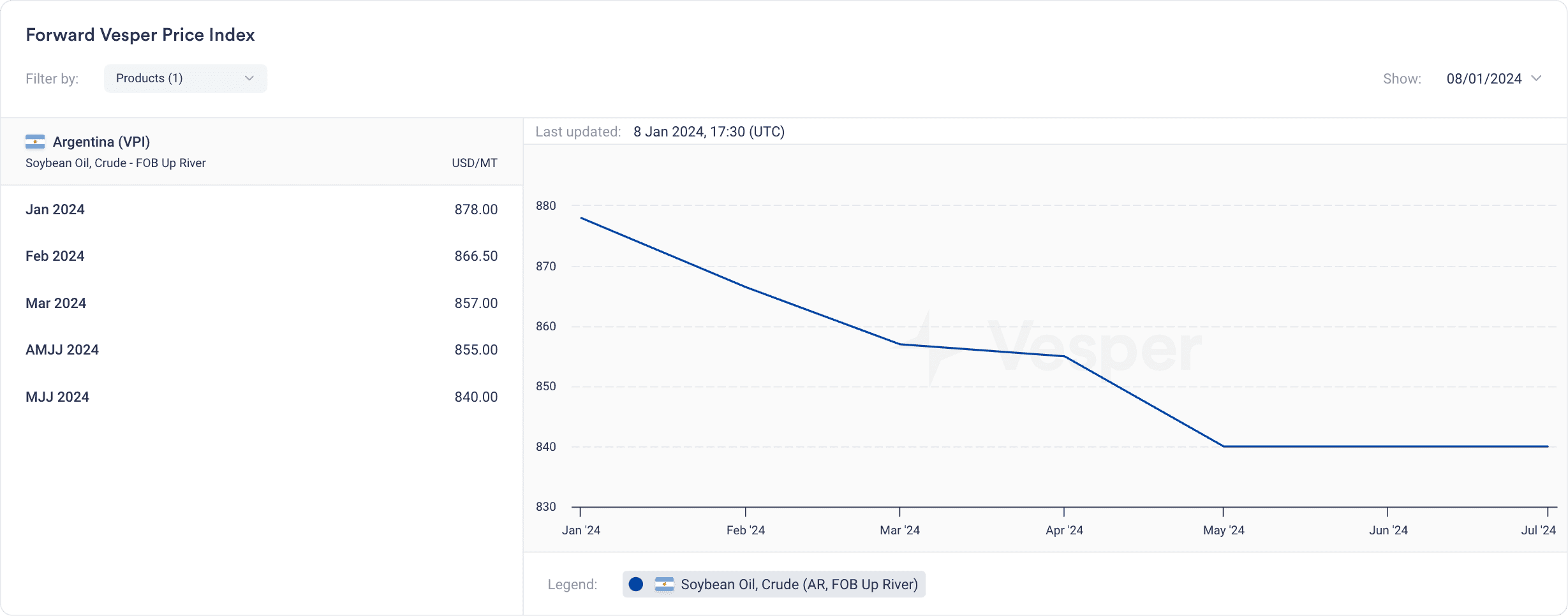

Interestingly, despite the overall downward trend, the Vesper Argentina Forward Price Index for Crude Soybean Oil (2024-01-08) saw an increase to $857 per metric ton (FOB Up River, Mar) from $855 per metric ton during the same period last week, as depicted in Figure 1. Current market conditions are reportedly firm due to low supply availability, and there is additional support from Brazil’s new biodiesel mandate, which increased for January, according to information provided by a trader to Vesper.

Figure 1: Forward Vesper Price Index for Crude Soybean Oil Argentina

Outlook

The upcoming WASDE report has the potential to add fuel to the market’s dynamics. However, it’s crucial to shift our attention beyond just Brazil and consider the broader South American context, especially regarding the utilization of soybean oil in biodiesel production across North and South America. Multiple analytical agencies are predicting downward adjustments in soybean crop estimates for both Brazil and Argentina. While the January WASDE report is eagerly awaited, it should be noted that its outcomes are known for their unpredictability, and historically, they have sparked substantial price fluctuations, particularly in the soybean market. We are neutral-bullish.

Download our recent Vegetable Oil Highlights and get the soybean oil market update for the next 30 days.