The global sugar market continues to experience significant volatility, following the trend of recent weeks, as various factors drive price fluctuations. In Brazil, a severe drought in the Center-South region has notably affected sugarcane yields and quality, raising concerns about the season’s overall production. Although mills are adapting their production strategies to manage these challenges, unpredictable weather conditions remain a major risk.

Some market analysts have speculated about a “sudden death” scenario, where sugarcane plants could die abruptly due to prolonged dry conditions. However, this view is considered overly pessimistic. Nonetheless, current conditions are likely to slow down the pace of sugarcane crushing and result in an earlier-than-expected end to the harvest compared to the 22/23 season. Despite these challenges, projections indicate that sugar production in Center-South Brazil will slightly exceed 40 million metric tonnes (MMT), with estimates ranging from 40.0 to 40.4 MMT.

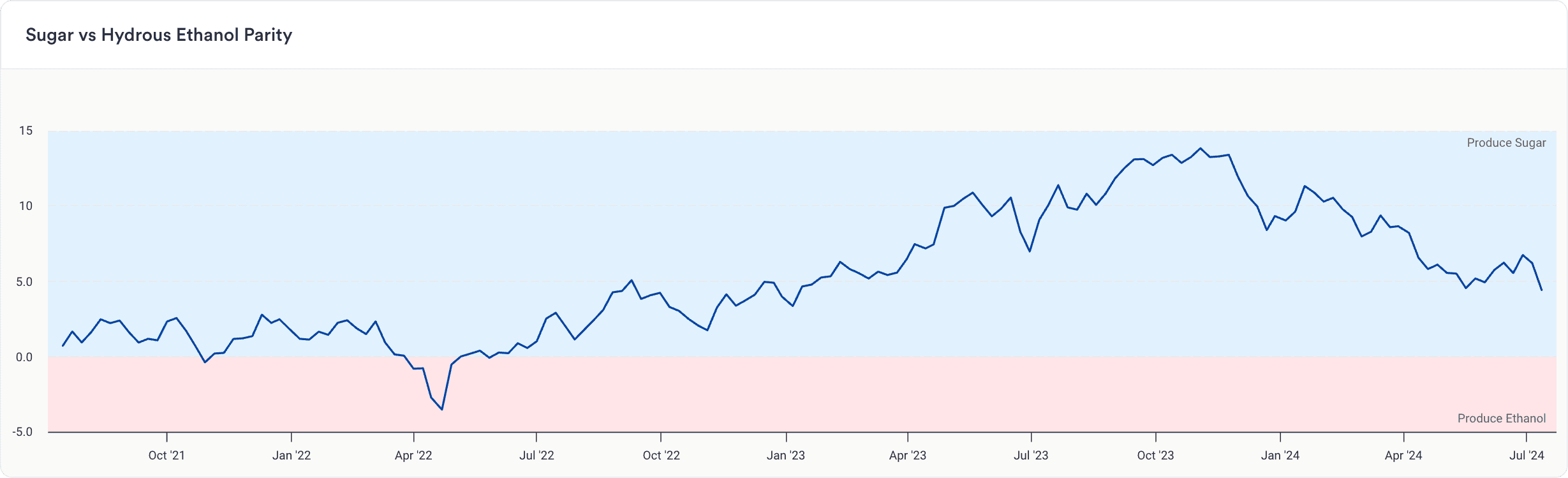

The Sugar/Ethanol Parity has been declining due to a drop in sugar prices and rising ethanol prices, see figure below. Although sugar remains the more profitable option, the parity stood at 2.3 USD cents per pound as of last Friday.

All in all, the situation in Brazil has created a fragile balance, where any further deterioration in crop conditions could tighten supply and drive prices higher, despite the market’s current bearish sentiment. With production challenges persisting, the market may see tighter supplies and potential price support in the coming months.

In India, uncertainty around sugar export policies has kept the market on edge. The Indian government’s focus on increasing ethanol production to meet ambitious blending targets has sparked speculation about potential export restrictions. Coupled with fluctuating currency exchange rates and varying weather conditions in other key producing regions, these factors have added layers of complexity to the market. Despite these growing concerns, there is a strong possibility that the market has yet to fully account for these potential risks.