According to market participants interviewed by Vesper, a premium of palm oil to other oils can remain in Europe in the following months. Traders reported to Vesper that the Red Sea crisis combined with higher prices at origin (MY and ID) squeeze traders’ margins reducing the supply of palm oil in Europe, see Figure 1.

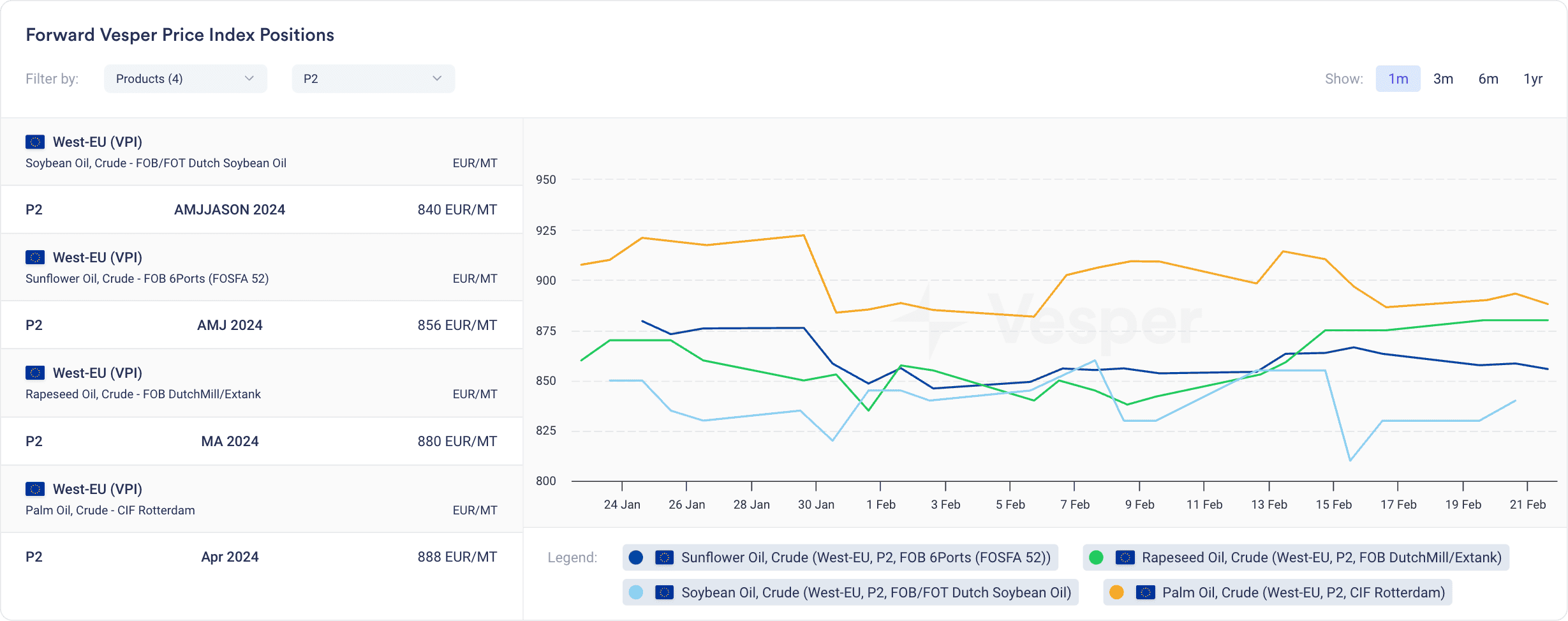

Figure 1: Veg Oil Forward Prices, West EU (USD/mt)

Last updated prices (22-02-2024):

- The Vesper West EU Forward Price Index for Crude Palm Oil decreased to €888 |

$960 / mt (CIF Rotterdam, Apr) - The Vesper West EU Forward Price Index for Crude Rapeseed Oil increased to€880 | $949 / mt (FOB DutchMill/Extank, MA)

- The Vesper West EU Forward Price Index for Crude Sunflower Oil increased to €856 | $925 / mt (FOB 6Ports (FOSFA 52), Apr-May-Jun)

- The Vesper West EU Forward Price Index for Crude Soybean Oil increased to (20-02-2024) €840 | $925 / mt (FOB Up River, Apr)

“Large players as Cargill, Olenex etc. have full control over their supply chain and import palm oil for their needs. But traders in Europe, that are not involved in the production, struggle to make margins,” said one Dutch paper broker. Yes, the demand for palm oil is also lower in Europe due to the higher prices and uncertainties related to the EUDR (European Deforestation Regulation). However, some of the discrete demand cannot be removed. Thus, a stable portion of the demand combined with low supply is expected to keep palm oil prices elevated in EU. It also should be noted that it doesn’t necessarily mean that rival oils will go up as palm oil has already been substituted with alternative oils whenever feasible.

Download our latest Vesper Price Index for free to unlock the latest global prices for sunflower, palm, soybean, rapeseed, olive, coconut and more oils.