This week’s JRC Mars Bulletin delivered promising news for Europe’s sugar beet industry, revising October’s EU27 average yield forecast up to 75.4 tons per hectare. This surpasses September’s figure of 74.7 tons per hectare and the five-year average of 73.2 tons per hectare. In terms of overall production, the EU sugar market remains stable, with estimated outputs for the 2024/25 season projected at around 17-17.5 million metric tons. France and Germany lead the charge, contributing an estimated 4.5 and 4.6 million metric tons, respectively.

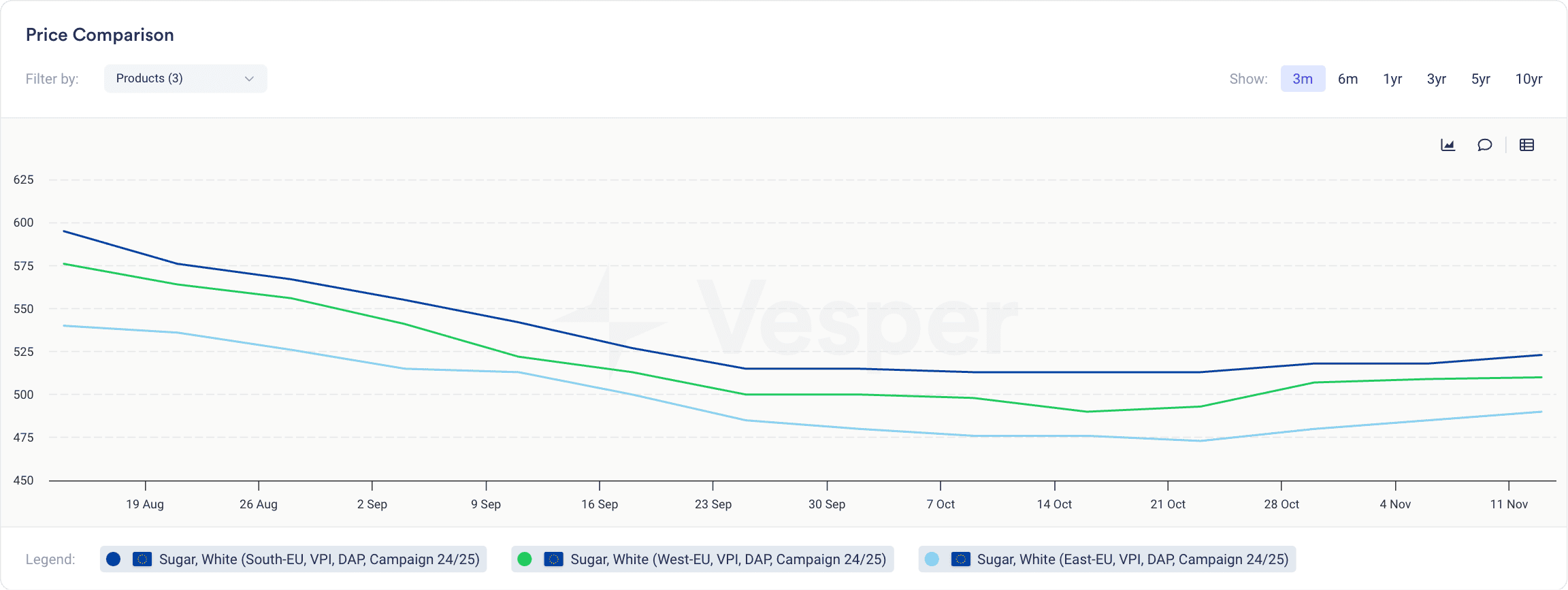

However, despite this steady production outlook, European sugar prices are climbing. According to the latest West-EU Vesper Price Index (dated October 30, 2024), sugar prices across the EU have seen notable increases:

- West-EU Vesper Price Index: €507/mt DAP

- South-EU Vesper Price Index: €518/mt DAP

- East-EU Vesper Price Index: €480/mt DAP

Figure 1: White Sugar Prices across the EU according to the Vesper Price Index in EUR/mt

Rising Sugar Prices: What’s Driving the Increase?

This price increase largely stems from the European Union’s shift toward exporting surplus sugar to balance supply levels, which, supported by steady Sugar No. 5 benchmark prices, has kept prices elevated, see figure below. Turkey, in particular, has emerged as a significant importer of EU sugar, driving demand and reducing stock levels across the EU.

Figure 2: YTD Sugar exports from Europe 28 in MT

Compounding this trend, German and French producers have reported concerns over lower-than-expected sucrose content in sugar beets this season. Both countries are now re-evaluating production strategies, a move that could have ripple effects on future supply levels.

With these production and export dynamics at play, European buyers may want to prepare for further price hikes if exports continue at their current high rates.

Additionally, EU producers are signaling reduced beet prices for 2025, down from an average of €50 per ton in 2023/24. This anticipated price drop may dissuade farmers from planting, potentially constraining supply in the coming years.

Global Market Pressures from Brazil

The European sugar market isn’t alone in facing supply challenges. In Brazil, heavy rainfall has delayed cane milling operations, tightening sugar supplies and forcing periodic shutdowns at key mills.

While Brazil recorded a small year-over-year increase in total cane crushing, the October rains have reduced the sucrose levels in the cane, exacerbating the impact of these disruptions. As a result, production in vital sugar-producing states like São Paulo and Goiás has slowed, placing additional pressure on already tight global stocks, see figure below.

Figure 3: Monthly production volumes of Sugar (Brazil) in MT

In response to unyielding global demand, Brazil’s sugar exports surged by 30% year-over-year in October, with record-breaking export figures from January through October 2024.

Looking ahead, Brazil’s Center-South region remains cautiously optimistic about continued demand, though unpredictable weather could further affect the cane’s Total Recoverable Sugar (TRS) levels, leading to potential supply limitations next season. The depreciation of the Brazilian Real has also enhanced Brazil’s export competitiveness, adding another layer of price support to the global sugar market.

What Does This Mean for European Sugar Buyers?

Given these global and regional dynamics, European sugar buyers may be facing a critical buying window. With strong export demand, a potential reduction in EU beet planting, and weather-related disruptions tightening Brazil’s supply, sugar prices are unlikely to drop significantly in the near term. Historically, current prices remain favorable, so what’s holding buyers back from acting now?

With the global sugar market in flux and the interplay of production challenges, economic pressures, and shifting planting decisions, all eyes will be on how these factors influence sugar availability and pricing well into the 2025 season.