In a surprising turn of events, the latest report from MPOB, unveiled on August 10, deviated from market expectations. Despite palm oil stocks reaching record highs, MPOB reported a lower stock figure than anticipated, standing at 1,731,512 metric in July vs. 1,719,835 metric tons in June, marking a slight increase of +0.68%. Production and export figures from June 23 to July 23, however were higher than expected. Production figures witnessed an increase of 11.21%, reaching 1,610,052 metric tons in July compared to 1,447,697 metric tons in June. Similarly, exports grew 15.55%, with 1,353,925 metric tons in July vs. 1,171,739 metric tons in June. When comparing August 1–15 to July 1–15, Malaysia’s palm oil exports showed growth: Amspec reported 633,585 metric tons, marking an increase of 22.11% from 518,849 metric tons, while ITS reported a rise of 18.85%, from 554,054 metric tons to 658,475 metric tons.

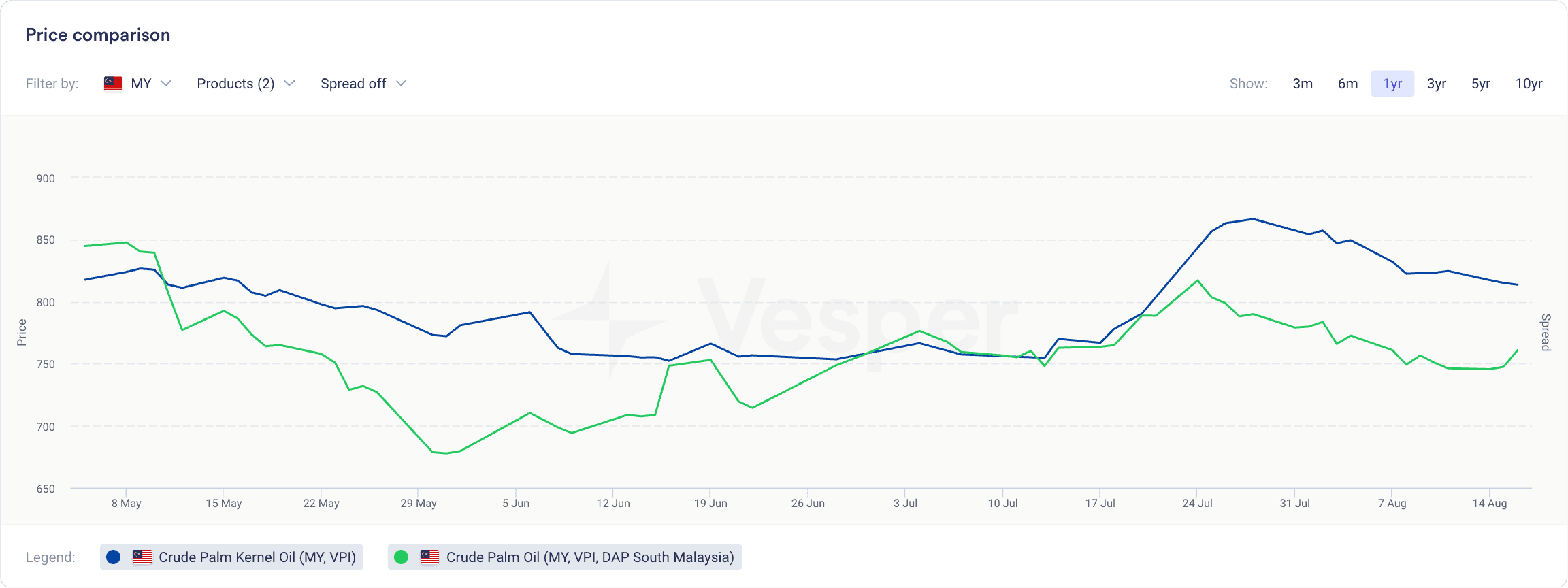

While the report initially provided a degree of support to palm oil prices in the previous week, these gains proved to be short-lived. The decline came about due to the influence of weaker competing oils and the aggressive sales tactics by Indonesian exporters. This downward trend was particularly evident in the Malaysian crude palm oil spot settlement price on the BMD for August 14, 2023, which decreased to €734 | $802 per metric ton from the previous €739 | $812 per metric ton recorded during the same period the previous week. Similarly, The Vesper West EU Forward Price Index for crude palm oil on the same date witnessed a decline, slipping to €869 | $950 per metric ton (CIF Rotterdam, November contract) from the prior €891 | $980 per metric ton. Insights from the market suggest that the anticipation of robust Malaysian exports throughout August may help contain the extent of palm oil losses.

Small tip: You can freely employ our vegetable oils calculators, for example, to ascertain the Free Fatty Acid (FFA) price adjustment and much more.

Finally, Vesper learned that Malaysian palm oil producers are currently under pressure to get rid of the stock and keep it to a minimum, which could also be a pressuring factor for palm oil prices. A Malaysia-based trader shared “Indonesia is still selling crude palm oil at a discount which weighs on Malaysian prices. But we see that the spread between two origins is narrowing”.

Read more news on the global oils and fats market on Vesper’s commodity intelligence platform.