Central bankers who manage trillions in foreign exchange reserves are loading up on gold as geopolitical tensions force them to revise their investment strategies. More than two-thirds of respondents to an annual survey of 83 central banks, who together control $7 trillion in foreign exchange assets, believed their peers would raise their gold holdings in 2023. In times of uncertainty, gold is often more appealing, and demand for it has increased recently. According to the World Gold Council, a trade group, central banks purchased 1,136 tonnes of gold in 2022, up 152% over the last year.

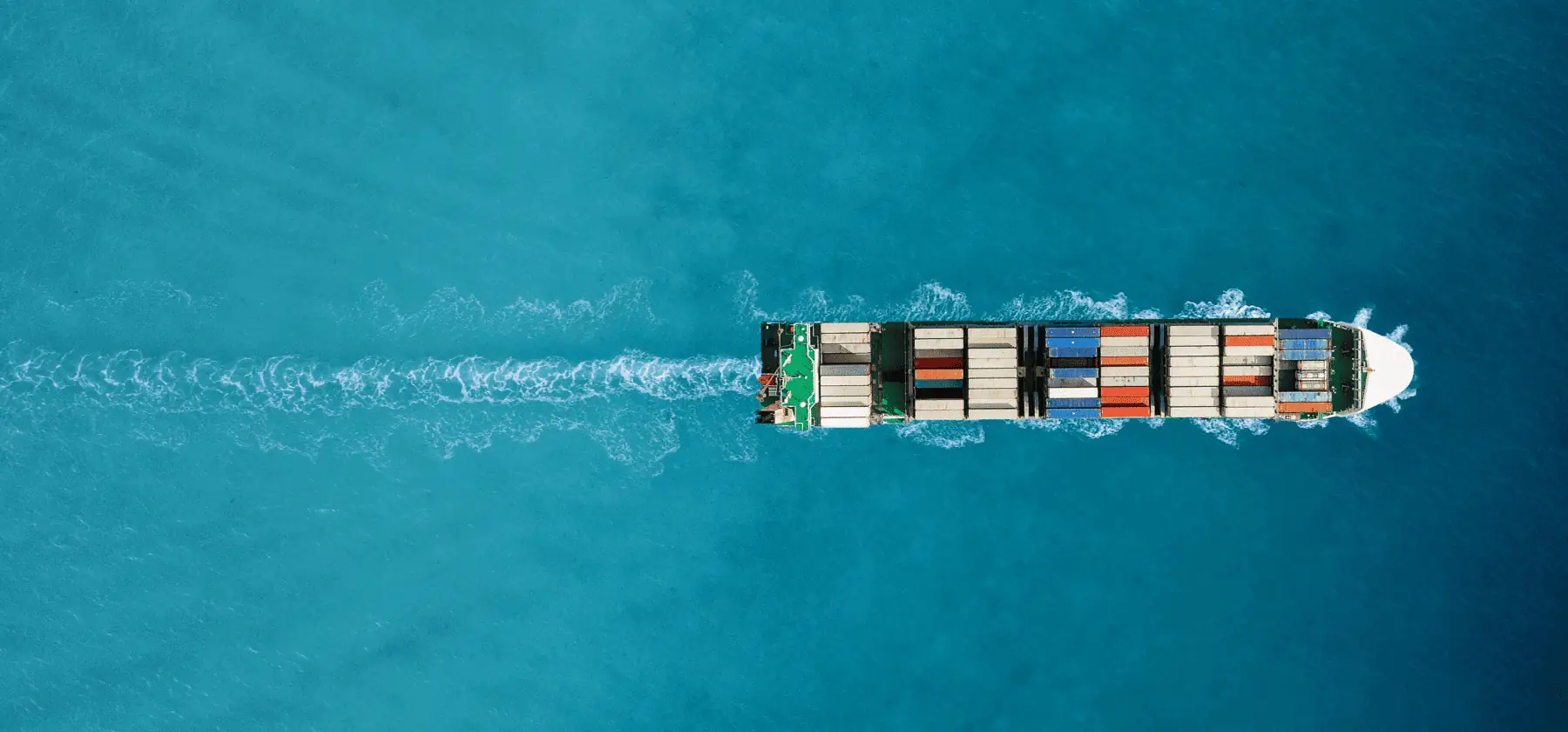

ExxonMobil, Halliburton, and Chevron have discussed projects in war-torn Ukraine with the nation’s state energy corporation as Kyiv seeks to entice foreign investment back into its energy industry. Following months of Russian bombardment of Ukraine’s energy infrastructure, significant US fossil fuel producers are now in talks with Ukraine as part of a deliberate effort to boost natural gas output, which Ukrainian authorities hope might help replace Russian supply to Europe in the years to come.

FYI: Stay ahead and download our Global Vegetable Oils Market Outlook for 2024.

In the eight months leading up to March, the EU’s natural gas usage decreased by about 18%, exceeding the bloc’s aim and allaying concerns about potential energy shortages brought on by drastic reductions in Russian imports. A milder winter contributed to European households using significantly less gas. However, it also reflected efforts to conserve energy, the suspension of some energy-intensive industrial operations, and a shift to alternative fuel and power sources in response to the dramatic cost increase that followed Russia’s full-scale invasion of Ukraine last year.

Tip: Use our free commodity calculators to make your day-to-day calculations easier.